Showing 1 - 10 of 1,750

Risk of crisis growing more acute

Oped, Chartchai Parasuk, Published on 05/03/2026

» This article is a follow-up to my previous piece titled "Fiscal deficit will trigger 2026 crisis". In that article, I argued Thailand's heavy dependence on external liquidity, combined with the government's need for 860 billion baht annually to finance its deficits, would lead to a severe liquidity shortage and, ultimately, a financial crisis.

Thailand RISE Fund Rebrands Thai Research Funding to Drive an Innovation Economy

Published on 27/02/2026

» The Science, Research, and Innovation Promotion Fund (SRI Fund), under Thailand Science Research and Innovation (TSRI), in collaboration with Chulalongkorn University, organised the national forum Thailand RISE Fund Forum: RISE UP THAILAND for the third time. The event aims to unlock research potential and translate academic work into tangible economic and social value. Following outreach events in Thailand’s northeastern and northern regions, this forum was held at Chulalongkorn University as a platform for stakeholders in the central and eastern regions.

Industrial property defies uncertainty

Business, Kanana Katharangsiporn, Published on 25/02/2026

» The industrial and logistics property sector continues to outperform other segments, supported by robust demand and ongoing government backing despite prevailing uncertainties, according to property consultancy CBRE Thailand.

Hong Kong offers buyouts for homes damaged in deadly fire

Reuters, Published on 21/02/2026

» HONG KONG - Authorities in Hong Kong on Saturday announced a buyout offer for owners who lost their homes in a deadly high-rise housing complex fire, rather than rebuilding the charred apartment blocks as some residents had hoped for.

Trump's new Iran threats rattle markets

Business, Nuntawun Polkuamdee and Nareerat Wiriyapong, Published on 21/02/2026

» RECAP: Most Asian equities fell and oil prices rose yesterday after Donald Trump ratcheted up Middle East tensions by hinting at possible military strikes on Iran if it did not make a "meaningful deal" in nuclear talks. The remarks put the brakes on a rebound in markets following an AI-fuelled sell-off earlier.

US GDP growth misses expectations

AFP, Published on 20/02/2026

» WASHINGTON - US economic growth cooled much more than expected in the final months of 2025, government estimates showed Friday, capping the first year of Donald Trump’s return to the presidency.

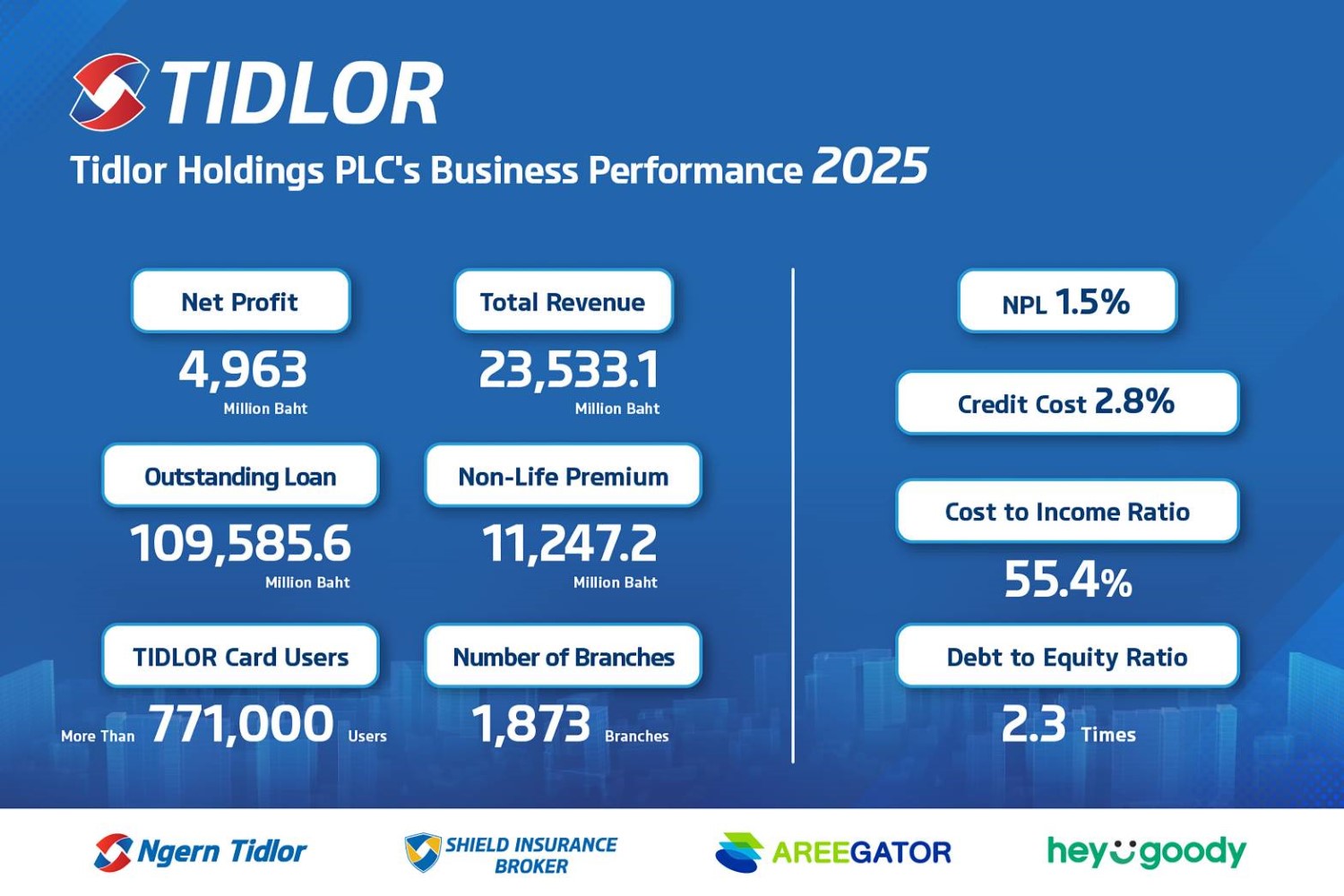

TIDLOR Posts Record 2025 Profit of 4.96bn baht, NPL Falls to 1.5%

Published on 20/02/2026

» Feb 20, 2026 – Tidlor Holdings Public Company Limited (“TIDLOR” or the “Group”) announced its 2025 operating results, reporting a record net profit of 4,963 million baht, up 17.4% year-on-year.

Conveyor belt sushi rises as Japanese dining cools

Business, Kuakul Mornkum, Published on 20/02/2026

» Conveyor belt sushi restaurants in Thailand have growth potential, while the overall Japanese restaurant sector is expected to see flat growth this year, says MAI-listed Maguro Group Plc.

Thai Union Group posts record 18.9% gross margin in FY2025, EPS up 7.2%-time high of 18.9%

Published on 19/02/2026

» Sales volumes grew to 908,000 metric tonnes following eight quarters of consecutive growth

Illegal road in wildlife sanctuary investigated

News, Apinya Wipatayotin, Published on 19/02/2026

» Natural Resources and Environment Minister Suchart Chomklin has ordered a crackdown on alleged abuses of authority in forest areas, sending officials to Mae Hong Son and setting a three-day deadline to clarify allegations against the head of Mae Yuam Wildlife Sanctuary.