Showing 1 - 10 of 27

Measures afoot to aid loan defaulters

Business, Wichit Chantanusornsiri, Published on 10/09/2024

» The Finance Ministry is preparing measures to assist debtors who have defaulted on their home and car loans after a rise in non-performing lending in these segments.

High debt remains key concern

Business, Lamonphet Apisitniran, Nareerat Wiriyapong and Phusadee Arunmas, Published on 18/12/2023

» Government efforts to tackle informal debt and loan sharks are a good starting point to reduce the household debt crisis, but this could prove a strenuous task, say researchers and industry leaders.

Senate mulls action over excessive rates on loans

News, Aekarach Sattaburuth, Published on 08/06/2021

» Senators have cast doubt over a proposed legislative amendment's ability to protect people from being overcharged interest on their debts.

Interest rate cut for loan defaulters

News, Post Reporters, Published on 28/05/2021

» Parliament has approved an emergency decree to amend the Civil and Commercial Code to reduce the interest rate charged for loan defaults which has been used for almost a century.

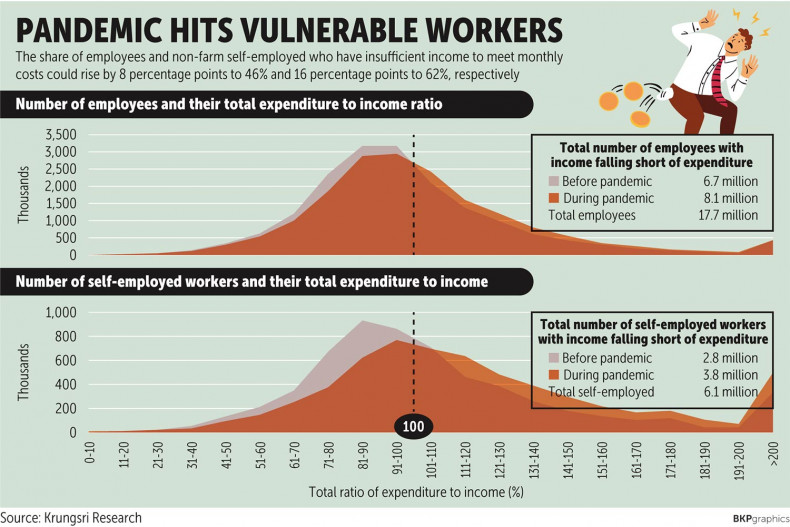

Households pile up debt as new virus wave weighs on income

Bloomberg, Published on 02/02/2021

» Thailand’s household debt, already among the highest in emerging Asia, is expected to rise further as a fresh Covid outbreak curbs incomes, weighing on consumer spending and heightening financial-stability risks.

THAI, ACAP among 2020 Tris defaults

Business, Published on 02/02/2021

» There were two defaults among corporate bond issuers in 2020 among the 206 rated issuers covered by Tris Rating, with the cumulative number of defaulters rising to 24 since 1994.

TCG sets B30bn loan guarantee for frail SMEs

Business, Wichit Chantanusornsiri, Published on 11/07/2020

» State-owned Thai Credit Guarantee Corporation (TCG) has set a loan guarantee amount of 30 billion baht for small and medium-sized enterprise (SME) operators whose loans are at risk of turning sour.

Savings accounts surge 14%

Business, Darana Chudasri, Published on 02/07/2020

» Banks' outstanding balance in savings accounts at the end of June jumped 14% from the end of last year, showing money continued to pour into bank deposits as they are perceived a safe haven amid economic uncertainties caused by the pandemic, despite the rock-bottom interest rates.

Household debt risks boiling over

Business, Somruedi Banchongduang, Published on 23/05/2020

» The country's household bad debt is expected to reach 1 trillion baht this year, putting the ratio to total loans outstanding into double digits as debt-servicing ability erodes amid coronavirus-induced income shocks, says the head of the National Credit Bureau (NCB).

GH Bank to launch debt rejig scheme

Business, Wichit Chantanusornsiri, Published on 24/02/2020

» State-owned GH Bank plans to introduce a new debt restructuring scheme, including a penalty interest haircut and interest payment deferrals, in April to help turn around bad loans.