Showing 1 - 6 of 6

Money market funds lure investors with returns

Business, Nuntawun Polkuamdee, Published on 19/04/2023

» Depositors have started to move their money from bank accounts to money market funds, in part because of ongoing concerns about the banking crisis and also offers of higher returns, according to a recent report from financial services company Morningstar.

Crypto spikes as SEC reassures public

Business, Nuntawun Polkuamdee, Published on 12/04/2023

» The price of Bitcoin surpassed US$30,000 on Tuesday, the highest level in 10 months, becoming the asset with the highest return year-to-date as investors become increasingly optimistic that the United States Federal Reserve (Fed) will soon end its aggressive monetary tightening.

SCBAM eyes 3-5% growth in assets

Business, Nuntawun Polkuamdee, Published on 24/03/2023

» SCB Asset Management (SCBAM) aims to grow its assets under management (AUM) by 3-5% this year from 1.6 trillion baht recorded in 2022.

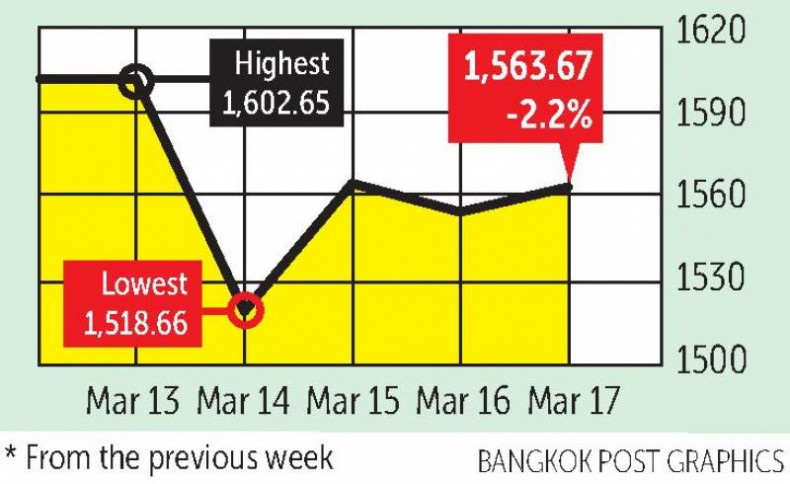

SET rides Asian rebound as bank worries ease

Business, Nuntawun Polkuamdee, Published on 18/03/2023

» RECAP: Asian equities advanced yesterday after a rescue package for First Republic Bank fuelled a rebound in US shares. Even so, the MSCI gauge of Asian shares recorded a second weekly loss after the recent turbulence in the global banking sector.

Mutual and pension funds tamp down concerns

Business, Nuntawun Polkuamdee, Published on 16/03/2023

» The Association of Investment Management Companies (AIMC) and the Government Pension Fund (GPF) yesterday issued a statement announcing they have no direct investment in the assets of the collapsed Silicon Valley Bank (SVB).

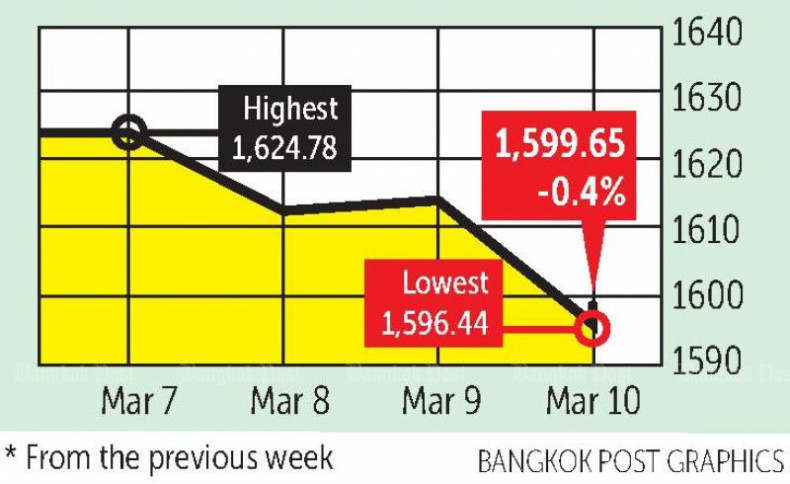

Asia follows Wall Street down, SET falls below 1,600

Business, Nuntawun Polkuamdee, Published on 11/03/2023

» RECAP: Asian shares slumped on Friday, with the SET closing below 1,600 points, following a sharp decline on Wall Street amid concern that pockets of trouble in the US banking sector could portend broader dangers.