Showing 1 - 10 of 10,000

What’s the point of luxury gyms?

BitesizeBKK, Published on 25/02/2026

» Luxury gyms are expanding across Bangkok at a pace that feels less like a passing trend and more like a structural shift in how urban space is being used. From private Pilates studios tucked into Thonglor side streets to padel courts embedded within mixed-use developments, these spaces are multiplying in neighbourhoods that already signal affluence, and they do so with a distinct confidence. Their membership fees are high, their interiors deliberately restrained, and their access often limited. What they offer extends well beyond fitness.

Thai central bank unexpectedly cuts policy rate

Published on 25/02/2026

» The Bank of Thailand (BoT) unexpectedly cut its key interest rate at a review on Wednesday, as it seeks to further support the economy facing challenges including US tariff uncertainty and a strengthening baht.

Division, theatre and one golden moment as Trump addresses Congress

AFP, Published on 25/02/2026

» WASHINGTON — If Donald Trump was worried about a hostile reception over his breakneck remaking of presidential norms, he did not show it — striding in six minutes late, with the unhurried confidence of a man who knew the evening belonged to him.

Boonrawd Brewery, PTT, IRPC mark new milestone for recycled plastic formula

Published on 25/02/2026

» Boonrawd Brewery Co Ltd, together with PTT Public Company Limited and IRPC Public Company Limited, has announced a significant achievement underscoring the collaborative efforts of expert teams from all three companies.

Future Trends concludes ‘Future Trends AHEAD SUMMIT 2026’ in grand style

Online Reporters, Published on 25/02/2026

» Future Trends has concluded Thailand’s largest trend-focused seminar, ‘Future Trends AHEAD SUMMIT 2026’, held on Feb 10 at Royal Paragon Hall, 5th Floor, Siam Paragon, Bangkok.

'Jaws' harpoon gun and 'Star Wars' treasures lead LA film and TV auction

AFP, Published on 25/02/2026

» LOS ANGELES — A harpoon gun from Jaws, a jacket worn by The Terminator, and a Star Wars lightsaber hilt and C-3PO head are among the eye-catching items to be sold at auction next month.

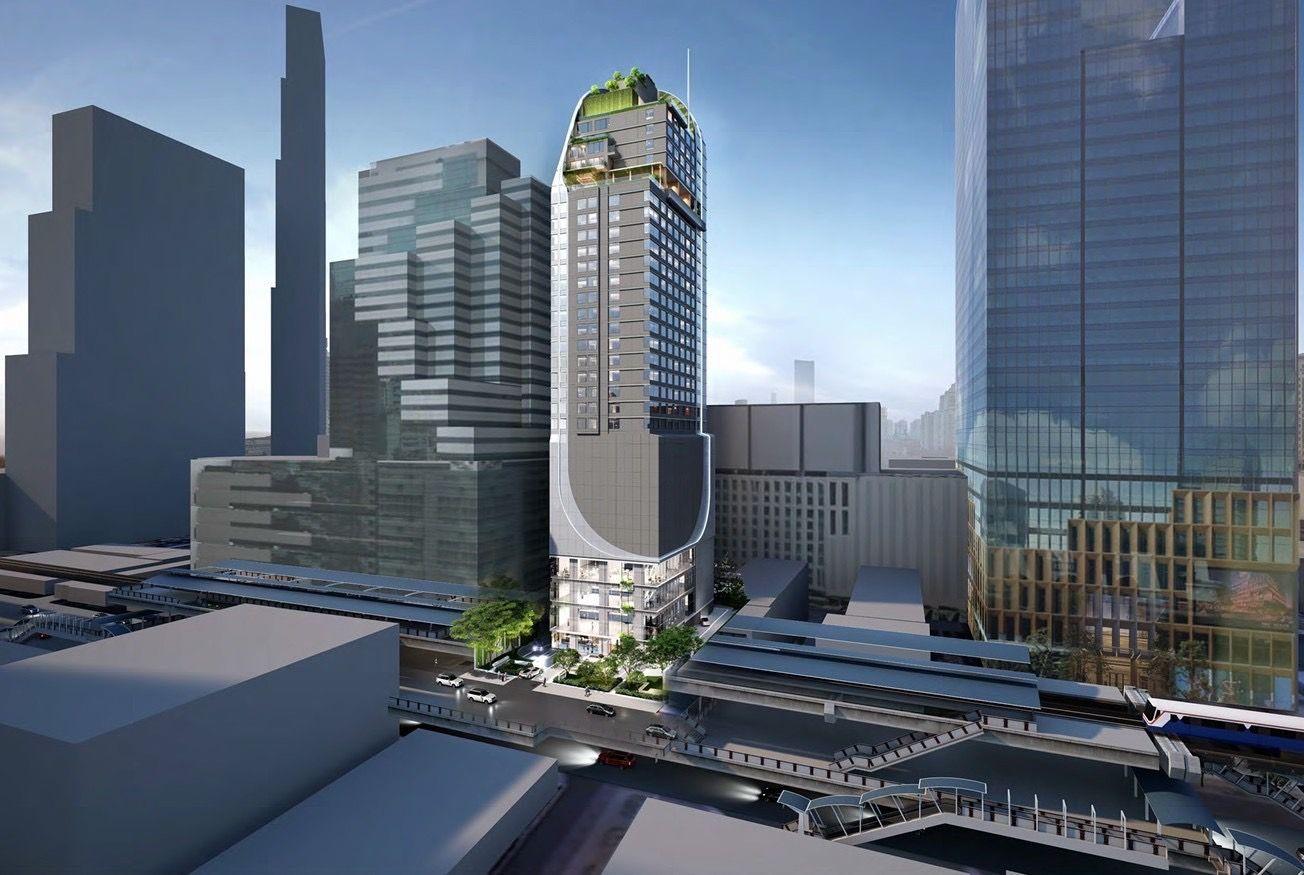

Aira Capital banking on leasehold developments

Business, Kanana Katharangsiporn, Published on 25/02/2026

» MAI-listed Aira Capital Group continues to focus on property investment on leasehold land, with plans to invest 2.3 billion baht to develop the DoubleTree by Hilton Bangkok Silom hotel, as well as 1 billion baht for a wellness residential project in a tourist destination.

Traditional media stages 2026 comeback

Business, Suchit Leesa-nguansuk, Published on 25/02/2026

» Thailand's media industry spending is expected to grow by 1.7% in 2026 to reach 87.3 billion baht, as brands shift from short-term performance marketing towards a more balanced, structurally driven growth strategy, according to media agency Media Intelligence Group (MI Group).

Industrial property defies uncertainty

Business, Kanana Katharangsiporn, Published on 25/02/2026

» The industrial and logistics property sector continues to outperform other segments, supported by robust demand and ongoing government backing despite prevailing uncertainties, according to property consultancy CBRE Thailand.

Car exports decline by 6% in January

Lamonphet Apisitniran, Published on 25/02/2026

» Thailand's car exports fell in January, dropping 6% year-on-year to 58,405 units -- the lowest level since May 2022 -- which was attributed to stricter environmental regulations and currency fluctuations, says the Federation of Thai Industries (FTI).