Showing 1 - 10 of 14

Economic Party, led by retired army general, to tackle debt

Post Reporters, Published on 13/01/2026

» Gen Rangsee Kitiyanasap, leader and prime ministerial candidate of the Economic Party, on Monday introduced the party's economic advisory team and key policy proposals, pledging to tackle household debt and reduce electricity costs.

Over 3% of Thais suffering poverty

News, Post Reporters, Published on 17/09/2025

» Thailand is still struggling with poverty, with 2.39 million people, or 3.41% of the population, classified as poor in 2023, says research by the Program Management Unit for Area-Based Development (PMU-A).

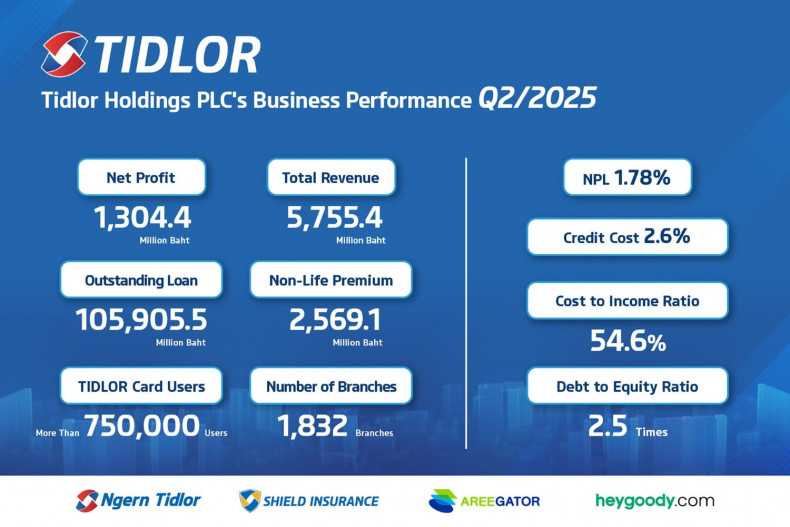

TIDLOR Hits Record Q2 Profit on Quality Growth

Published on 13/08/2025

» Bangkok, August 13, 2025 — Tidlor Holdings Public Company Limited (“TIDLOR” or the “Company”) has reported strong, quality-driven growth for the second quarter of 2025, driven by the robust expansion of its low-risk insurance brokerage business and effective cost and credit quality management in its lending operations.

Tidlor Holdings Soars 56% on SET Debut

Published on 16/05/2025

» Bangkok, 15 May 2025 – Tidlor Holdings Public Company Limited (“Tidlor Holdings”) made its trading debut on the Stock Exchange of Thailand (SET) under the ticker symbol TIDLOR, following its successful transformation into a holding company structure. The shares were enthusiastically received by investors, closing at THB 15 on the first day—an increase of 56.25% from the previous closing price of NTL.

VAT mulled for firms with less revenue

News, Wichit Chantanusornsiri, Published on 02/05/2025

» Finance Minister Pichai Chunhavajira on Thursday floated an idea of collecting value-added tax (VAT) from businesses with an annual income below 1.8 million baht to boost state income and reduce budget deficits.

Govt mulls buying underperforming NPLs

News, Somruedi Banchongduang, Published on 24/03/2025

» The government has announced plans to purchase non-performing loans (NPLs) with outstanding balances below 100,000 baht to alleviate financial burdens on small-scale debtors.

Debt plan spooks pundits

News, Apinya Wipatayotin and Somruedi Banchongduang, Published on 20/03/2025

» Academics warned the government on Wednesday about implementing former prime minister Thaksin Shinawatra's proposal to address household debt, saying it may not solve the underlying issue and could even backfire.

Thai Credit Targets Double-Digit Growth with Digital Focus

Published on 13/02/2025

» Thai Credit Bank Public Company Limited (CREDIT) has announced its 2025 business plan, setting ambitious targets for double-digit loan growth while embracing digital transformation to boost service efficiency and deliver sustainable growth. This follows the bank’s record-breaking net profit of 3,624 million baht in 2024, reinforcing confidence in its long-term strategic direction.

BAM Enhances Customer Reach with ConnectX CDP

Published on 13/06/2024

» Bangkok Commercial Asset Management PCL. known as BAM, a leading force in resolving commercial banks’ NPAs and NPLs issues and driving the Thai economy and society towards sustainable growth, has made significant strides in customer engagement through its strategic collaboration with ConnectX and adoption of cutting-edge MarTech solutions to enhance marketing efficiency through the seamless integration of a Customer Data Platform (CDP). This integrated solution has significantly optimised how the company collects and utilises customer data, leading to enhanced marketing strategies with increased precision and relevance.

GSB and BAM Form 1 Billion Baht Debt Relief Venture

Published on 31/05/2024

» Government Savings Bank (GSB) has partnered with Bangkok Commercial Asset Management (BAM) to establish a joint venture, ARI Asset Management Co., Ltd. (ARI-AMC), with a capital investment of 1 billion baht. ARI-AMC will purchase and transfer non-performing loans (NPLs) from GSB over the course of three quarters in the fiscal year 2024, providing assistance to over 500,000 accounts of small and medium-sized enterprise (SME) debtors and credit card debtors.