Showing 1 - 10 of 18

Gold traders and BoT discuss controls

Nuntawun Polkuamdee, Published on 25/12/2025

» Gold traders have proposed dollar-denominated trading as a way to curb baht volatility, as the Bank of Thailand scrambles to ease the strength of the Thai currency, while bullion soars to a fresh all-time high.

Thai banks tipped for strong growth

Business, Nuntawun Polkuamdee, Published on 27/06/2025

» Analysts are maintaining an overweight stance on Thailand's banking sector, citing attractive valuations and high dividend yields following the Bank of Thailand's decision to keep its policy rate unchanged at 1.75% this week.

Leasing firms wary of tighter oversight

Business, Nuntawun Polkuamdee, Published on 19/06/2025

» Leasing firms have expressed concerns over the Bank of Thailand's move to bring auto leasing and hire-purchase businesses under its supervision, saying tighter rules could push vulnerable borrowers towards informal lending.

InnovestX anticipates further rate cuts by BoT

Business, Nuntawun Polkuamdee, Published on 18/10/2024

» InnovestX Securities expects the Bank of Thailand to continue cutting the policy rate to 1.50% next year, down from 2.25%, to maintain the interest spread between the Thai policy rate and the US federal funds rate.

Lighthub-WeLab consortium among virtual bank applicants

Nuntawun Polkuamdee, Published on 20/09/2024

» A consortium of Lighthub Asset, a Thai fintech powerhouse, and WeLab, a leading pan-Asian fintech platform, has applied for the Bank of Thailand's (BoT) virtual bank licence, with results expected in the first half of 2025.

Asian markets retreat ahead of Powell speech

Business, Nuntawun Polkuamdee, Published on 26/08/2023

» RECAP: A mini-rally on most Asian markets came to a halt yesterday ahead of a keenly awaited speech by US Federal Reserve chief Jerome Powell at around 9pm Thailand time, with traders increasingly worried about higher US interest rates.

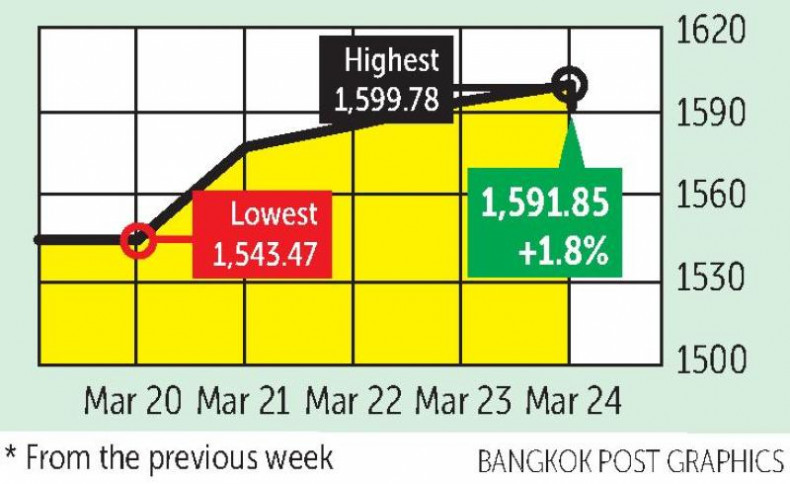

Lingering bank worries keep lid on Asian shares

Business, Nuntawun Polkuamdee, Published on 25/03/2023

» RECAP: Asian shares came under pressure yesterday after lingering banking stability concerns gripped Wall Street, while bond markets bet that recent rate hikes by central banks will be among the last of the cycle, allowing for policy relief later in the year.

