Showing 1 - 10 of 164

Pretty vacant

Life, Tatat Bunnag, Published on 23/01/2026

» As far as cop thrillers go, The Rip checks a lot of familiar boxes. It's gritty, it's propulsive -- at least in theory -- and it clearly wants to position itself as a throwback to those older, morally murky crime dramas about corrupt cops and fractured loyalties.

Indie band TV Girl to play Sam Yan

Life, Published on 24/11/2025

» TV Girl, an American indie pop band, will give their Bangkok debut concert "TV Girl Perform Their Hits Live" at the Samyan Mitrtown Hall of Samyan Mitrtown, Rama IV Road, on Dec 1 at 8pm.

Gold’s historic rise comes with a bonus for emerging markets

Published on 20/10/2025

» A relentless surge in the price of gold is delivering windfalls across emerging markets, boosting investor confidence in countries that mine and buy the metal.

In an Irish memorial, I see echoes of Palestine

Oped, Published on 03/10/2025

» The figures by the River Liffey in Dublin are more clothes than flesh. The Famine Memorial, created by Rowan Gillespie, holds in bronze a moment of suffering, the settling in of the Great Hunger, which would cut Ireland's population by more than a quarter, the gone either dead or emigrated.

New central bank chief promises cooperation but vows independence

Published on 01/10/2025

» Thailand's new central bank chief said on Wednesday that he will maintain the independence of the Bank of Thailand (BoT) while collaborating with the government to address the country's economic challenges.

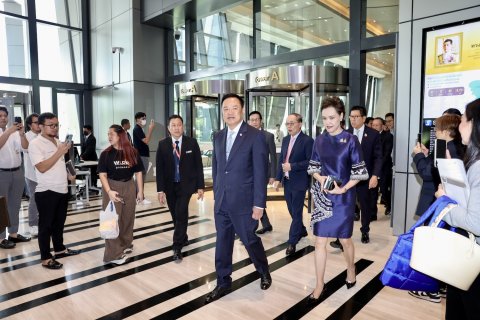

PM Anutin vows prudence to avoid rating cut

Published on 25/09/2025

» Prime Minister Anutin Charnvirakul says he will look to build confidence in Thailand’s economy following an outlook downgrade by Fitch Ratings.

Fitch cuts Thailand’s outlook to negative

Published on 24/09/2025

» Fitch Ratings has downgraded Thailand’s credit rating outlook to negative from stable, citing rising risks to public finances from prolonged political uncertainty and weakening growth prospects.

Your horoscope for Sept 19-25

Guru, Chaiyospol Hemwijit, Published on 19/09/2025

» Your spot-on horoscope for work, money and relationship from Guru by the Bangkok Post's famously accurate fortune teller. Let's see how you will fare this week and beyond.

Thai political turmoil threatens growth, lifts rate cut bets

Published on 02/09/2025

» With Thailand’s major political parties vying to form a new government — which may last only a few months — economists see further risks to economic growth and rising odds of steeper interest rate cuts.

Thailand warns of hit from US tariffs even as growth beats forecast

Published on 18/08/2025

» Thailand’s top economic council called for urgent structural reforms as exports are threatened by US tariffs, even after second-quarter growth surpassed estimates on a rush by businesses to ship goods to beat the new levies.