Showing 1 - 10 of 2,338

Border traders need help

Oped, Editorial, Published on 20/02/2026

» After months of suffering in silence, businesses along the Thai-Cambodian border are finally starting to speak up, saying the security measures implemented in the wake of the armed clashes between the two countries -- including border closures -- have dealt a heavy blow to their livelihoods.

The gist of Thai politics over 20 years

Oped, Thitinan Pongsudhirak, Published on 20/02/2026

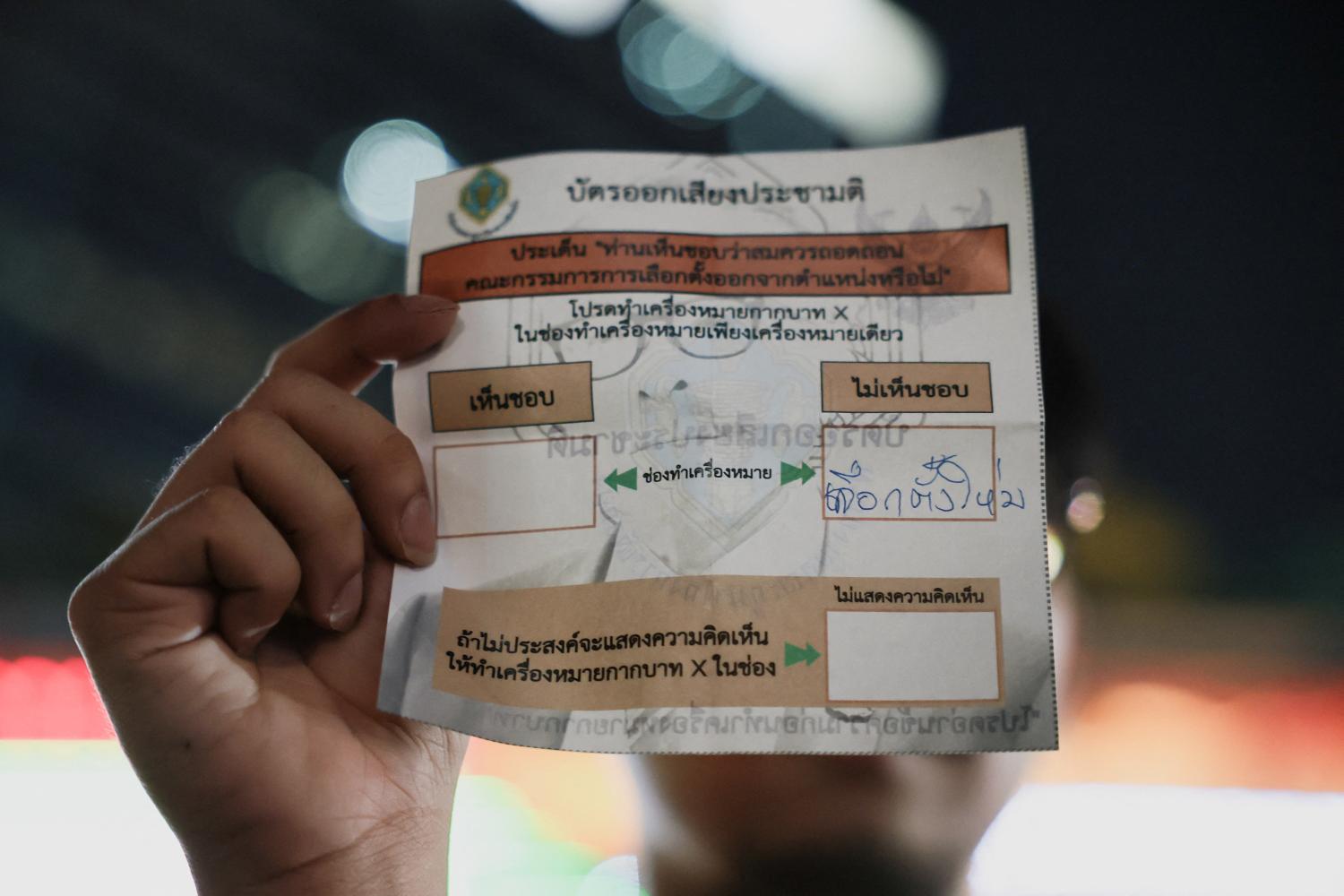

» Thailand's democratic institutions have been repressed and kept weak to the point that confusion still prevails almost two weeks after the Feb 8 election, which purportedly showed a clear victory for the ruling Bhumjaithai (BJT) Party under Prime Minister Anutin Charnvirakul. On the one hand, Mr Anutin and BJT stalwarts are busy forming a coalition government with other parties. On the other hand, fraud allegations from civil society groups and the opposition People's Party have reached a critical mass with the plausibility that the recent vote might be nullified to pave the way for a new poll.

Why communities pay for mining

Oped, Christopher Rutledge, Published on 19/02/2026

» Last week, policymakers and industry executives of mining companies gathered in Cape Town for the annual African Mining Indaba. They followed a familiar script: governments would court investors, companies would promise jobs and growth, and champagne would flow as speakers tout Africa as indispensable to the global energy transition.

Fiscal deficit will trigger 2026 crisis

Oped, Chartchai Parasuk, Published on 19/02/2026

» If readers want to be fully convinced that there will be a financial crisis in 2026, I can do that in three minutes. Readers need only look at the last two columns of the attached table, which depict the financing situation of the Thai economy in 2025 (actual) and 2026 (projected).

Could a Brics currency rival the dollar?

Oped, Jim O'Neill, Published on 18/02/2026

» Could the Brics (Brazil, Russia, India, China, South Africa) ever launch a shared currency to challenge the US dollar's dominant position in the world economy? Like many conventional international economists, I have generally dismissed the idea, despite my own role in coining the Brics acronym, which led to the creation of a formal Brics club (since expanded into the Brics+, with the addition of five new members).

Asean's role in a new world order

Oped, Chartsiri Sophonpanich, Published on 16/02/2026

» Profound shifts are reshaping the global economy as political uncertainty, geopolitical rivalry and changing trade patterns disrupt the old world order, while a new one has yet to fully emerge.

How world's super-rich are rewriting the rules

Oped, Joseph E Stiglitz & Jayati Ghosh, Published on 13/02/2026

» Ongoing efforts to derail multilateral tax cooperation lie at the heart of a global programme to replace democratic governance with coercive rule by the extremely wealthy -- or what we call 21st-century Caesarism. Any strategy to counter this programme, therefore, must recognise that taxing extreme wealth is essential to saving democracy.

One year of marriage equality

Oped, Niamh Collier-Smith, Published on 13/02/2026

» Every year on Feb 14, the world pauses to celebrate love -- traditionally through flowers, romance and promises. But this Valentine's Day in Thailand goes beyond sentiment, marking over one full year of legal marriage equality.

Surviving the collapse of the population

Oped, Gwynne Dyer, Published on 13/02/2026

» 'To them that hath shall [more] be given" is generally a reliable guide, especially in economic matters, but it doesn't work if the beneficiaries are too stupid to take advantage of the gift. The scarce and precious commodity in this case being people, who are in increasingly short supply.

Emerging markets stand strong

Oped, Kristalina Georgieva and Mohammed Al-Jadaan, Published on 12/02/2026

» It used to be that when advanced economies sneezed, emerging markets caught a cold. That is no longer true. Following recent global shocks, such as the post-pandemic inflation surge and a new wave of tariffs, emerging markets have held up well. Inflation has continued to slow, currencies have generally retained their value, and debt issuance costs have remained at manageable levels. There has been no sign of the kind of financial turbulence that came with past economic shocks.