Showing 1 - 10 of 10,000

Rate cut impact limited

Business, Kampon Adireksombat, Wachirawat Banchuen & Pongsakorn Srisakawkul, Published on 05/12/2019

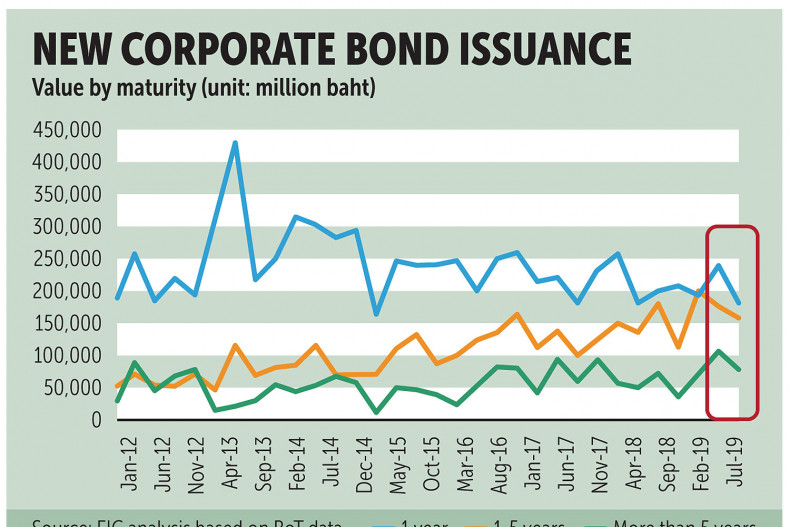

» Thailand's financial conditions were tighter than the historical average in the third quarter this year despite a policy rate cut by the Monetary Policy Committee (MPC) in August. This reflected persistent baht appreciation, an increase in corporate spreads and a slowdown in corporate borrowing and commercial bank loan growth.

Analyst anticipates rate cut

Business, Nuntawun Polkuamdee, Published on 07/08/2021

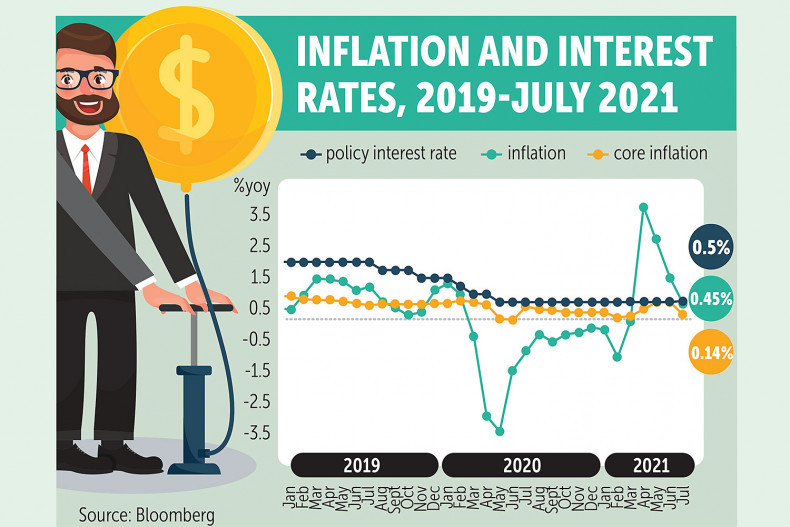

» The Monetary Policy Committee (MPC) is expected to cut the policy interest rate at one of its three remaining meetings scheduled for this year to help the struggling economy amid a worsening pandemic, says Asia Plus Securities (ASPS).

Cabinet approves electricity rate cut

Yuthana Praiwan and Onine Reporters, Published on 01/04/2025

» The cabinet on Tuesday approved a proposed reduction in the price of electricity from 4.15 baht per kilowatt hour to 3.99 baht for the billing period May 1 to Aug 31.

Baht shrugs off rate cut

Bloomberg News, Published on 08/08/2019

» The baht is defying the conventional wisdom that an interest-rate cut spurs weakness in a currency.

Civil code's interest rate cut

Online Reporters, Published on 09/03/2021

» The cabinet on Tuesday approved amendments to the Civil and Commercial Code to cut its statutory interest rate from 7.5% to suit economic conditions, according to the prime minister.

Rate cut not the answer

News, Editorial, Published on 28/06/2021

» Prime Minister Prayut Chan-o-cha recently asked the Bank of Thailand to review interest rates for credit cards and personal loans to tackle skyrocketing household debt.

Russia delivers surprise rate cut

Bloomberg News, Published on 08/04/2022

» Russia’s central bank unexpectedly slashed its key interest rate in a sign of confidence that the worst of the financial turmoil triggered by the invasion of Ukraine is past.

Student loan rate cut proposed

Business, Wichit Chantanusornsiri, Published on 17/06/2022

» The interest rate for the Student Loan Fund will be lowered to reduce the burden on borrowers, says permanent finance secretary Krisada Chinavicharana.

Global rate-cut debate unfolding

News, Daniel Moss, Published on 19/01/2024

» From villains to heroes. If there's one theme that has dominated markets in the opening days of the year, it's been breathless speculation about which central bank will cut interest rates first and by how much: It's no longer if but when. There's little doubt that borrowing costs will be lower in many key economies well before the end of 2024. Even the notoriously hawkish Bundesbank is on board.

Industrialists join rate-cut chorus

Lamonphet Apisitniran, Published on 07/05/2024

» The Bank of Thailand should consider reducing interest rates in the second half to relieve the financial burden of small and medium-sized enterprises (SMEs), which are facing tougher competition and an uncertain economy, says the Federation of Thai Industries (FTI).