Showing 1 - 10 of 16

In an uncertain world, gold is a comfort

Oped, Chartchai Parasuk, Published on 05/02/2026

» With Thai citizens heading to the polls this Sunday to decide which party will form the next government, I have decided to postpone my article on the economic crisis for another two weeks.

2026 will be a year of debt struggles

Oped, Chartchai Parasuk, Published on 08/01/2026

» Forget GDP growth. Forget tourist arrivals. Forget export figures. In 2026, Thailand's overriding economic challenge will not be growth but debt repayment.

Don't let politics mask economic woes

Oped, Chartchai Parasuk, Published on 26/06/2025

» As if economic problems in Thailand are not bad enough, political issues add to the complications. The worst is the split in the coalition. Even with an overwhelming majority of 314 (out of 493 parliamentary seats) prior to the break-up, the government could not push for many major policies, including the 10,000 baht cash handout scheme.

Dear Santa: Please send $14 billion

Oped, Chartchai Parasuk, Published on 02/11/2023

» What Thailand needs is money, money -- and money. The government needs 560 billion baht to run its 10,000 baht cash handout programme next year, and the country needs (at least) 420 billion baht to prevent the 4th quarter economy from collapsing.

Whoever takes office will inherit a mess

Oped, Chartchai Parasuk, Published on 15/06/2023

» The election result is clear and the MOU to form a 312-seat government in the 500-seat parliament is agreed. But who will lead Thailand and its economy for the next four years is unclear. Whether it will be a pro-equality government, pro-growth government, or even a pro-big-spending government remains in doubt.

World faces prospect of financial tumult

Oped, Chartchai Parasuk, Published on 23/03/2023

» Today, I was supposed to present the third article, Managing Household Debt, in the series "Changing Thailand". In fact, I have finished drafting a payment reduction model which could reduce monthly debt payments by 4.6 times without the hair-cutting debt principal or requiring government financial support. But I will delay that article for now.

Risk of global financial crisis spiking

Oped, Chartchai Parasuk, Published on 03/11/2022

» I am writing this article in Tokyo. Judging from my walks around the city during the past week, and despite the fact everyone is wearing face masks, it's like Covid has vanished. Subways and trains are jam-packed and shopping areas are full of people. However, the pandemic has left some scars. Many shops have gone under, including my favourite 50-year-old sushi restaurant.

Economic growth in 2022 no mean feat

Oped, Chartchai Parasuk, Published on 10/02/2022

» Most economic research houses, government and private, projected Thailand would see GDP growth of 3.5-4% this year. Even the Joint Standing Committee of Commerce, Industry, and Banking, an organisation representing Thai business entities, supported that range.

No choice but to open the economy

Oped, Chartchai Parasuk, Published on 14/10/2021

» There are not many countries on this planet that depend on outside markets like Thailand. Exports of goods account for 54% of GDP while foreign tourism income accounts for another 12% -- totaling 66% of GDP. The rest is made up by domestic private consumption.

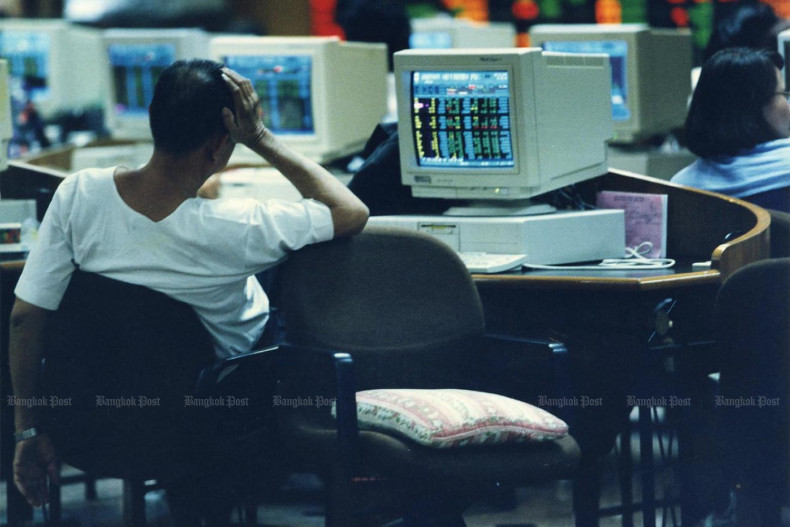

Lessons from the 1997 economic crisis

Oped, Chartchai Parasuk, Published on 01/04/2021

» Today is April Fools' day. But there is no fooling about the threat of liquidity crisis. I am sure that many readers are sceptical about the possibility of a liquidity crunch in this country. First, the government debt to GDP ratio is less than 60% which is not high by international standards. Second, Thailand now, unlike in 1997, has adopted a flexible exchange rate system which has a low risk of currency speculation. And, third, the country has international reserves equivalent to 11 months of imports of goods and services which is two times higher than IMF's suggested requirement. How could an economy this good be at risk?