Showing 1 - 10 of 12

Ensure fair and just audits and avoid abusive taxation

Business, Lawalliance Limited Company, Published on 05/09/2017

» The Revenue Code provides various tools to tax officials to ensure that taxes can be collected with a high level of efficiency. These tools can serve as a double-edge sword, ensuring tax compliance while also imposing punishment on defaulting taxpayers.

Lump-sum payments to departing employees

Business, Lawalliance Limited Company, Published on 12/07/2016

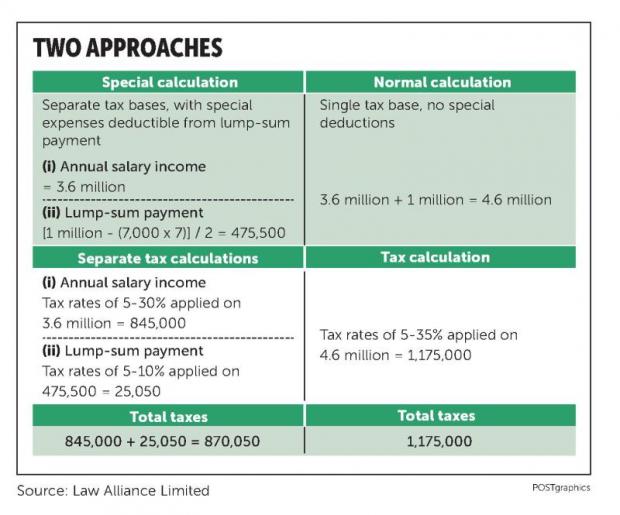

» When employment comes to an end, whether due to retirement, redundancy or voluntary resignation, the employer may need to make a lump-sum payment to the employee. As the lump sum could be all that a retired employee has left to live on, or a fund to be used during the vocational transition, the law helps to ease the tax burden by allowing a special calculation so that it is taxed separately from other income.

Rebranding a regional operating headquarters as an international HQ

Business, Lawalliance Limited Company, Published on 10/03/2015

» The regional operating headquarters (ROH) provisions that Thai tax authorities introduced in 2002 have never been popular, as they are difficult to understand and comply with. As a result, many businesses have bypassed Thailand and chosen Kuala Lumpur for their regional offices.

Tax auditors snooping around pricey houses and cars

Business, Lawalliance Limited Company, Published on 01/07/2014

» There have been some interesting developments on the tax front since last week. As part of its ongoing reshuffle of senior officials, the National Council for Peace and Order shifted the director-general of the Customs Department to an inspector-general position at the Finance Ministry, effective immediately. The demotion was not unexpected, and more changes are likely to follow.

Administrative law versus revenue assessment

Business, Lawalliance Limited Company, Published on 25/02/2014

» When the taxman issues an assessment notice demanding additional tax liability, most people tend to focus mainly on the tax issue and find a way to get around the Revenue Department. They often forget that, apart from the main dispute, there is the possibility that they can take advantage of protection mechanisms granted to them under administrative law as well.

New year TAX update: Corporate reorganisation and others

Business, Lawalliance Limited Company, Published on 14/01/2014

» During the festive season, several new tax laws were passed quietly while all worried eyes were on Thailand's growing political uncertainty. The changes to the progressive rates for personal income tax, which offer lower tax brackets, have already been well publicised. However, the following developments are also worth studying:

Tax reporting of OTC share transactions

Business, Lawalliance Limited Company, Published on 24/09/2013

» The government is currently struggling with an important decision as to whether it should increase the value-added tax (VAT) rate to cope with the need to cover the rising budget deficit. As the increase will certainly have a negative impact on living costs, raise inflation and reduce domestic consumption, some government officials favour expanding the tax base as much as possible in lieu of increasing the VAT rate.

Impact of 5% tax on Mid-Year filing

Business, Lawalliance Limited Company, Published on 16/07/2013

» Just like one domino toppling over inevitably leads to the collapse of all the other dominoes, failure to comply with filing one's tax return or keep books and records only leads from one tragedy to another.

The battle over boi tax treatment

Business, Lawalliance Limited Company, Published on 04/06/2013

» It is common nowadays to read about debates between the Finance Ministry and the Bank of Thailand over interest rates and economic figures. Similar spirited conversations have been taking place behind the scene about different topics between the Board of Investment (BoI) and the Revenue Department for quite some time.

Handling the 5% tax assessment

Business, Lawalliance Limited Company, Published on 07/05/2013

» In the real world, your company may come across a situation in which a financial statement cannot be signed off because of some problems. For example, conflict from changing the licensed auditor from one house to another often delays the audit process as the old one may refuse to cooperate and return necessary documents. Violating Securities and Exchange Commission rules, such as for a connected transaction, could also be the cause of postponing the completion of the financial statement until the problem can be resolved.