Showing 1 - 10 of 16

GH Bank sees 19% loan growth in 2025

Business, Wichit Chantanusornsiri, Published on 11/12/2025

» Government Housing Bank (GH Bank), a state-owned financial institution that has more than 40% of the market for housing loans across the financial system, believes that demand for homes priced below 2 million baht will remain strong next year.

Flat-rate interest for leasing on the way out

Wichit Chantanusornsiri, Published on 20/08/2025

» The use of flat-rate interest calculation in the vehicle leasing business should be scrapped in the interest of fairness to borrowers, according to a government committee tasked with addressing household debt.

GH Bank eager to explore the high-end mortgage market

Business, Wichit Chantanusornsiri, Published on 02/08/2025

» Government Housing (GH) Bank is expanding its housing loan market to include the high-end segment, which accounts for 4.5% of its total lending.

Several banks reduce loan rates, following the regulator

Business, Somruedi Banchongduang and Wichit Chantanusornsiri, Published on 06/03/2025

» Six major commercial banks and a handful of state-owned banks announced a reduction of lending interest rates following the Bank of Thailand's policy rate cut late last month to alleviate the financial burden for borrowers amid a weakening economy.

Government Housing Bank offers mortgages for LGBTQ+ couples

Business, Wichit Chantanusornsiri, Published on 06/02/2025

» The Government Housing (GH) Bank, a state financial institution specialising in mortgages, is committed to supporting the government's policy on gender equality, launching a loan programme tailored for LGBTQ+ couples.

Healthy enrolment eyed for debt scheme

Business, Wichit Chantanusornsiri, Published on 07/01/2025

» The government expects its "You Fight, We Help" debt relief programme will attract participation from debtors owing up to 300 billion baht, representing around 70% of those eligible to participate.

Banking on technology

Business, Wichit Chantanusornsiri, Published on 01/11/2021

» State agencies and state-run banks have been harnessing technology to enhance their performance, ranging from analysing suspicious tax evasion cases to facilitating bank customers conducting a live chat to request a loan.

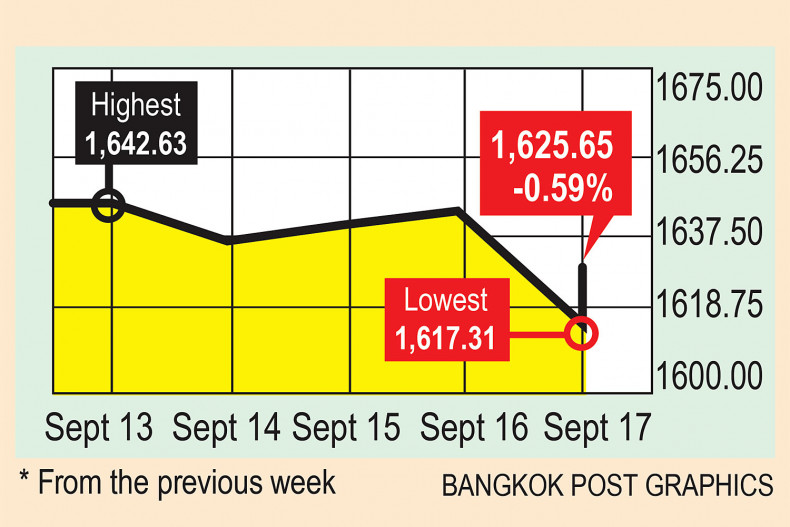

Fed policy and Evergrande debt weigh on sentiment

Business, Nuntawun Polkuamdee and Pornkamon Teerapiboonkun, Published on 18/09/2021

» Recap: European and emerging markets were mixed on Friday as global investors and traders weighed the prospect of reduced US Federal Reserve stimulus and risks from a likely default by the debt-ridden Chinese property developer Evergrande.

Scheme for low income earners proves popular

Business, Wichit Chantanusornsiri, Published on 14/09/2021

» A Government Housing Bank (GHB) project offering loans for low income earners to purchase a residence has received an overwhelming response as loan applications rose to 42 billion baht in value, two times higher than the amount earmarked for the loan scheme, just three days after opening for registration.

GH Bank plans digital offerings

Business, Wichit Chantanusornsiri, Published on 10/03/2021

» State-owned GH Bank plans to offer fully digital banking services by 2023, aiming to drastically reduce almost all over-the-counter transactions and beef up application services.