Showing 1 - 10 of 188

AI remains dominant factor in 2026

Business, Nuntawun Polkuamdee, Published on 06/01/2026

» XSpring Asset Management (XSpring AM) sees artificial intelligence (AI) as the dominant investment theme in 2026, continuing to reshape global equity markets and drive long-term capital flows across regions and sectors.

SET posts weakest performance in region

Business, Nuntawun Polkuamdee, Published on 02/01/2026

» The Stock Exchange of Thailand (SET) continues to face significant structural and cyclical challenges this year, after posting the weakest performance in the region in 2025.

BLS touts tech funds with AI growth set to continue

Nuntawun Polkuamdee, Published on 30/12/2025

» Bualuang Securities (BLS) recommends investors raise their exposure in technology funds focusing on the artificial intelligence (AI) trend, as global equities are likely to extend gains in 2026 despite some short-term corrections.

Dumping cash for cards

Business, Nuntawun Polkuamdee, Published on 08/12/2025

» International travel has been transformed more in the past decade than in the previous 50 years. Flights are booked instantly, hotels auto-recommend themselves, and in many major cities, cash has vanished almost entirely.

Thai bourse seeks to jump-start growth

Business, Nuntawun Polkuamdee, Published on 06/12/2025

» As global markets turn increasingly competitive and the Thai bourse continues to underperform, the Stock Exchange of Thailand (SET) is pushing forward one of its most ambitious reform programmes.

XPG projects B1.1bn revenue this year

Business, Nuntawun Polkuamdee, Published on 05/11/2025

» SET-listed XSpring Capital (XPG) is targeting 1.1 billion baht in revenue and 150 million baht in net profit for 2025, driven by its non-performing loan (NPL) management, expanding digital asset portfolio and strong lending growth.

Gulf turns down KBank's share repurchase request

Business, Nuntawun Polkuamdee, Published on 04/11/2025

» Kasikornbank's (KBank) share repurchase programme has drawn market attention following reports that the bank asked its major shareholder, Gulf Development (Gulf) Plc, to refrain from selling KBank shares during the buyback period.

Insurance sector goes green

Business, Nuntawun Polkuamdee, Published on 27/10/2025

» At its core, the insurance business is about managing risks, including those related to environmental, social and governance (ESG) factors. As sustainability requirements change the business landscape, insurers are increasingly realising the importance of integrating the ESG agenda into their corporate strategies.

Securities and Exchange Commission toughens stance on margin loans

Business, Nuntawun Polkuamdee, Published on 24/10/2025

» The Securities and Exchange Commission (SEC) has introduced new regulations to mitigate systemic risks in margin loan activities, prohibiting securities companies and derivatives business operators from providing loans secured by securities for non-investment purposes.

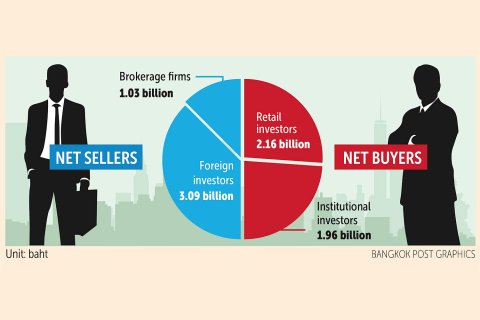

Asian stocks track bank-led losses on Wall Street

Business, Nuntawun Polkuamdee, Published on 18/10/2025

» RECAP: Asian stocks tracked losses on Wall Street yesterday, as worries about credit quality led to a rout in US regional banking shares. Concerns about trade tensions, a possible tech bubble and the US government shutdown also persisted.