Showing 1 - 7 of 7

BAAC plans B10bn debt restructuring

Business, Wichit Chantanusornsiri, Published on 25/08/2025

» The Bank for Agriculture and Agricultural Cooperatives (BAAC) is preparing a debt haircut for 10 billion baht worth of chronic debt and money owed by borrowers over 70.

Firm proposed to manage bad household debt

Wichit Chantanusornsiri, Published on 20/10/2023

» Deputy Finance Minister Krisada Chinavicharana has proposed a novel response to high levels of household debt: establishing an asset management company (AMC) for efficient management of bad debt.

SME NPLs may reach 10% in year ahead

Business, Wichit Chantanusornsiri, Published on 29/11/2021

» Non-performing loans (NPLs) of small and medium-sized enterprises (SMEs) next year are expected to rise to 10% from 6% at present if relief measures by financial institutions are not extended from the end of this year, says Export-Import (Exim) Bank of Thailand president Rak Vorrakitpokatorn.

Creditors vote Wednesday on THAI rehab plan

News, Wichit Chantanusornsiri, Published on 12/05/2021

» If Thai Airways International Plc (THAI) were to go under on decision day, which is Wednesday, creditors would only be paid 12.9% of what is owed to them, a source at the airline warned.

GH Bank to launch debt rejig scheme

Business, Wichit Chantanusornsiri, Published on 24/02/2020

» State-owned GH Bank plans to introduce a new debt restructuring scheme, including a penalty interest haircut and interest payment deferrals, in April to help turn around bad loans.

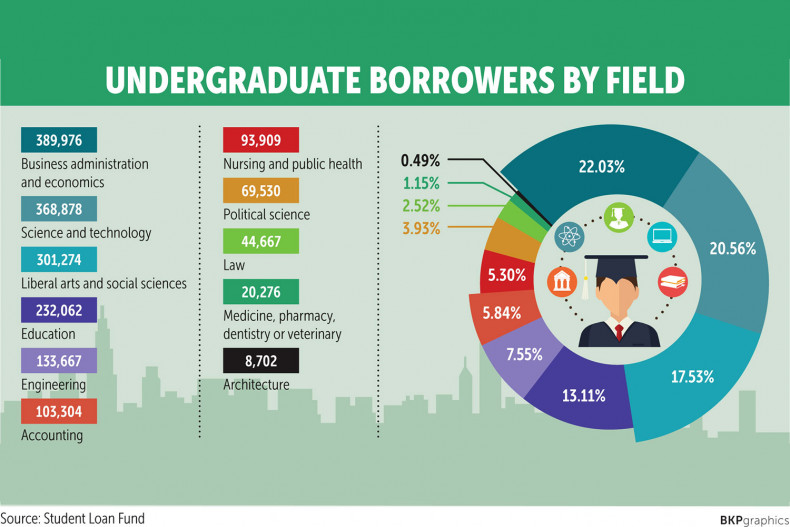

Student loan defaults blamed on poor discipline

Business, Wichit Chantanusornsiri, Published on 15/10/2019

» Lack of financial discipline is the most common reason borrowers have defaulted on their education debt, says Chainarong Katchapanan, Student Loan Fund (SLF) manager.

GH Bank keen to cut low-cost rates

Business, Wichit Chantanusornsiri, Published on 21/03/2019

» State-owned GH Bank wants to slash the mortgage rate for the 1-million-unit low-cost government housing scheme to below 3% and lengthen the maximum housing loan term to 50 years from 40 years.