Showing 1 - 7 of 7

VAT hikes alone won't narrow deficit

Oped, Chartchai Parasuk, Published on 27/11/2025

» This article is not meant to attack Finance Minister Ekniti Nitithanprapas’s Medium-Term Fiscal Framework (MTFF) for the fiscal years from 2026 to 2030. It is meant to emphasise the fragility of a Thai fiscal position that requires multiple revenue enhancement measures.

BoT ought to revise exchange rate policy

Oped, Chartchai Parasuk, Published on 26/09/2024

» This is not the usual time slot for my article. My articles are usually published every other Thursday. The next one was for Oct 3. However, I feel that the "too strong" Thai baht requires immediate attention.

2024 GDP forecast is wishful thinking

Oped, Chartchai Parasuk, Published on 14/12/2023

» If one thinks 2023 was a not-so-good year for the Thai economy because GDP growth is likely below 2%, 2024 could be worse owing to three major economic risks: liquidity inadequacy, high gasoline price, and high electricity cost.

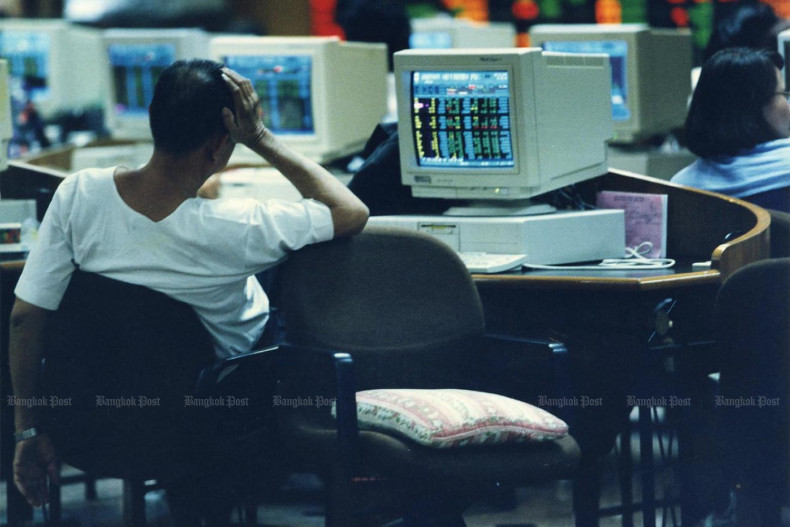

Why do I smell tom yum kung cooking?

Oped, Chartchai Parasuk, Published on 10/08/2023

» Readers who follow my bi-weekly economic column will have no doubt that the tom yum kung I am referring to is not a traditional Thai soup dish but the financial crisis of 1997.

Hiked wages could ease current slump

Oped, Chartchai Parasuk, Published on 24/02/2022

» Before getting to the main story of raising wages, I have a point of concern to raise. That is the unusual movement of Thai baht exchange rates. Theoretically, this is the time the baht should be depreciating because of rising current account deficits due to the high prices of imported oil.

Lessons from the 1997 economic crisis

Oped, Chartchai Parasuk, Published on 01/04/2021

» Today is April Fools' day. But there is no fooling about the threat of liquidity crisis. I am sure that many readers are sceptical about the possibility of a liquidity crunch in this country. First, the government debt to GDP ratio is less than 60% which is not high by international standards. Second, Thailand now, unlike in 1997, has adopted a flexible exchange rate system which has a low risk of currency speculation. And, third, the country has international reserves equivalent to 11 months of imports of goods and services which is two times higher than IMF's suggested requirement. How could an economy this good be at risk?

This could get worse before it improves

Oped, Chartchai Parasuk, Published on 16/07/2020

» This is not the first time the world has faced economic dangers but the Covid-19 outbreak is by far the most devastating. I have a feeling that it could beat the legendary 1930s Great Depression. There are many questions to ask, particularly about the future of the world and the Thai economy. I'd like to raise three questions as follows: