Showing 1 - 10 of 13

Interview: Leading Thailand’s Micro-SME Banking Revolution

Published on 08/12/2025

» As Thailand works to expand financial inclusion and uplift its vast network of small business owners, Thai Credit Retail Bank Plc (CREDIT) has emerged as a fast-growing force driving change at the heart of the informal economy. In this interview, Chief Executive Officer Mr Roy Agustinus Gunara explains how the Bank has carved out a distinctive position in the national banking landscape prioritising micro-SME lending, relationship-based services and a forward-looking digital transformation designed to unlock opportunities for millions of entrepreneurs traditionally excluded from mainstream finance.

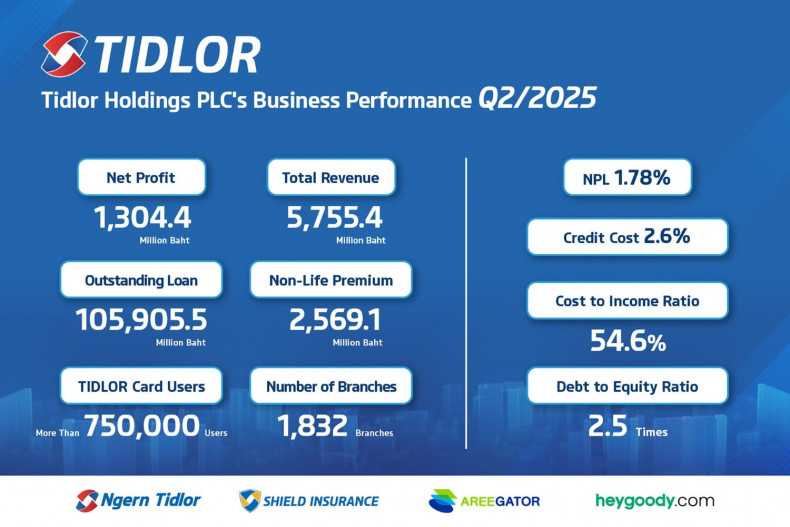

TIDLOR Hits Record Q2 Profit on Quality Growth

Published on 13/08/2025

» Bangkok, August 13, 2025 — Tidlor Holdings Public Company Limited (“TIDLOR” or the “Company”) has reported strong, quality-driven growth for the second quarter of 2025, driven by the robust expansion of its low-risk insurance brokerage business and effective cost and credit quality management in its lending operations.

TRIS Upgrades Tidlor Holdings and NTL to A+/Stable

Published on 27/05/2025

» TRIS Upgrades Tidlor Holdings to “A+/Stable” and NTL from “A” to “A+/Stable”Reflecting the strength of its restructuring into a holding company and its positive impact on funding costs

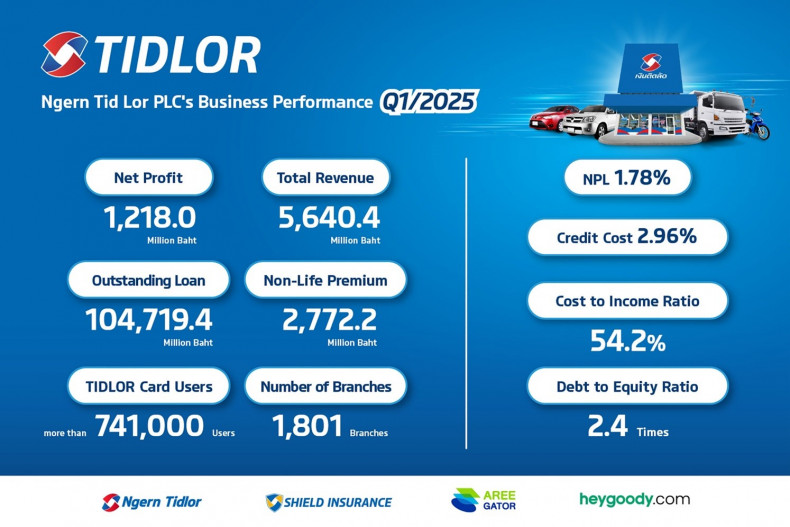

Ngern Tid Lor Posts Record Profit Amid Sustained Growth

Published on 27/05/2025

» Bangkok, 27 May 2025 – Ngern Tid Lor Public Company Limited (NTL) delivered record-breaking financial results in Q1/2025, reporting a net profit of THB 1,218 million, marking a 10.3% year-on-year increase and 16.6% quarter-on-quarter growth. Total revenue rose 6.2% year-on-year to THB 5,640.4 million, driven by continued expansion in lending and insurance brokerage and supported by robust cost control measures.

