Showing 1 - 10 of 725

DBS calls for discipline in volatile world

Business, Nuntawun Polkuamdee, Published on 12/02/2026

» Disciplined diversification, long-term conviction, and a focus on structural themes are vital for investors to navigate global markets this year amid elevated volatility, uneven interest rate paths and persistent geopolitical risks, says Singapore-based DBS Bank.

UOB: Economic growth depends on stability

Business, Somruedi Banchongduang, Published on 11/02/2026

» Effective implementation of the new government's policies will be pivotal in building investor confidence and attracting both foreign portfolio inflows and foreign direct investment (FDI) into Thailand, according to UOB Thailand.

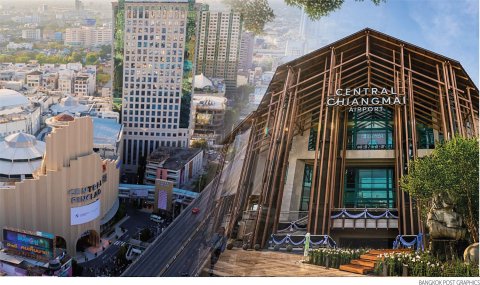

CPN property fund looks to upgrades for growth

Business, Published on 05/02/2026

» CPN Retail Growth Leasehold Real Estate Investment Trust (CPNREIT) is reinforcing the strength of its high-quality asset portfolio by transforming Central Pinklao and Central Chiangmai Airport.

Beyond campaign rhetoric

Business, Nuntawun Polkuamdee and Nareerat Wiriyapong, Published on 03/02/2026

» With the Feb 8 general election on the horizon, equity analysts and investors are watching the economic and capital market proposals of major political parties, which collectively strike a broadly pro-investment tone.

Executive publishes warning for the SET

Business, Nuntawun Polkuamdee, Published on 22/01/2026

» Thailand's stock market is edging dangerously close to a critical point, underscoring the urgent need to restore investor confidence and market liquidity, notes the chief of the Investment Analysts Association (IAA), calling for swift and decisive support from the government.

Energy transition and climate capital: financing the green shift

Business, Rewin Pataibunlue, Published on 20/01/2026

» The global energy system is undergoing its most significant transformation since the Industrial Revolution. As climate science strengthens and extreme weather intensifies, governments, investors and industries are converging on a central truth: decarbonisation is an economic necessity.

Agency sees promise in creative economy

Business, Kuakul Mornkum, Published on 15/01/2026

» The Creative Economy Agency (CEA), a public organisation, says the creative economy could be Thailand's new growth driver.

Bualuang Securities expects equities to lead financial markets

Business, Nuntawun Polkuamdee, Published on 13/01/2026

» Global financial markets are expected to continue gains in 2026, led by global equities as the earnings cycle and artificial intelligence (AI) investment reshape portfolio strategies, according to Bualuang Securities (BLS).

Geopolitics redraws the trade map

Business, Somhatai Mosika, Yuthana Praiwan, Lamonphet Apisitniran, Nuntawun Polkuamdee and Somruedi Banchongduang, Published on 12/01/2026

» Geopolitical tensions between the US and Venezuela underscore the vulnerability of the global economy and trade to political conflict.

Tisco puts forward three investment themes for 2026

Business, Nuntawun Polkuamdee, Published on 09/01/2026

» Tisco Bank has outlined three investment themes for 2026, suggesting investors can seek attractive returns relative to risk amid easing monetary conditions, accelerating megatrends, and persistent geopolitical uncertainty.