Showing 1 - 10 of 25

Examining the crux of the credit crunch

Business, Kanana Katharangsiporn, Published on 18/10/2025

» Thailand's residential property sector is grappling with a severe credit crunch, as mortgage rejection rates have surged to an unprecedented 80% this year, up sharply from around 30% during the pandemic, according to developers.

Knight Frank points to vulnerable sectors

Business, Kanana Katharangsiporn, Published on 09/07/2025

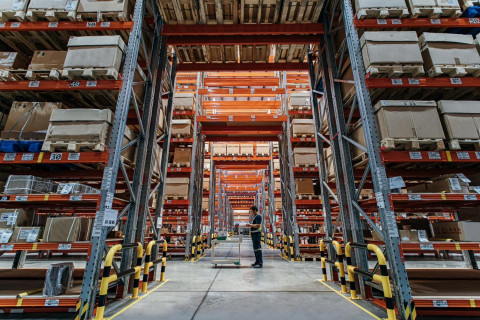

» The notification by letter yesterday stating that the US plans to maintain a 36% import duty on Thai goods is expected to affect manufacturing, logistics and industrial real estate as Thailand risks losing its appeal to foreign investors, according to property consultancy Knight Frank Thailand.

Quake rocks property market

Business, Kanana Katharangsiporn, Published on 01/04/2025

» Cracks and damage found in many high-rise condos in Bangkok after Friday's earthquake have rattled consumer confidence, likely making this year's second quarter the weakest quarter for condo sales and transfers in 15 years.

Foreigners key to North's residential market

Business, Kanana Katharangsiporn, Published on 18/03/2025

» The residential market in Chiang Mai and Chiang Rai will need to rely on demand from China and Myanmar, along with locals in the upper-end segment as lower-income earners continue to struggle in terms of purchasing power and access to mortgage loans.

Developers want urgent support

Business, Kanana Katharangsiporn, Published on 14/03/2025

» Residential developers want swift implementation of property measures, including cuts to transfer and mortgage fees and eased lending curbs, while calling on banks to reduce interest rates by 0.25%, the level of the policy rate reduction, instead of 0.05% to 0.10%.

Condo market subdued in Q4

Business, Kanana Katharangsiporn, Published on 28/12/2024

» Developers should focus on strategies to reduce risks and drain unsold units priced at 1-3 million baht in the condo market, which faces challenges from weakened purchasing power and stricter lending conditions, threatening market stability.

Details behind the great loan-to-value debate

Business, Kanana Katharangsiporn, Published on 07/12/2024

» Amid slowing demand and economic uncertainty, residential developers are urging regulators to ease loan-to-value (LTV) rules, believing more flexible measures could revitalise the housing market, enhance affordability and propel an economic recovery.

Projected growth seen boosting housing demand next year

Business, Kanana Katharangsiporn, Published on 19/11/2024

» The projected economic growth for 2025, along with measures to address household debt, support for vulnerable groups and an anticipated increase in foreign arrivals, are expected to boost housing demand after an estimated 4.4% decline in 2024.

Mortgage terms may be extended

Kanana Katharangsiporn, Published on 10/07/2024

» The Ministry of Finance is planning to hold discussions with commercial banks about the possibility of extending the home loan repayment period to a maximum age of 85 among borrowers in an effort to stimulate local demand amid the economic slowdown.

Supalai suggests interest rate cut to stimulate more growth

Business, Kanana Katharangsiporn, Published on 10/05/2024

» The residential market has improved following the implementation of property measures last month, but interest rates should be cut to further stimulate growth, especially in the lower-income segment, according to SET-listed developer Supalai.