Showing 1 - 10 of 38

Lump-sum payments to departing employees

Business, Lawalliance Limited Company, Published on 12/07/2016

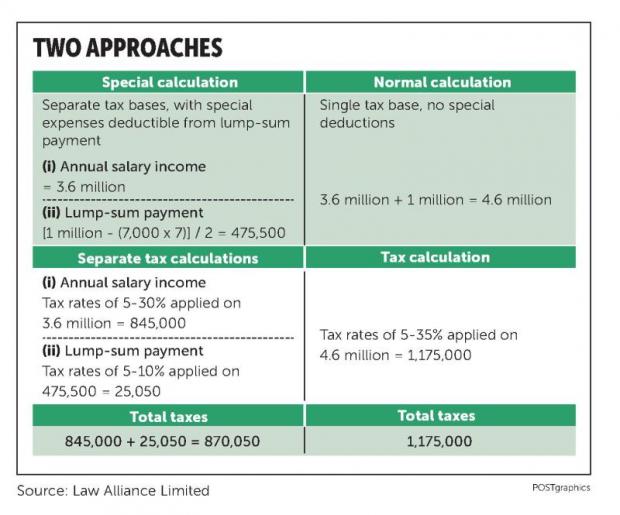

» When employment comes to an end, whether due to retirement, redundancy or voluntary resignation, the employer may need to make a lump-sum payment to the employee. As the lump sum could be all that a retired employee has left to live on, or a fund to be used during the vocational transition, the law helps to ease the tax burden by allowing a special calculation so that it is taxed separately from other income.

Deductibility of guaranteed amounts by fund sponsors

Business, Lawalliance Limited Company, Published on 03/10/2017

» Property funds have long been popular with investors in Thailand, where the mutual-fund structure is being phased out and funds are being converted to real estate investment trusts or REITs. Raising funds from investors through such vehicles often involves a guarantee from the originator to increase confidence in the investment. This can be the starting point for problems on the tax front.

Tax issues and business transfers: the devil is in the details

Business, Lawalliance Limited Company, Published on 25/07/2017

» Ever since tax incentives for business reorganisation were introduced two decades ago, different issues have arisen intermittently, especially as they relate to an entire business transfer (EBT), which has become a popular practice.

Looking for tax incentives? Make sure you comply

Business, Lawalliance Limited Company, Published on 13/06/2017

» Tax incentives can be as sweet as honey, but making a mistake in compliance, inadvertently or otherwise, can leave a taste as bitter as gall. Corporate taxpayers have learned this painful lesson in light of court rulings on the tax treatment of losses carried forward from Board of Investment-promoted businesses.

New tax legislation to comply with Fatca

Business, Lawalliance Limited Company, Published on 16/05/2017

» On March 4 last year, Thailand and the United States entered into an agreement to improve international tax compliance and to implement the Foreign Account Tax Compliance Act (Fatca), which Washington introduced in 2010 in an attempt to discourage tax evasion by US citizens holding assets abroad.

Tougher measures against tax dodgers

Business, Lawalliance Limited Company, Published on 21/02/2017

» The world is entering a new era in which national tax authorities are joining hands to set up a system to hound those who dodge paying their fair share of tax by applying unacceptable tax-planning schemes.

The tax cost base rules for share trades

Business, Lawalliance Limited Company, Published on 13/12/2016

» Trading shares is a common activity today because various authorities -- including the Revenue Department, the Stock Exchange of Thailand and the Securities and Exchange Commission -- have established clear guidelines for almost every aspect of the process. This helps put investors' minds at ease, as they feel they have enough knowledge to deal with most of the tax issues without difficulty. Unfortunately, this belief can be shaken when the guidelines do not strictly follow the fundamental provisions of the law.

When software value is liberated from royalty taxes

Business, Lawalliance Limited Company, Published on 15/11/2016

» It is amazing how ubiquitous software has become in the past few decades, becoming an essential part of everything from washing machines to mobile phones. Few people are aware, however, that there can be tax implications for some software that comes with the hardware they are paying for.

When receivables are seized to pay off tax debts

Business, Lawalliance Limited Company, Published on 29/11/2016

» The government has been giving away a lot of tax packages -- not only as a new-year present but all year round. It started with a tax amnesty programme (without calling it an amnesty), and has also offered allowances for those who spend at Thai resorts during holidays, double deductions for new investments, and tax incentives for investors that take significant steps in contributing to technological growth.

Broader interpretation boosts anti-avoidance rules

Business, Lawalliance Limited Company, Published on 20/09/2016

» Businesses seeking to structure cross-border transactions in ways that help them avoid paying tax are finding it more difficult as authorities worldwide step up information sharing. One such example is the Global Forum on Transparency and Exchange of Information for Tax Purposes, which is driven by the Organization for Economic Co-operation and Development and has 135 members. The cabinet recently approved Thailand's membership in the forum.