Showing 1 - 9 of 9

Is a return to gold standard possible?

Oped, Chartchai Parasuk, Published on 11/12/2025

» We are now in the middle of the holiday season. Therefore, I will refrain from writing about heavy and depressing issues like the Thai economy and the outlook for 2026 and beyond. In this moment of joy, I will write about the possibility of returning to the gold standard, which some supporters say can be seen in central banks aggressively buying gold bullion to replace the dubious US dollar. The last article of the year will be about the Sovereign Wealth Fund (SWF).

Why gold matters in a changing world

Oped, Chartchai Parasuk, Published on 13/11/2025

» After reading my previous article, "Thailand has become the sick man of Asean", a good friend asked me what would happen to the Thai economy after becoming the sick man?

Digital wallet scheme poses credit risk

Oped, Chartchai Parasuk, Published on 25/07/2024

» During the debate on the extra-fiscal budget for 2024 of 1.22 billion baht to fund the digital wallet (DW) scheme, the government presented the bright side of the figurative coin. This article will present the dark side of the scheme.

Liquidity shortage a big risk for govt

News, Chartchai Parasuk, Published on 16/11/2023

» Liquidity is the most ignored issue in economics. Liquidity is considered to be like "oxygen" which is readily available when needed and, thus, has no intrinsic value.

Dear Santa: Please send $14 billion

Oped, Chartchai Parasuk, Published on 02/11/2023

» What Thailand needs is money, money -- and money. The government needs 560 billion baht to run its 10,000 baht cash handout programme next year, and the country needs (at least) 420 billion baht to prevent the 4th quarter economy from collapsing.

Whoever takes office will inherit a mess

Oped, Chartchai Parasuk, Published on 15/06/2023

» The election result is clear and the MOU to form a 312-seat government in the 500-seat parliament is agreed. But who will lead Thailand and its economy for the next four years is unclear. Whether it will be a pro-equality government, pro-growth government, or even a pro-big-spending government remains in doubt.

Interest gap could spell economic peril

Oped, Chartchai Parasuk, Published on 06/10/2022

» On a recent Monday, the Fed called an emergency meeting. The discussion topics were not made known. Could it possibly be about turmoil in the UK bond market and the financial troubles of large investment banks? At this fragile time, the world cannot afford another Lehman Brothers-type disaster.

Thai interest rate policy needs changing

Oped, Chartchai Parasuk, Published on 05/05/2022

» On March 16, the Federal Open Market Committee (FOMC), the US equivalent of Thailand's Monetary Policy Committee, raised its policy interest rate (Fed Funds Rate) by 25 basis points from 0.00%-0.25% to 0.25%-0.50% to tame rising inflation.

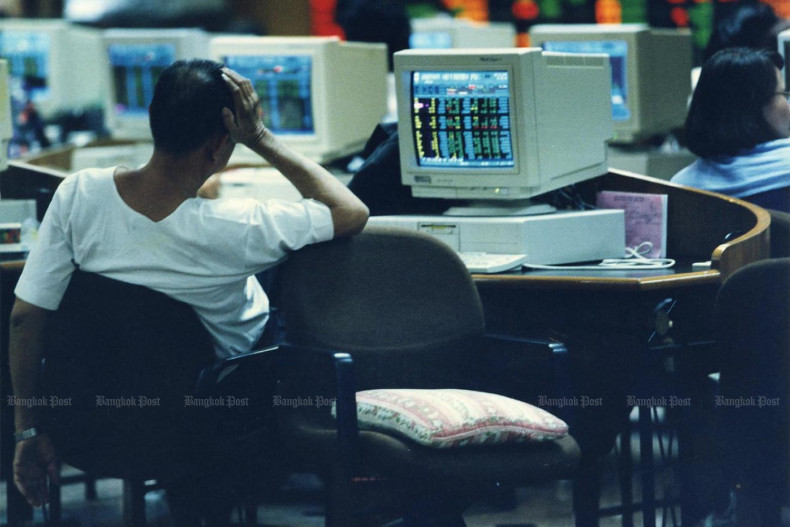

Lessons from the 1997 economic crisis

Oped, Chartchai Parasuk, Published on 01/04/2021

» Today is April Fools' day. But there is no fooling about the threat of liquidity crisis. I am sure that many readers are sceptical about the possibility of a liquidity crunch in this country. First, the government debt to GDP ratio is less than 60% which is not high by international standards. Second, Thailand now, unlike in 1997, has adopted a flexible exchange rate system which has a low risk of currency speculation. And, third, the country has international reserves equivalent to 11 months of imports of goods and services which is two times higher than IMF's suggested requirement. How could an economy this good be at risk?