Showing 1 - 10 of 10,000

Duo on motorbike snatch bag from tuk-tuk tourists

Online Reporters, Published on 25/02/2026

» Police are hunting for two thieves on a motorcycle, who snatched valuables from two Chinese women on a moving tuk-tuk late at night near the Pathumwan intersection in Bangkok.

Fruit tycoon shot to death in debt-related argument

Jakkrit Waewkraihong, Published on 25/02/2026

» Police have arrested a 33-year-old man in Chanthaburi on charges of shooting a local fruit tycoon to death and stealing five baht-weight of gold worth about 375,000 baht.

ONE Championship: Myanmar’s Salai Htan Khee Shein turns orphan’s pain into power at Lumpinee

Nick Atkin, Published on 25/02/2026

» Lumpinee Stadium roared for Myanmar’s new golden boy.

Border security tightened as more scammers flee crackdowns

Online Reporters, Published on 25/02/2026

» The Royal Thai Police Office (RTP) has ordered heightened border security after detecting attempts by transnational scam syndicates to slip into Thailand to evade intensified crackdowns in neighbouring countries.

Thai central bank unexpectedly cuts policy rate

Reuters and Post Reporters, Published on 25/02/2026

» The Bank of Thailand (BoT) unexpectedly cut its key interest rate at a review on Wednesday, as it seeks to further support the economy facing challenges including US tariff uncertainty and a strengthening baht.

Claude Cowork AI rattles software world after $830bn rout

Komsan Jandamit, Published on 25/02/2026

» A new wave of “digital co‑workers” from artificial intelligence (AI) firm Anthropic is unsettling technology investors and forcing companies to rethink how office work is done, after its Claude Cowork tool moved decisively beyond chat and into real tasks, from organising files to drafting reports, sending fresh tremors through the global software industry.

Google highlights AI-driven Play security gains in 2025

Puriward Sinthopnumchai, Published on 25/02/2026

» Google has published its 2025 annual security report, detailing how artificial intelligence (AI) has strengthened protections across Google Play and the wider Android app ecosystem, as the company seeks to bolster trust among billions of Android users worldwide.

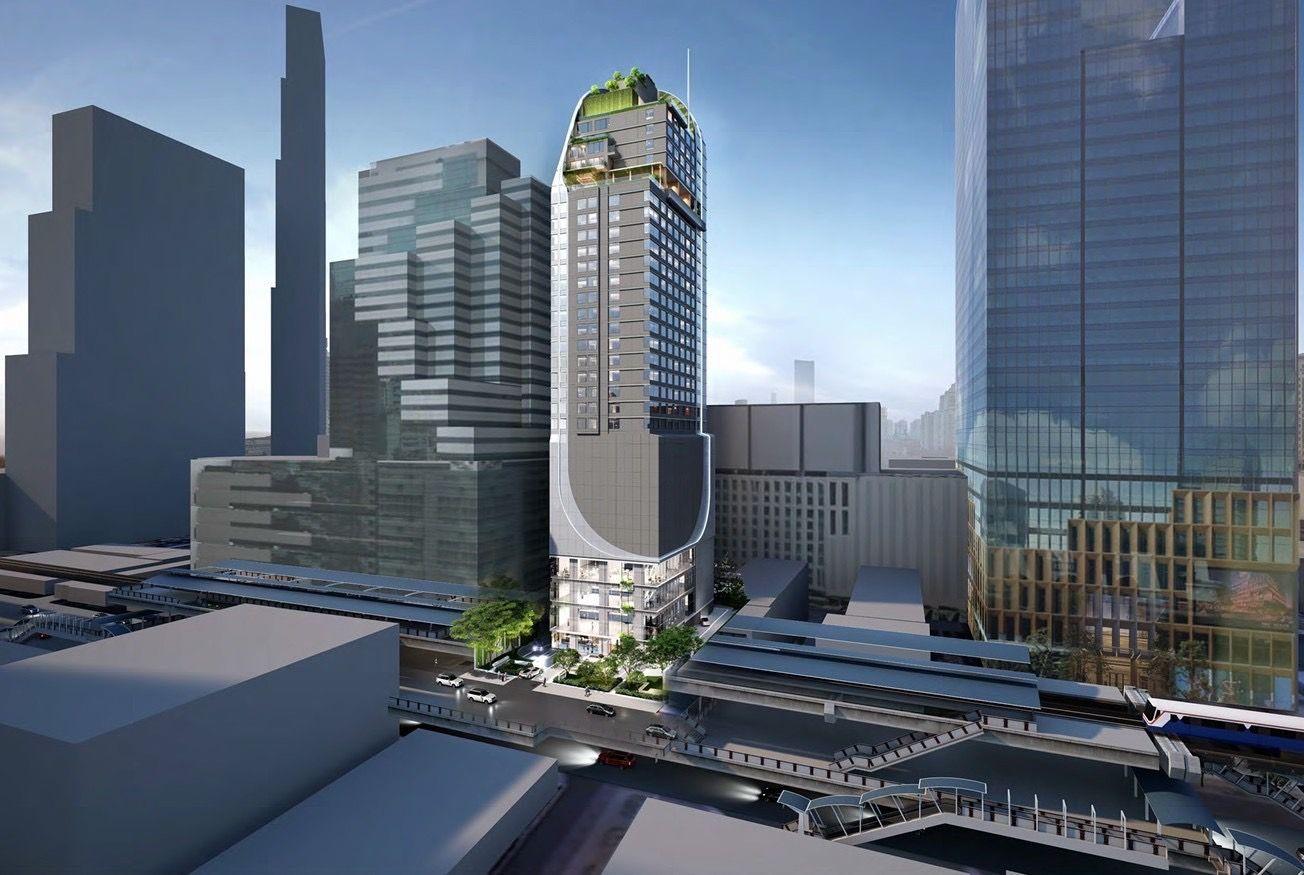

Aira Capital banking on leasehold developments

Business, Kanana Katharangsiporn, Published on 25/02/2026

» MAI-listed Aira Capital Group continues to focus on property investment on leasehold land, with plans to invest 2.3 billion baht to develop the DoubleTree by Hilton Bangkok Silom hotel, as well as 1 billion baht for a wellness residential project in a tourist destination.

Traditional media stages 2026 comeback

Business, Suchit Leesa-nguansuk, Published on 25/02/2026

» Thailand's media industry spending is expected to grow by 1.7% in 2026 to reach 87.3 billion baht, as brands shift from short-term performance marketing towards a more balanced, structurally driven growth strategy, according to media agency Media Intelligence Group (MI Group).

Industrial property defies uncertainty

Business, Kanana Katharangsiporn, Published on 25/02/2026

» The industrial and logistics property sector continues to outperform other segments, supported by robust demand and ongoing government backing despite prevailing uncertainties, according to property consultancy CBRE Thailand.