Showing 1 - 9 of 9

Non-life growth seen falling short

Business, Nuntawun Polkuamdee, Published on 23/09/2025

» The non-life insurance industry's rate of growth is projected to fall below expectations at only 2.5% this year, but stronger expansion could be seen next year, driven by economic stimulus under the new government and increased consumer and business spending following the upcoming election.

Sustainable investing the new standard

Nuntawun Polkuamdee, Published on 31/03/2025

» ESG investing is more than just a trend -- many expect it to become the new standard.

Bond default risk minimal in Q2

Business, Nuntawun Polkuamdee, Published on 05/04/2024

» The likelihood of bonds defaults in the second quarter is relatively low, with total default value projected at less than 1% of the total outstanding market value, says the Thai Bond Market Association (ThaiBMA).

SEC urges trading probe

Business, Nuntawun Polkuamdee, Published on 27/11/2023

» The Securities and Exchange Commission (SEC) is asking the Stock Exchange of Thailand (SET) to study and consider whether to review the use of trading programs, including high-frequency trading (HFT), to determine the current trading volume and whether they are appropriate for the Thai bourse.

Looking for culprits in the Thai bourse

Business, Nuntawun Polkuamdee, Published on 23/11/2023

» Short selling and naked short -- the culprits that cause chaos in the Thai stock market today?

Tips for reading financial statements

Nuntawun Polkuamdee, Published on 10/07/2023

» The recent allegations of fraud at Stark Corporation has caused severe damage to investors.

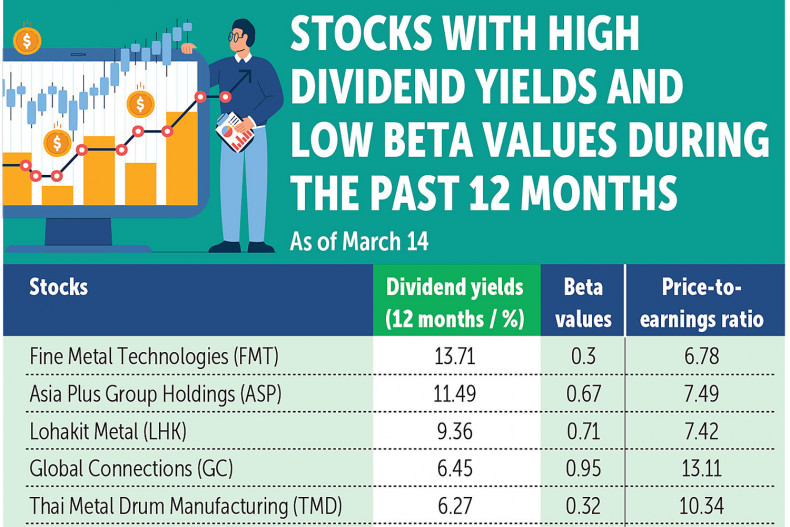

Investors told to seek high dividends to beat inflation

Business, Nuntawun Polkuamdee, Published on 19/04/2022

» SET Investnow, an investment educational unit of the Stock Exchange of Thailand (SET), suggests investing in stocks with high dividend payouts of above 5% with low beta values to hedge against volatility and inflation.

Total AUM poised to dip by over 10%, says banker

Business, Nuntawun Polkuamdee, Published on 03/11/2020

» Total assets under management (AUM) in Thailand's mutual fund industry are expected to decrease by more than 10% because of lower asset valuations from the economic slowdown and outflows from long-term equity funds (LTF), says a veteran banker.

Kasikorn: Derivative warrant trade to rise

Business, Nuntawun Polkuamdee, Published on 01/02/2018

» Trading of derivative warrants (DWs) is expected to rise twofold this year, supported by the stock market's bullish outlook and the reasonable price structure of DWs, says Kasikorn Securities (KS).