Showing 1 - 10 of 90

Policy signals hold key to cryptocurrency recovery

Business, Nuntawun Polkuamdee, Published on 10/02/2026

» Clearer signals on US monetary policy and the appointment of the next Federal Reserve chair could drive a recovery in the cryptocurrency market, which is expected to remain stuck in a bearish, stagnant phase throughout the first quarter of 2026, says Merkle Capital.

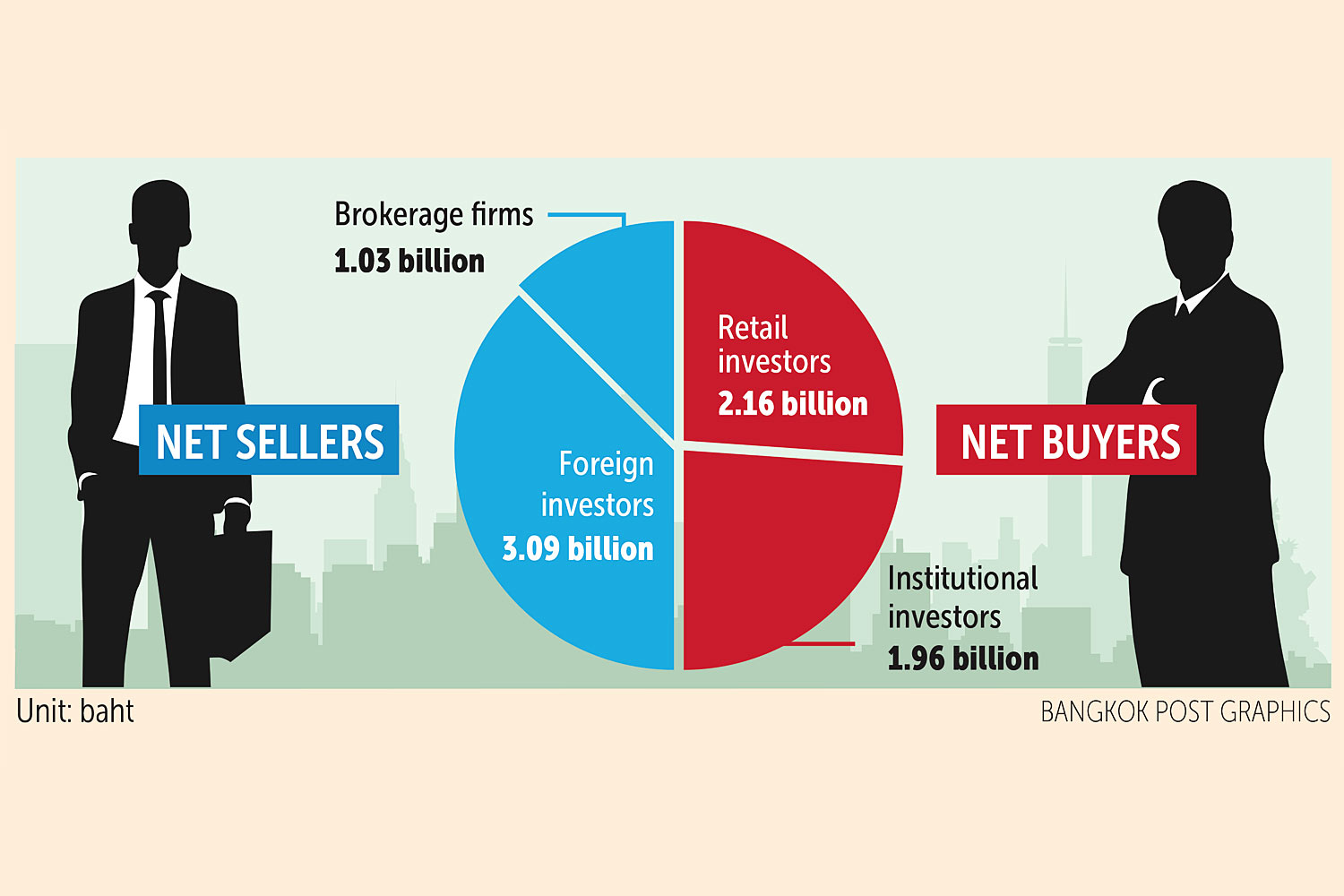

SET a bright spot for global investors

Business, Nuntawun Polkuamdee, Published on 06/02/2026

» The Thai equities market is staging a strong comeback as foreign investors return, supported by an election rally, unexpectedly high dividend payouts, and eased selling pressure from long-term equity funds (LTFs), says the Stock Exchange of Thailand (SET).

MTS Gold bullish on long-term price trend

Business, Nuntawun Polkuamdee, Published on 05/02/2026

» MTS Gold Mae Thongsuk, one of Thailand's largest gold dealers, has maintained a bullish outlook for gold over the medium and long term.

Asian stocks track bank-led losses on Wall Street

Business, Nuntawun Polkuamdee, Published on 18/10/2025

» RECAP: Asian stocks tracked losses on Wall Street yesterday, as worries about credit quality led to a rout in US regional banking shares. Concerns about trade tensions, a possible tech bubble and the US government shutdown also persisted.

Large health premium uptick expected

Business, Nuntawun Polkuamdee, Published on 29/09/2025

» Thai health insurance premiums are expected to increase by almost 10% this year and continue that trajectory into 2026, driven by a surge in medical inflation that has reached the highest rate globally, demographics, and the rising threat of emerging diseases.

Imminent US interest rate cut likely to boost Thai stocks

Business, Nuntawun Polkuamdee, Published on 26/08/2025

» Foreign capital is expected to flow into the Stock Exchange of Thailand (SET) as the US Federal Reserve (Fed) signalled an interest rate cut in September, although short-term domestic political uncertainties could limit the upside, analysts say.

MFC touts emerging Asian equities as US is overvalued

Business, Nuntawun Polkuamdee, Published on 13/08/2025

» MFC Asset Management says Thai and other emerging Asian equities are becoming more attractive than US stocks, which are trading at elevated valuations, as the company is overweighting bonds relative to equities in the second half of 2025 amid global interest rate cuts.

YLG sees gold hitting $3,650 in H2

Business, Nuntawun Polkuamdee, Published on 15/07/2025

» Gold trader YLG expects global gold prices to reach US$3,650 an ounce in the second half of this year amid tariff tensions and demand from various central banks.

Traders bullish on gold at $4,000 in 3-5 years

Business, Nuntawun Polkuamdee, Published on 09/06/2025

» Gold prices are expected to continue climbing to US$4,000 an ounce in the medium term, driven by intensifying geopolitical tensions and a shift towards lower interest rates globally, says trader YLG Bullion and Futures.

All eyes on crucial Fed interest rate meeting

Business, Nuntawun Polkuamdee, Published on 18/03/2025

» The US Federal Open Market Committee (FOMC) meeting, scheduled for March 18-19, is expected to be a crucial indicator of the stock market's direction alongside precious metal prices, following spot gold's record high of US$3,004.86 per ounce on Friday.