Showing 1 - 10 of 88

Dumping cash for cards

Business, Nuntawun Polkuamdee, Published on 08/12/2025

» International travel has been transformed more in the past decade than in the previous 50 years. Flights are booked instantly, hotels auto-recommend themselves, and in many major cities, cash has vanished almost entirely.

New ATM licences to expand availability

Business, Somruedi Banchongduang, Published on 04/10/2025

» The Bank of Thailand plans to introduce new business licences for white-label automated teller machines (ATMs) next year.

Peeling back the curtain on NT's great migration

Business, Komsan Tortermvasana, Published on 09/08/2025

» National Telecom (NT) has migrated most of its 2 million subscribers on the 2100-megahertz, 2300MHz and 850MHz spectrum bands to its 700MHz band, following the expiry of its ability to use the three bands on Aug 4.

Regional banking boost for Krungsri

Business, Somruedi Banchongduang, Published on 04/03/2025

» Krungsri (Bank of Ayudhya) reported its regional banking business accounted for 20% of total revenue, primarily attributed to high-yield loan products.

Cash handouts fuel ATM withdrawals

Business, Wichit Chantanusornsiri, Published on 30/01/2025

» The 10,000-baht cash handout for the elderly has stimulated spending, with withdrawals from Bank for Agriculture and Agricultural Cooperatives (BAAC) ATMs surging 13.3 times on the first day of transfers.

B10,000 handout reaches elderly, more to follow

Post Reporters, Published on 27/01/2025

» The government delivered its 10,000-baht handout to each of 3 million elderly people early Monday morning, and Prime Minister Paetongtarn Shinawatra said payments of subsequent stages would follow later.

Thai credit rating set to remain unchanged

Business, Wichit Chantanusornsiri, Published on 23/12/2024

» Moody's is likely to maintain Thailand's sovereign credit rating after two other rating agencies -- Standard & Poor's (S&P) and Fitch Ratings -- maintained the rating with a stable outlook, according to the Public Debt Management Office (PDMO).

Funding in place for 2nd phase of digital handout

Business, Wichit Chantanusornsiri, Published on 01/10/2024

» Deputy Finance Minister Paopoom Rojanasakul has confirmed that the government has sufficient funding for the second phase of the digital wallet scheme, with a budget of 180 billion baht having already been allocated.

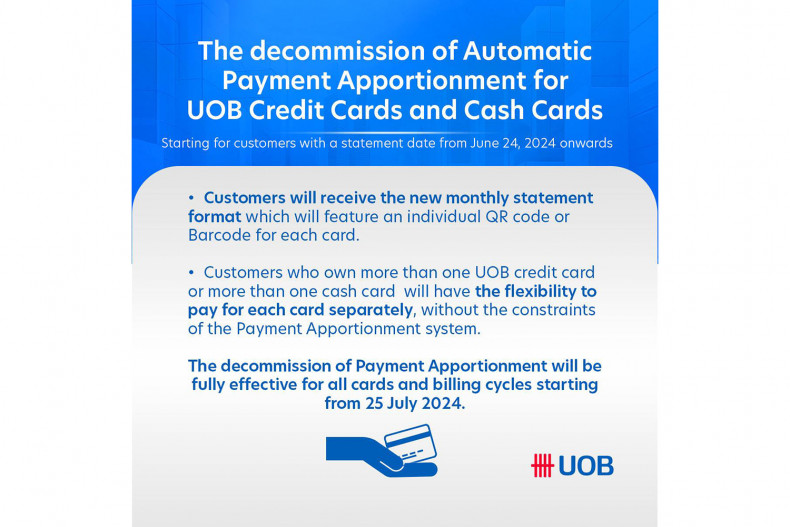

Decommission of Payment Apportionment for UOB Credit Cards and Cash Cards

Published on 08/07/2024

» Starting from the billing cycle cut date of 24 June 2024 onwards, UOB Thailand will decommission the automatic payment apportionment system for UOB credit cards and cash cards. The customers with billing cycle cut date from 24 June onwards will receive the new monthly statement format which will feature an individual QR code and Barcode for each card. This change is intended to allow customers who hold more than one UOB credit card or more than one cash card, to have the flexibility to pay each card balance separately, without the constraints of the Payment Apportionment system.

PromptPay usage hits record high in 2023

Business, Somruedi Banchongduang, Published on 12/04/2024

» Financial transactions via PromptPay, Thailand’s national electronic payment platform, tallied a new high last year, while cash transactions posted a notable decline.