Showing 1 - 10 of 446

Corruption keeps getting worse

Editorial, Published on 15/02/2026

» Everyone knows corruption in Thailand is bad, but few realise how bad. By global standards, Thailand is slipping into the bottom tier.

Emerging markets stand strong

Oped, Kristalina Georgieva and Mohammed Al-Jadaan, Published on 12/02/2026

» It used to be that when advanced economies sneezed, emerging markets caught a cold. That is no longer true. Following recent global shocks, such as the post-pandemic inflation surge and a new wave of tariffs, emerging markets have held up well. Inflation has continued to slow, currencies have generally retained their value, and debt issuance costs have remained at manageable levels. There has been no sign of the kind of financial turbulence that came with past economic shocks.

Rethinking global health finance

Oped, Walter O Ochieng & Tom Achoki, Published on 06/02/2026

» For the past half-century, the economics of global health were straightforward. Under the so-called "grant-based" approach, rich countries donate to poor countries, which use the funds to meet their populations' health needs. Success was measured by services provided or lives saved, rather than by balance sheets. While this model was far from perfect, the latest approach replacing it -- focused on using tools like guarantees and blended finance to crowd in private capital -- threatens to produce even worse outcomes.

In an uncertain world, gold is a comfort

Oped, Chartchai Parasuk, Published on 05/02/2026

» With Thai citizens heading to the polls this Sunday to decide which party will form the next government, I have decided to postpone my article on the economic crisis for another two weeks.

Our tariff-era dollar, your problem

Oped, Qiyuan Xu, Published on 04/02/2026

» In 2025, the dollar index, which measures the greenback's strength against a basket of major currencies, fell by roughly 9.4%. Over the same period, the United States' average effective tariff rate rose by around 14.4 percentage points, from 2.4% to 16.8%, according to the Yale Budget Lab. Taken together, these shifts imply that, in the import trade domain, the US experienced an effective exchange-rate depreciation of around 24%.

Thai baht under watch

News, Editorial, Published on 03/02/2026

» As Thailand heads to the polls this Sunday, the campaign trail has been crowded with promises of wage hikes, subsidies and generous domestic giveaways. Yet last week, a far more sobering message arrived from Washington. The US Treasury has placed Thailand back on its currency monitoring list, a move that carries implications well beyond a routine financial assessment.

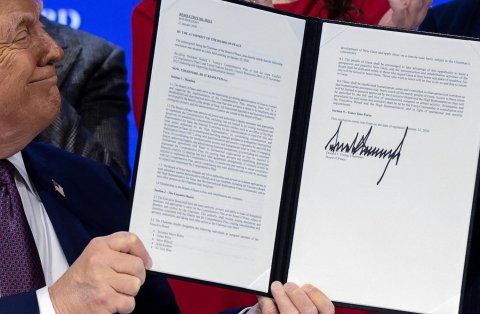

Thailand's responses to Board of Peace

Oped, Kavi Chongkittavorn, Published on 27/01/2026

» US President Donald Trump's invitation to Thailand to join the Board of Peace (BOP) has elicited three distinct responses. The first two are succinct and clear in their rationale. The third, however, is more nuanced -- and notable for its ambivalence.

Philanthropy must dive deeper

News, Shaun Seow, Published on 23/01/2026

» Long-term global stability depends heavily on what happens in the ocean. Nowhere is this more evident than in Asia, home to much of the Coral Triangle and vast mangrove and seagrass ecosystems that sustain fisheries, protect coastal communities, and store massive amounts of carbon. Together, these ecosystems underpin food security, employment, and climate resilience across the continent and beyond.

Thailand must manage debt to progress

Oped, Chartchai Parasuk, Published on 22/01/2026

» This article may be read as a continuation of my previous piece, Year of the Debt. That article focused mainly on household debt, which has already risen beyond the ability of Thai consumers to repay.

2026 outlook calls for recalibration

News, Mohamed A El-Erian, Published on 17/01/2026

» For global markets, 2025 was defined as much by what did not happen as by what did. The year offered a masterclass in the power of a single narrative, with massive, concentrated bets on AI masking various other unanswered questions. Yet as we move further into 2026, the AI narrative is unlikely to prove strong enough to continue overshadowing other lingering uncertainties, many of which reflect deeper structural shifts. For investors, central banks, and governments alike, the situation demands adaptation.