Showing 1 - 10 of 7,090

Trump's new Iran threats rattle markets

Business, Nuntawun Polkuamdee and Nareerat Wiriyapong, Published on 21/02/2026

» RECAP: Most Asian equities fell and oil prices rose yesterday after Donald Trump ratcheted up Middle East tensions by hinting at possible military strikes on Iran if it did not make a "meaningful deal" in nuclear talks. The remarks put the brakes on a rebound in markets following an AI-fuelled sell-off earlier.

US Supreme Court strikes down Trump’s tariffs

Reuters and Bloomberg, Published on 20/02/2026

» WASHINGTON - The US Supreme Court on Friday struck down the sweeping tariffs that President Donald Trump has pursued under a law meant for use in national emergencies, rejecting one of his most contentious assertions of his authority in a ruling with major implications for the global economy.

Court extends sentence for lawyer who called for monarchy reform

Reuters and online reporters, Published on 20/02/2026

» The Criminal Court in Bangkok has sentenced jailed human rights lawyer Arnon Nampa to an additional two years and eight months in prison for royal defamation and sedition in connection with a speech he gave at a protest in Bangkok in November 2020, a rights group said on Friday, bringing his combined sentence to more than 30 years.

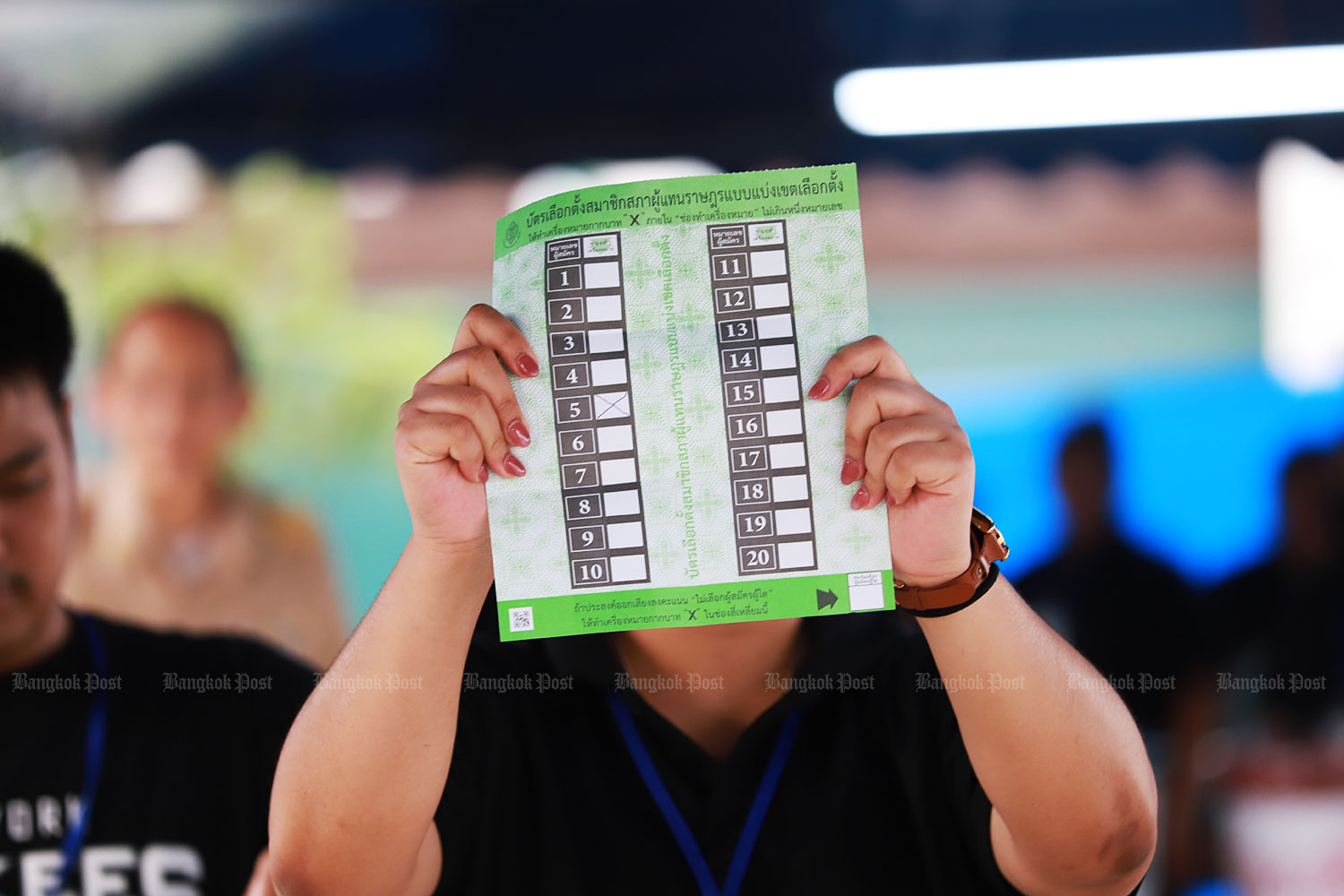

'Barcodes may make poll void'

News, Chairith Yonpiam and Apinya Wipatayotin, Published on 20/02/2026

» Former deputy prime minister Wissanu Krea-ngam has warned that the inclusion of barcodes on ballot papers could undermine the secrecy of the vote and potentially render the Feb 8 election invalid.

Thailand ready to help post-poll Myanmar

Achadthaya Chuenniran and Reuters, Published on 18/02/2026

» PHUKET - Thailand is moving more actively to serve as a post-election “bridge” to help Myanmar reintegrate into the Asean family, while urging Nay Pyi Taw to respond to concerns raised by the regional bloc and the wider international community.

Gunman who caused Pathum Thani panic surrenders

Wassayos Ngamkham and Pongpat Wongyala, Published on 18/02/2026

» A gunman wanted for shooting at an emergency vehicle and assaulting his wife in Chon Buri surrendered to police on Wednesday afternoon in Pathum Thani, where fears for public safety had led to school closures earlier.

YouTube outage affects 340,000 users, other sites disrupted

Bloomberg and Reuters, Published on 18/02/2026

» YouTube was down for nearly 340,000 users, internet monitor Downdetector said, while the streaming site reported an issue with its recommendations system.

US civil rights leader Jesse Jackson dies

Reuters and Bloomberg, Published on 17/02/2026

» The charismatic US civil rights leader Jesse Jackson, an eloquent Baptist minister raised in the segregated South who became a close associate of Martin Luther King Jr and twice ran for the Democratic presidential nomination, has died at age 84, his family said in a statement on Tuesday.

Malaysia drops defamation case against Australian in Thailand

AFP and Online Reporters, Published on 17/02/2026

» Malaysia has withdrawn a criminal defamation complaint lodged in Thailand against an Australian journalist, his lawyer said on Tuesday, after he agreed to apologise and take down articles deemed defamatory.

Gold slides below $5,000 as Lunar New Year holiday mutes trade

Bloomberg News, Published on 17/02/2026

» LONDON — Gold slipped further below US$5,000 an ounce in thin trading, with much of Asia closed for the Lunar New Year and after a US holiday on Monday.