Showing 1 - 6 of 6

Policy options for an overvalued baht

Oped, Chartchai Parasuk, Published on 25/12/2025

» This is the last article of 2025. I have to thank readers for following my articles throughout the years. I believe I wrote my first article for the Bangkok Post in January 2020. So, it has been a five-year collaboration with the paper. Thank you, Bangkok Post.

Making Cambodia pay for border row

Oped, Chartchai Parasuk, Published on 02/10/2025

» What I am covering today is a sensitive issue that all economic research houses, both government and private, avoid talking about. That is the economic impact of the border dispute between Thailand and Cambodia.

Ability to pay key to debt restructuring

Oped, Chartchai Parasuk, Published on 03/04/2025

» Last week's earthquake has provided Thais with two valuable lessons. First, Thailand has no national disaster management plan. No government agency seems to have had carefully thought-out plans and procedures to manage the situation. All measures were carried out on an ad-hoc basis. Worse, there appears to be no coordination among various agencies. Thais were left to rely on their own two feet as thousands of Bangkokians had no choice but to walk for hours to their homes when the mass transit railways were shutdown.

Dear Santa: Please send $14 billion

Oped, Chartchai Parasuk, Published on 02/11/2023

» What Thailand needs is money, money -- and money. The government needs 560 billion baht to run its 10,000 baht cash handout programme next year, and the country needs (at least) 420 billion baht to prevent the 4th quarter economy from collapsing.

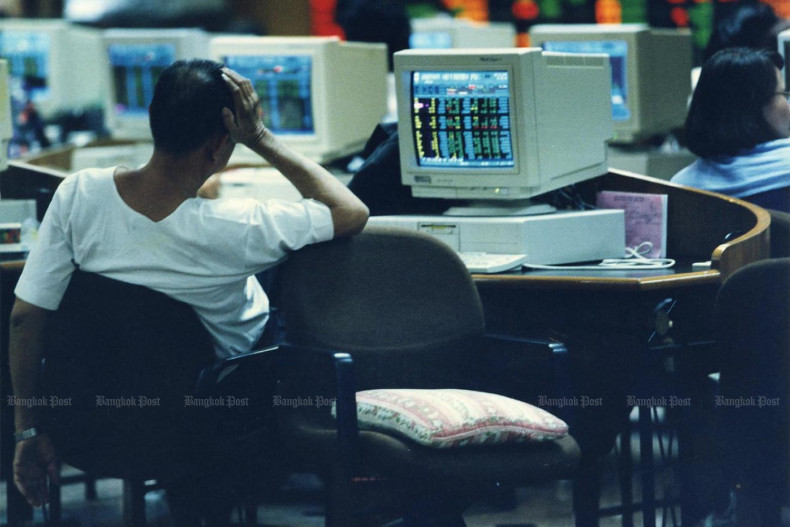

Lessons from the 1997 economic crisis

Oped, Chartchai Parasuk, Published on 01/04/2021

» Today is April Fools' day. But there is no fooling about the threat of liquidity crisis. I am sure that many readers are sceptical about the possibility of a liquidity crunch in this country. First, the government debt to GDP ratio is less than 60% which is not high by international standards. Second, Thailand now, unlike in 1997, has adopted a flexible exchange rate system which has a low risk of currency speculation. And, third, the country has international reserves equivalent to 11 months of imports of goods and services which is two times higher than IMF's suggested requirement. How could an economy this good be at risk?

Virus plus oil crisis spells recession

Oped, Chartchai Parasuk, Published on 12/03/2020

» All economists, including myself, predict the spread of Covid-19 will put a big brake on economic growth through reductions in spending, particularly on travel. Assuming the virus outbreak lasts for about six months, the lower spending will likely last until the fourth quarter. Countries like Thailand, which depend heavily on foreign tourist revenue, will be hurt the most.