Showing 11 - 20 of 1,752

Thai Union Group posts record 18.9% gross margin in FY2025, EPS up 7.2%-time high of 18.9%

Published on 19/02/2026

» Sales volumes grew to 908,000 metric tonnes following eight quarters of consecutive growth

Illegal road in wildlife sanctuary investigated

News, Apinya Wipatayotin, Published on 19/02/2026

» Natural Resources and Environment Minister Suchart Chomklin has ordered a crackdown on alleged abuses of authority in forest areas, sending officials to Mae Hong Son and setting a three-day deadline to clarify allegations against the head of Mae Yuam Wildlife Sanctuary.

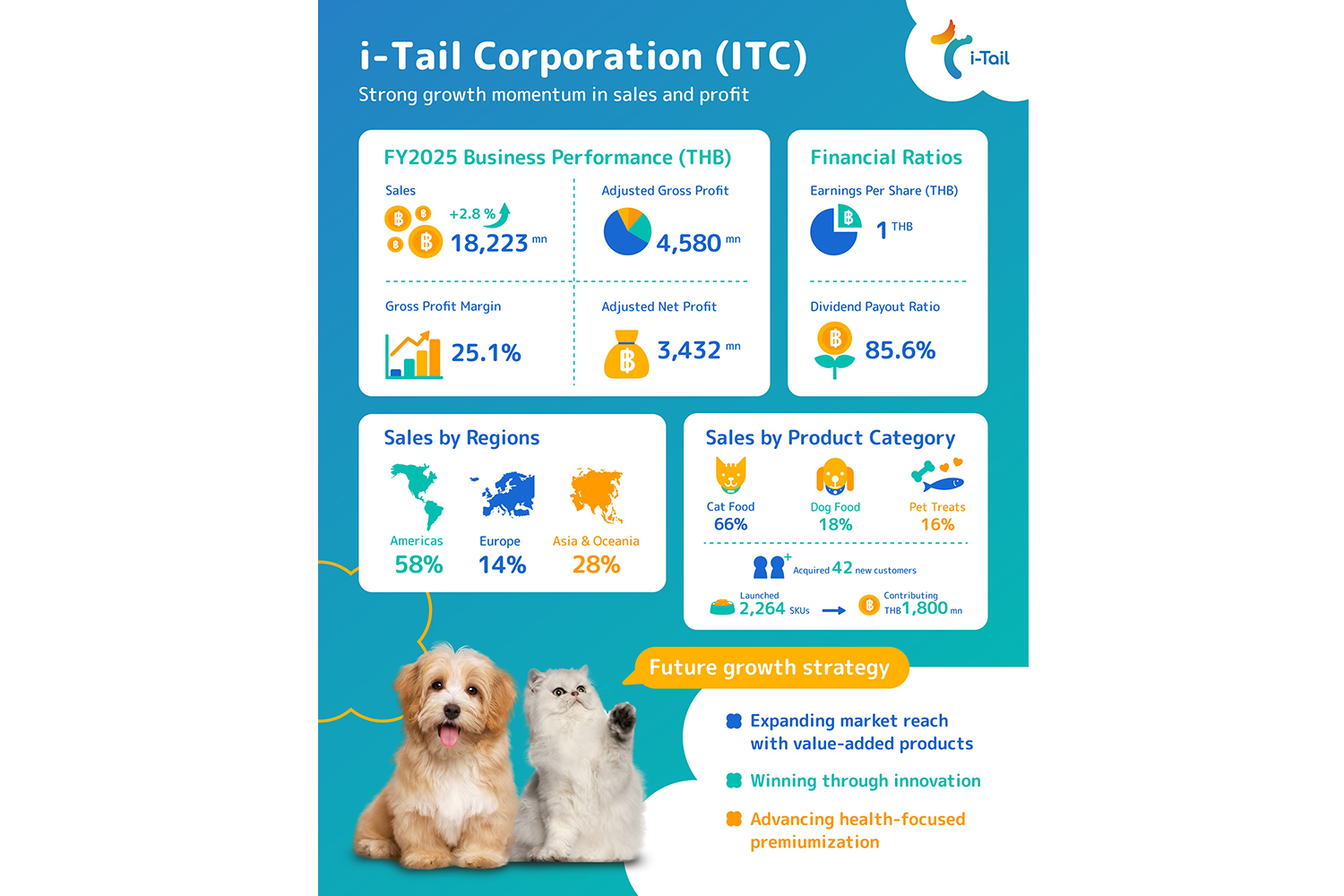

ITC’s 2025 sales grew to THB 18.2 billion, with THB 3.4 billion in adjusted net profit

Published on 18/02/2026

» Bangkok – 18 February 2026 – i-Tail Corporation PCL (ITC), a global leader in the pet food industry, reported strong full-year 2025 results, with full-year sales in U.S. dollar terms growing by 9.2% year-on-year to USD 554 million, while sales in Thai baht increased to THB 18.2 billion, up 2.8% year-on-year. Adjusted net profit stood at THB 3.4 billion (excluding transformation costs), demonstrating disciplined execution and sustained demand across key markets despite a challenging global economic environment. The board approved a full-year dividend of THB 0.85 per share, representing a payout ratio of 85.6%.

Senators demand clarity on charter change policy

News, Aekarach Sattaburuth, Published on 11/02/2026

» A group of "new breed" senators yesterday urged the incoming government to clearly outline the framework and process for drafting a new constitution in its policy statement, expressing hope that a second referendum could be held by the end of the year.

Chiang Mai tourism in flux

Business, Narumon Kasemsuk, Published on 09/02/2026

» Chiang Mai, once dominated by Chinese visitors, has gradually changed as the foreign market diversifies, with more arrivals from South Korea and Japan, as well as a notable resurgence of long‑haul tourists.

Buri Ram's Airport terminal begins trial run

News, Post Reporters, Published on 08/02/2026

» The Department of Airports (DOA) has held a soft opening of the new passenger terminal at Buri Ram airport, marking a major upgrade to regional transport infrastructure.

Billionaire clan said to weigh $2bn Thai Summit sale

Bloomberg, Published on 05/02/2026

» Thai Summit Group, the country’s largest auto-parts manufacturer, is weighing a sale of its business amid mounting pressure from the global shift to electric vehicles, political uncertainty and family succession gaps, according to people familiar with the matter.

Banpu acquires battery farm in US

Business, Yuthana Praiwan, Published on 03/02/2026

» Energy conglomerate Banpu Plc has announced a major step into the US battery energy storage market with the acquisition of the Megamouth Battery Energy Storage System (BESS) project in Texas, marking its latest move to grow its global battery farm portfolio.

Thai border trade drops due to spats with Cambodia

Online Reporters, Published on 02/02/2026

» Thailand’s border trade with its immediate neighbours slid in 2025 due to armed clashes with Cambodia and internal conflicts in Myanmar.

‘Flawed’ app points to Social Security graft, says critic

News, Post Reporters, Published on 31/01/2026

» People’s Party list-MP candidate Rukchanok Srinork has accused the Social Security Office (SSO) of corruption and mismanagement in connection with its 850-million-baht web application, saying the flawed project has left insured members unable to access their benefits.