Showing 1 - 10 of 13

New insurance strategy to tackle climate disasters

Business, Nuntawun Polkuamdee, Published on 16/10/2025

» The Office of the Insurance Commission (OIC) is launching a new strategic roadmap to strengthen Thailand's non-life insurance sector, aiming to address rising disaster risks and the growing challenges of an ageing population.

Regulator picks premiums to hit B1tn this year

Business, Nuntawun Polkuamdee, Published on 05/02/2025

» Life and non-life insurance businesses should expand this year, driving the industry's overall premiums to 1 trillion baht if economic growth continues, says the Office of the Insurance Commission (OIC).

Regulator considers screening for actuaries

Business, Nuntawun Polkuamdee, Published on 12/08/2024

» The Office of the Insurance Commission (OIC) is considering a plan to set up a screening committee that can suspend or revoke the licences of actuarial mathematicians to prevent risks to insurance firms and policyholders.

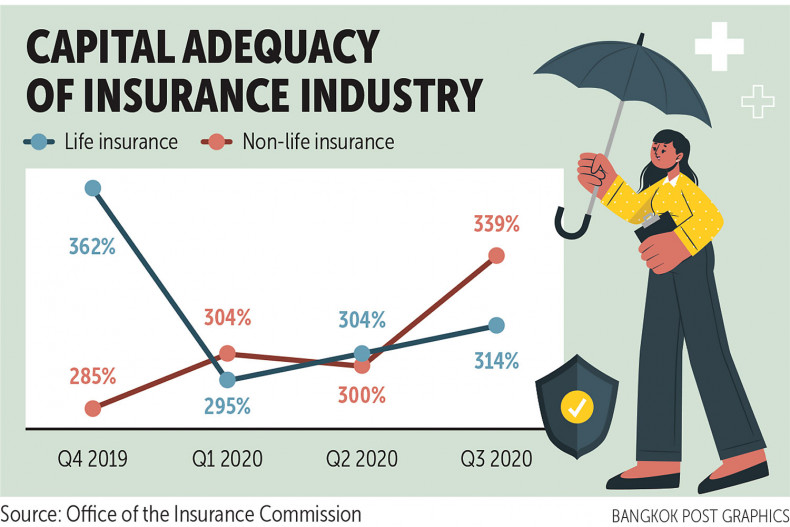

Regulator nails down capital adequacy method

Business, Darana Chudasri, Published on 05/02/2021

» The Office of Insurance Commission (OIC) has approved the revision of its capital adequacy ratio (CAR) calculation method, broadening opportunities for local insurance companies to invest in foreign assets and diversify risks during the pandemic and amid low interest rates.

Investment eyed in lower-grade bonds

Business, Darana Chudasri, Published on 28/01/2021

» The Office of the Insurance Commission (OIC) is poised to allow insurance companies to invest in non-investment grade bonds to seek higher investment returns amid a struggling economy, says a market source who requested anonymity.

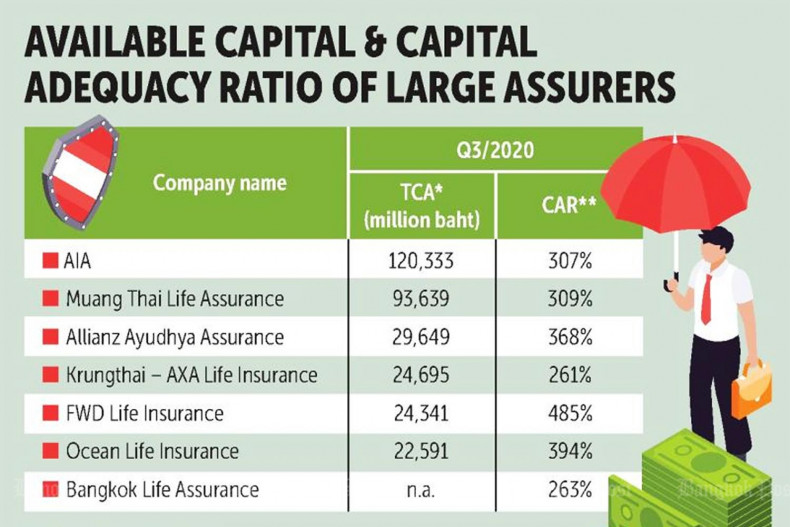

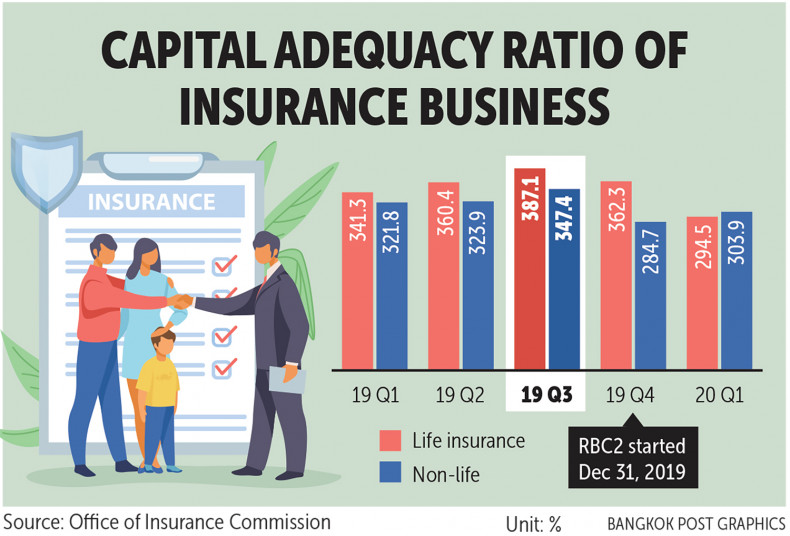

New capital calculation to benefit markets, firms say

Business, Darana Chudasri, Published on 09/09/2020

» Insurance companies say an adjustment of the risk-based capital calculation criteria will create positive investor sentiment for risk management and could benefit capital markets.

Risk charge method under fire

Business, Darana Chudasri, Published on 29/08/2020

» Insurance companies are requesting that the Office of the Insurance Commission (OIC) review the risk charge calculation version 2 that was implemented last year, citing its negative impact on the industry's capital adequacy ratio (CAR).

Experts approve of OIC policy

Business, Darana Chudasri, Published on 28/04/2020

» Industry experts recommend auto insurance policyholders exploit the Office of the Insurance Commission's (OIC) policy to allow insurers to temporarily charge premiums on a pro-rata basis by putting the insurance on hold while working from home to either receive cash back or extend the protection period.

The end of retirement

Business, John D. Stoll, Published on 11/01/2020

» It took about six years of annual asset reviews with my financial planner, Joe Mackey, to confront a big question. After I spent my entire adult life trying to save enough to quit working by 65, Mr. Mackey wanted to know what my rush was.

OIC tries to help insurers offset poor bond yields

Business, Darana Chudasri, Published on 14/09/2019

» The Office of the Insurance Commission (OIC) wants to ease the liability adequacy test (LAT) calculation for life insurance companies to alleviate the impact from falling bond yields on businesses.