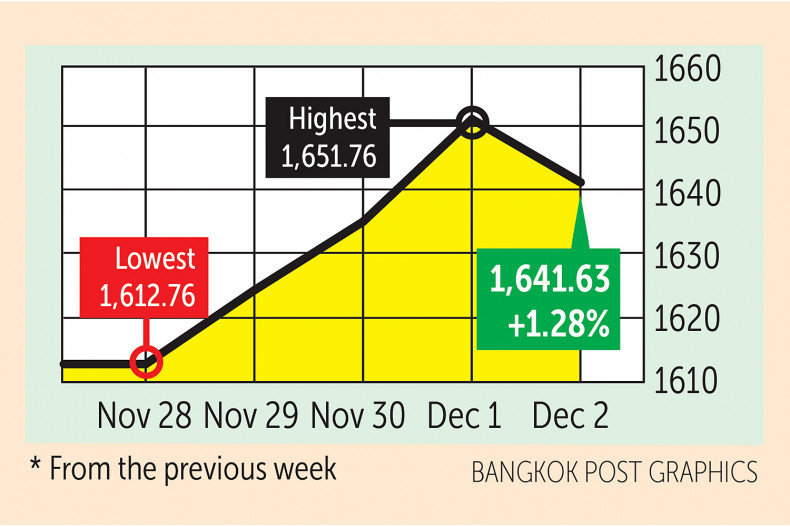

Easing of Chinese Covid curbs lifts equity sentiment

Business, Nuntawun Polkuamdee, Published on 03/12/2022

» RECAP: Asian shares were mixed yesterday as investors were heartened by the possible easing of Covid curbs in China, while they awaited job figures in the United States that could determine whether the Federal Reserve will start to moderate its interest-rate increases as widely expected.

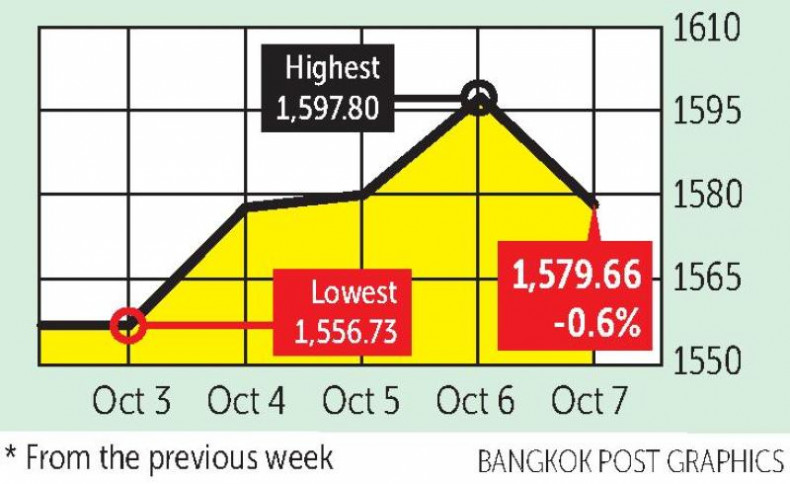

Asian shares fall as rate fears return

Business, Nuntawun Polkuamdee, Published on 08/10/2022

» RECAP: Asian markets fell yesterday as optimism that had fuelled earlier buying gave way to nervousness ahead of a US jobs report that could determine Federal Reserve rate hike plans.

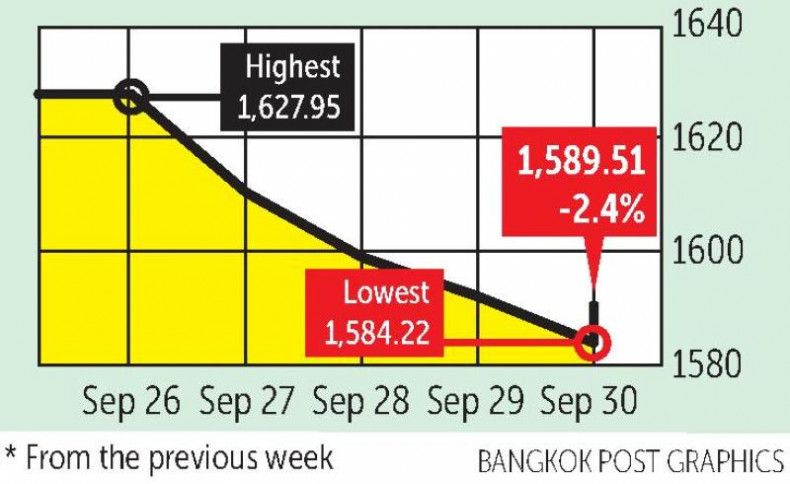

Asian shares follow Wall Street downward

Business, Nuntawun Polkuamdee, Published on 01/10/2022

» RECAP: Stocks fell in most Asian markets yesterday after another plunge on Wall Street as the prospect of higher interest rates and turmoil in Europe stoked fears of a global recession.