Showing 1 - 10 of 19

Measures afoot to aid loan defaulters

Business, Wichit Chantanusornsiri, Published on 10/09/2024

» The Finance Ministry is preparing measures to assist debtors who have defaulted on their home and car loans after a rise in non-performing lending in these segments.

High debt remains key concern

Business, Lamonphet Apisitniran, Nareerat Wiriyapong and Phusadee Arunmas, Published on 18/12/2023

» Government efforts to tackle informal debt and loan sharks are a good starting point to reduce the household debt crisis, but this could prove a strenuous task, say researchers and industry leaders.

THAI, ACAP among 2020 Tris defaults

Business, Published on 02/02/2021

» There were two defaults among corporate bond issuers in 2020 among the 206 rated issuers covered by Tris Rating, with the cumulative number of defaulters rising to 24 since 1994.

TCG sets B30bn loan guarantee for frail SMEs

Business, Wichit Chantanusornsiri, Published on 11/07/2020

» State-owned Thai Credit Guarantee Corporation (TCG) has set a loan guarantee amount of 30 billion baht for small and medium-sized enterprise (SME) operators whose loans are at risk of turning sour.

Savings accounts surge 14%

Business, Darana Chudasri, Published on 02/07/2020

» Banks' outstanding balance in savings accounts at the end of June jumped 14% from the end of last year, showing money continued to pour into bank deposits as they are perceived a safe haven amid economic uncertainties caused by the pandemic, despite the rock-bottom interest rates.

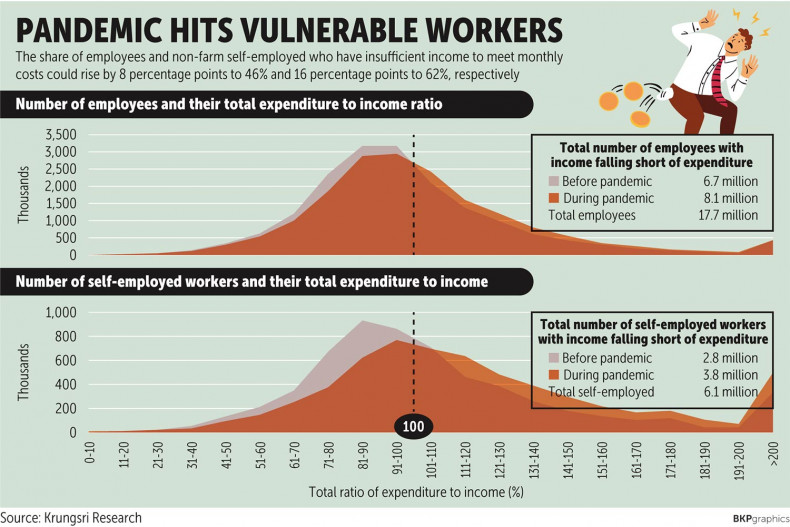

Household debt risks boiling over

Business, Somruedi Banchongduang, Published on 23/05/2020

» The country's household bad debt is expected to reach 1 trillion baht this year, putting the ratio to total loans outstanding into double digits as debt-servicing ability erodes amid coronavirus-induced income shocks, says the head of the National Credit Bureau (NCB).

GH Bank to launch debt rejig scheme

Business, Wichit Chantanusornsiri, Published on 24/02/2020

» State-owned GH Bank plans to introduce a new debt restructuring scheme, including a penalty interest haircut and interest payment deferrals, in April to help turn around bad loans.

BoT's Debt Clinic expands criteria

Business, Somruedi Banchongduang, Published on 04/02/2020

» The Bank of Thailand has relaxed conditions for its Debt Clinic, a scheme that pools unsecured bad loans owed to multiple creditors, to cover cases that have a single debtor and expanded qualified creditors to specialised financial institutions (SFIs) to step up efforts to keep a lid on bad loans.

Cabinet passes relief for SMEs

Business, Chatrudee Theparat and Somruedi Banchongduang, Published on 08/01/2020

» The cabinet on Tuesday green-lighted a new aid package for small and medium-sized enterprises and agreed to make efforts to shore up SMEs as part of the national agenda.

BAAC rejigs to focus on communities

Business, Wichit Chantanusornsiri, Published on 03/01/2020

» The state-owned Bank for Agriculture and Agricultural Cooperatives (BAAC) is set to revamp its branches' tasks to focus on community business development to boost the income of rural people and step up efforts to fight poverty.