Govt mulls buying underperforming NPLs

News, Somruedi Banchongduang, Published on 24/03/2025

» The government has announced plans to purchase non-performing loans (NPLs) with outstanding balances below 100,000 baht to alleviate financial burdens on small-scale debtors.

PM defends Thaksin’s debt proposal

Mongkol Bangprapa, Published on 18/03/2025

» Prime Minister Paetongtarn Shinawatra on Tuesday defended an idea floated by her father, former prime minister Thaksin Shinawatra, to address the household debt problem by allowing private companies to buy and manage debt from the banking system.

UOB’s FY24 net profit rose 6% to record S$6.0 billion

Published on 26/02/2025

» UOB Group reported a record net profit of S$6.0 billion, up 6%, for the financial year ended 31 December 2024 (FY24).

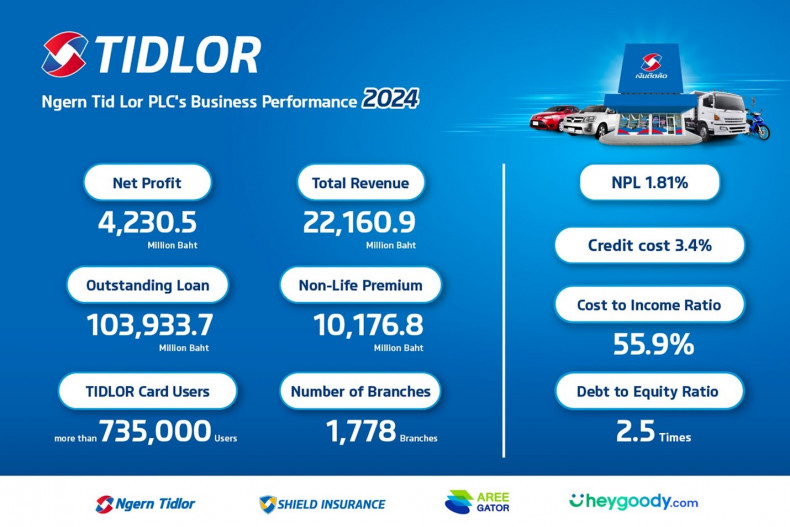

TIDLOR Reports Record Profit and Strong Insurance Growth

Published on 11/02/2025

» Ngern Tid Lor Public Company Limited (“TIDLOR” or the “Company”) reported a record-high net profit of THB 4,230.5 million for 2024, reflecting an 11.6% year-on-year (YoY) growth. This impressive performance was driven by an expansion in lending operations, an improvement in net interest margin, and strong results in the insurance brokerage business.

TIDLOR Declares 40% Interim Dividend, Reschedules Tender Offer

Published on 20/12/2024

» Ngern Tid Lor Public Company Limited (TIDLOR) has approved an interim cash dividend of 0.438 Baht per share, equivalent to 40% of its net profit for the first nine months of 2024. The record date for eligible shareholders is January 6, 2025, with payment scheduled for January 17, 2025.

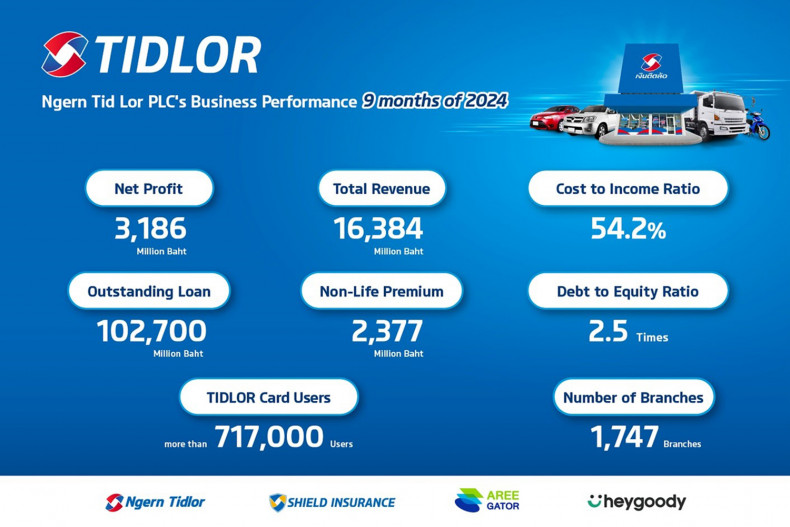

TIDLOR Posts 10% Profit Growth, NPL at 1.88%

Published on 29/11/2024

» Ngern Tid Lor Public Company Limited (TIDLOR) reported robust operational results for the first three quarters of 2024, with a net profit of 3.186 billion baht, marking a 10.3% year-on-year (YoY) growth. Total revenues increased by 19.5% (YoY), attributed to higher interest income from credit loan business expansion, strategic adjustments in net interest margin, and continued growth in fee and service income from the insurance brokerage business.