Showing 1 - 10 of 22

SCBS touts stocks with pricing power

Business, Nuntawun Polkuamdee, Published on 14/04/2022

» SCB Securities (SCBS) recommends focusing on stocks with pricing power and stable margins as it expects the Thai and global economies to transition from reflation to stagflation over the next 3-6 months, triggered by rising energy prices.

Picking sides

Business, Nuntawun Polkuamdee, Published on 18/10/2021

» In an uncertain market, investors may wonder whether growth or value stocks are a better bet, as each type has benefits to match varying circumstances.

Prolonged lockdowns to cause GDP drop

Business, Nuntawun Polkuamdee, Published on 28/07/2021

» The economic impact from lockdowns may cause Thai GDP to drop by 300 billion baht or 1.7 percentage points, while listed companies' earnings price per share are expected to decline by 4% this year, as reflected in recent decreases in share prices, according to Kasikorn Securities.

Analysts forecast dip in leasing securities

Business, Nuntawun Polkuamdee, Published on 16/07/2021

» Profits of leasing and hire-purchase stocks will likely decline in second half this year because of the possibility that interest rate ceilings for credit card and personal loans will be lowered and asset quality risks will rise due to lockdown measures, according to SCB Securities (SCBS).

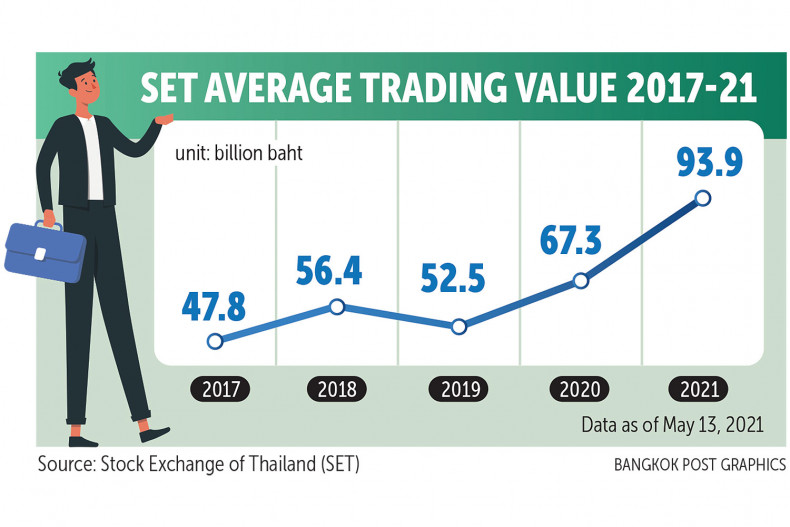

Global recovery to boost profit of securities firms

Business, Nuntawun Polkuamdee, Published on 17/05/2021

» The performance of securities firms this year will improve significantly because the daily trading value on the Stock Exchange of Thailand (SET) has increased to nearly 100 billion baht per day, says SCB Securities (SCBS).

Volatile financial markets expected

Business, Nuntawun Polkuamdee, Published on 03/05/2021

» Higher risk from the prospect of a liquidity drop is expected to cause volatility in the capital and money markets as an increase in US inflation and bond yields has signalled the country may be planning to taper its quantitative easing (QE), says Sukit Udomsirikul, managing director of research at SCB Securities (SCBS).

SCBS: Time may be right for dollar loans

Business, Nuntawun Polkuamdee, Published on 17/12/2020

» SCB Securities (SCBS) believes there is an opportunity for short-term loans in US dollars because it predicts the Federal Reserve will stabilise all monetary policy, maintain the interest rate at 0.00-0.25% and expand the balance sheet in government bonds to US$80 billion and mortgage-backed securities to $40 billion.

SCBS predicts volatile Q4

Business, Nuntawun Polkuamdee, Published on 02/10/2020

» Stock market volatility is likely to surge this quarter as positive factors dissipate amid heightening downside risks both internally and externally, says SCB Securities (SCBS).

Investors hold their breath

Business, Nuntawun Polkuamdee, Published on 20/07/2020

» Confidence in the rapid development of a Covid-19 vaccine is making some investors bullish on stock prices for the second half of the year, while other analysts warn of turbulence and volatility ahead and suggest playing a defensive investment strategy.

Aviation firms reeling after gusty 2019

Business, Nuntawun Polkuamdee, Published on 17/01/2020

» Despite higher foreign tourist arrivals and rosy tourism revenue, the financial performance of SET-listed firms operating in the aviation industry has been reeling from a slew of negative factors, sending airline share prices into a nosedive across the board in 2019.