Showing 1 - 10 of 10,000

Boonrawd Brewery, PTT, IRPC mark new milestone for recycled plastic formula

Published on 25/02/2026

» Boonrawd Brewery Co Ltd, together with PTT Public Company Limited and IRPC Public Company Limited, has announced a significant achievement underscoring the collaborative efforts of expert teams from all three companies.

Future Trends concludes ‘Future Trends AHEAD SUMMIT 2026’ in grand style

Online Reporters, Published on 25/02/2026

» Future Trends has concluded Thailand’s largest trend-focused seminar, ‘Future Trends AHEAD SUMMIT 2026’, held on Feb 10 at Royal Paragon Hall, 5th Floor, Siam Paragon, Bangkok.

Google highlights AI-driven Play security gains in 2025

Puriward Sinthopnumchai, Published on 25/02/2026

» Google has published its 2025 annual security report, detailing how artificial intelligence (AI) has strengthened protections across Google Play and the wider Android app ecosystem, as the company seeks to bolster trust among billions of Android users worldwide.

UK govt says will release files on 'rude' ex-prince Andrew

AFP, Published on 25/02/2026

» LONDON - Britain's government committed on Tuesday to releasing documents on ex-prince Andrew Mountbatten-Windsor's past role as a trade envoy, after the Jeffrey Epstein scandal widened with the arrest of a veteran UK politician.

Academic seeks Election Commission probe, People's Party's demise

News, Chairith Yonpiam, Published on 25/02/2026

» An independent academic on Tuesday petitioned the Election Commission (EC) to seek the dissolution of the People's Party (PP) over its alleged links with media-related firm Spectre C.

BoT upgrades Thai GDP forecast after robust Q4

Business, Somruedi Banchongduang, Published on 25/02/2026

» The Bank of Thailand is upbeat about the country's growth prospects, projecting GDP expansion of 1.9% this year, up from its previous estimate of 1.5%, after the economy grew stronger than forecast in the fourth quarter of last year.

AI learning versus human creativity is a real battle

Life, James Hein, Published on 25/02/2026

» If you’ve been reading these columns long enough, you’ll probably know that I write music and I’ve written some books. With the advent of artificial intelligence, the concept of copyright and private property has blurred. The standard rule was, what you have worked hard on to create, belongs to you. As musicians and authors, ideally, we create, we write and we invent. In the world of AI, it will draw a picture, write a book and create music for you based on a simple text prompt that itself may have also been written for you by AI.

Unlocking Thai competitiveness

Oped, Published on 25/02/2026

» Regulatory reform is an urgent priority in restoring growth to Thailand's emerging economy. Rigid rules and excessive red tape have become significant structural barriers to private sector development. Evidence from several key industries demonstrates that outdated, fragmented legislation continues to constrain competitiveness.

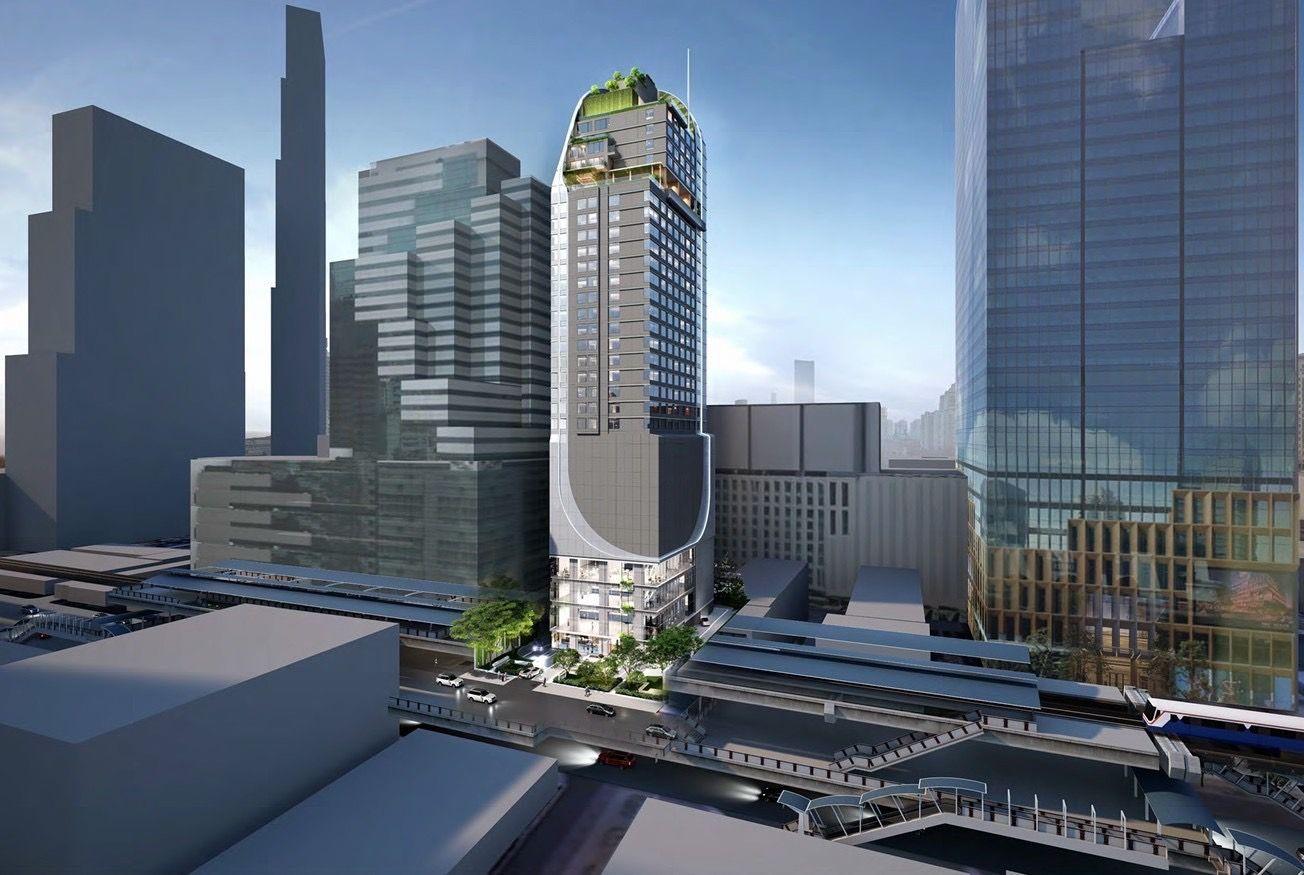

Aira Capital banking on leasehold developments

Business, Kanana Katharangsiporn, Published on 25/02/2026

» MAI-listed Aira Capital Group continues to focus on property investment on leasehold land, with plans to invest 2.3 billion baht to develop the DoubleTree by Hilton Bangkok Silom hotel, as well as 1 billion baht for a wellness residential project in a tourist destination.

Demographics fuel Bangkok Life Assurance's growth drive

Business, Nuntawun Polkuamdee, Published on 25/02/2026

» Bangkok Life Assurance (BLA) expects Thailand's life insurance industry to maintain its growth momentum this year, supported by demographic tailwinds and regulatory flexibility, as the company prepares to increase its exposure to Thai equities and roll out a new long-term care product targeting age-related diseases.