Showing 1 - 10 of 17

Deductibility of guaranteed amounts by fund sponsors

Business, Lawalliance Limited Company, Published on 03/10/2017

» Property funds have long been popular with investors in Thailand, where the mutual-fund structure is being phased out and funds are being converted to real estate investment trusts or REITs. Raising funds from investors through such vehicles often involves a guarantee from the originator to increase confidence in the investment. This can be the starting point for problems on the tax front.

New tax legislation to comply with Fatca

Business, Lawalliance Limited Company, Published on 16/05/2017

» On March 4 last year, Thailand and the United States entered into an agreement to improve international tax compliance and to implement the Foreign Account Tax Compliance Act (Fatca), which Washington introduced in 2010 in an attempt to discourage tax evasion by US citizens holding assets abroad.

The tax cost base rules for share trades

Business, Lawalliance Limited Company, Published on 13/12/2016

» Trading shares is a common activity today because various authorities -- including the Revenue Department, the Stock Exchange of Thailand and the Securities and Exchange Commission -- have established clear guidelines for almost every aspect of the process. This helps put investors' minds at ease, as they feel they have enough knowledge to deal with most of the tax issues without difficulty. Unfortunately, this belief can be shaken when the guidelines do not strictly follow the fundamental provisions of the law.

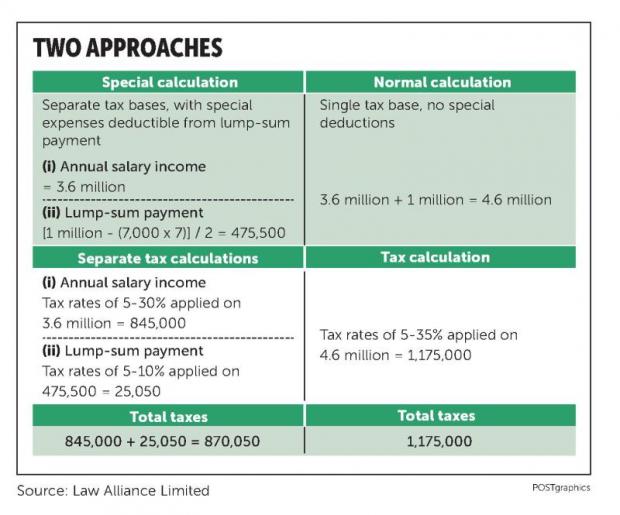

Lump-sum payments to departing employees

Business, Lawalliance Limited Company, Published on 12/07/2016

» When employment comes to an end, whether due to retirement, redundancy or voluntary resignation, the employer may need to make a lump-sum payment to the employee. As the lump sum could be all that a retired employee has left to live on, or a fund to be used during the vocational transition, the law helps to ease the tax burden by allowing a special calculation so that it is taxed separately from other income.

New tax incentives aimed at summer spending sprees

Business, Lawalliance Limited Company, Published on 05/04/2016

» Once again, Thailand's hot summer has become the season for tax incentives. So much legislation has been coming out lately that it's difficult for taxpayers to ensure timely and accurate compliance.

Will the price-valuation rules change in the near future?

Business, Lawalliance Limited Company, Published on 22/09/2015

» Ever since Section 65 bis and Section 65 ter of the Revenue Code were created, most transactions, unless excluded from the tax regime, have been subject to tax based on transaction value. However, the law rarely accepts a transaction value lower than the "market value" and allows authorities to assess additional tax based on "imputed revenue", which is on a par with the market value.

New year TAX update: Corporate reorganisation and others

Business, Lawalliance Limited Company, Published on 14/01/2014

» During the festive season, several new tax laws were passed quietly while all worried eyes were on Thailand's growing political uncertainty. The changes to the progressive rates for personal income tax, which offer lower tax brackets, have already been well publicised. However, the following developments are also worth studying:

Tax reporting of OTC share transactions

Business, Lawalliance Limited Company, Published on 24/09/2013

» The government is currently struggling with an important decision as to whether it should increase the value-added tax (VAT) rate to cope with the need to cover the rising budget deficit. As the increase will certainly have a negative impact on living costs, raise inflation and reduce domestic consumption, some government officials favour expanding the tax base as much as possible in lieu of increasing the VAT rate.

Critical TAX issues unresolved for reits

Business, Lawalliance Limited Company, Published on 02/07/2013

» With great efforts from a working team, the Securities and Exchange Commission seems ready for the launch of real estate investment trusts (REITs). Several property projects are in the pipeline pending the SEC's approval. The arrival of REITs also triggers a countdown for regular property funds (PFs), which have been in use for a long time.

How the Thailand-Taiwan tax treaty could help you

Business, Lawalliance Limited Company, Published on 18/06/2013

» A news report last week about VAT fraud of 3.6 billion baht by more than 30 companies claiming exports of empty containers reminds everyone of the 1997 incident that misled the government to believe that Thailand's economy was still doing well due to healthy exports.