Showing 1 - 5 of 5

Department plans to study a sodium tax

Business, Wichit Chantanusornsiri, Published on 15/08/2023

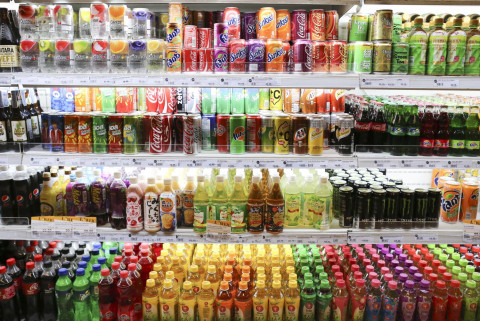

» The Excise Department is planning a study of sodium tax collection measures after the success of the "sweet tax" on sugar-sweetened beverages implemented in 2017 to shift consumer and industry behaviour towards making healthier choices, says director-general Ekniti Nitithanprapas.

Sugary drinks keep their fizz despite tax

Business, Wichit Chantanusornsiri, Published on 27/03/2023

» The third stage of the excise tax hike for sugar-sweetened beverages comes into effect on April 1 after a six-month government postponement expires.

Excise mulls delaying drink tax hike

Business, Wichit Chantanusornsiri, Published on 27/02/2021

» The Excise Department is considering freezing the step-up hike of the excise levy placed on drinks with a sugar-based sweetener to reduce business operators' financial burdens.

Salt tax aims to change behaviour

Business, Wichit Chantanusornsiri, Published on 21/10/2019

» Instant noodles, snacks and seasoning powder have been targeted for taxation on salty foods, with the Excise Department likely to apply World Health Organisation (WHO) guidance on dietary sodium intake capped at 2,000 milligrammes per day as a benchmark to determine the levy rates.

Tax on high salt content dusted off

Business, Wichit Chantanusornsiri, Published on 10/09/2019

» The Excise Department has unveiled an old plan to tax salty foods by setting a ceiling at 2,000 milligrammes per day of sodium as a benchmark to determine the levy rates, a senior official says.