Showing 1 - 10 of 18

Land & Houses projects housing slump amid economic stagnation

Business, Kanana Katharangsiporn, Published on 22/01/2026

» SET-listed developer Land & Houses (LH) plans to launch only two residential projects worth a combined 3.66 billion baht in 2026, the lowest level in more than two decades, due to a sluggish economy and unpredictable housing market conditions.

Pressured property developers look to adapt

Kanana Katharangsiporn, Published on 29/12/2025

» The residential property market closed 2025 under heavy pressure from weak purchasing power, tight mortgage lending and external shocks, prompting developers to recalibrate strategies for 2026 around affordability, risk management and liquidity preservation.

Bangkok land prices decline in 2nd quarter

Business, Kanana Katharangsiporn, Published on 31/07/2025

» The price index for vacant land in Greater Bangkok fell in the second quarter of 2025 after two consecutive quarterly increases, mainly attributed to the economic slowdown and the postponement of Bangkok's new city plan implementation to 2027.

Condo developers struggle with B80bn debt mountain

Kanana Katharangsiporn, Published on 13/03/2025

» A mismatch between loan terms and project durations has forced developers with substantial condo inventory to grapple with short-term debt obligations, with over 80 billion baht in debentures due for repayment this year, according to Asia Plus Securities (ASPS).

N.C. Housing Plc unveils five projects worth B3bn

Business, Kanana Katharangsiporn, Published on 12/02/2025

» Mid-sized developer N.C. Housing Plc (NCH) plans to launch five new projects worth a combined 3 billion baht to replace sold-out projects, with a target of 4 billion baht in presales and 2 billion baht in revenue.

Bangkok residential supply dip to persist

Business, Kanana Katharangsiporn, Published on 11/02/2025

» Launches of new residential supply in Greater Bangkok will decline for a third consecutive year in 2025, largely attributed to an increase in unsold units carried over from 2024, an uncertain economy and high household debt, according to Kasikorn Research Center.

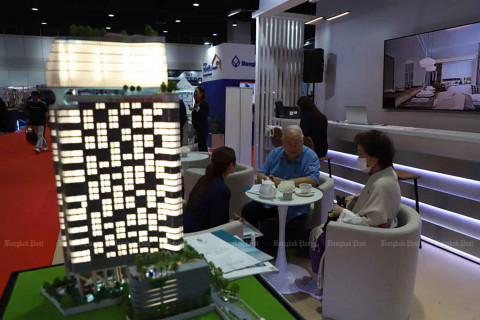

Firms jittery on new launches

Kanana Katharangsiporn, Published on 26/09/2024

» Residential developers in Greater Bangkok should exercise caution regarding new launches over the next nine months as the market is showing signs of strain, with declining sales and increasing unsold inventory in the second quarter.

Developers look to shareholders for loans

Kanana Katharangsiporn, Published on 05/08/2024

» Listed residential developers have sought to retain and raise cash by avoiding new costs, borrowing short-term loans from major shareholders, and selling assets to mitigate risks amid difficulties in the financial market and limited mortgage loan approvals.

Sena adopts cautious investment strategy

Kanana Katharangsiporn, Published on 31/07/2024

» Developers need to be more cautious with investments in the second half, as the financial market is concerned about corporate debenture repayments, due to the economic slowdown that affected demand in the first half.

Property Perfect plans cautious strategy

Business, Kanana Katharangsiporn, Published on 28/02/2024

» SET-listed developer Property Perfect is taking a more cautious approach this year, focusing on debt reduction and launching fewer new projects because of stricter funding rules for both supply and demand.