Showing 1 - 10 of 54

Pressured property developers look to adapt

Kanana Katharangsiporn, Published on 29/12/2025

» The residential property market closed 2025 under heavy pressure from weak purchasing power, tight mortgage lending and external shocks, prompting developers to recalibrate strategies for 2026 around affordability, risk management and liquidity preservation.

Wealthy Chinese still keen on Thai property

Kanana Katharangsiporn, Published on 17/04/2025

» Wealthy Chinese buyers have shifted from the United States to Thailand for overseas homes, with Thailand rising from seventh to first place last year, though safety remains a concern.

Banks highlight methods to reduce mortgage rejections

Business, Kanana Katharangsiporn, Published on 17/04/2025

» Clearing debts, disclosing all sources of income, preparing documents and avoiding rushed applications can reduce the mortgage rejection rate, which rose to an average of 45% in the first quarter, according to financial institutions.

Charn Issara eyes luxury projects

Kanana Katharangsiporn, Published on 08/03/2025

» Charn Issara Development plans to launch six new projects worth a combined 16 billion baht, primarily in the luxury segment across Bangkok, Phuket and Hua Hin, driven by strong demand.

Office oversupply hits Bangkok occupancy rates

Kanana Katharangsiporn, Published on 15/01/2025

» The Ploenchit-Chidlom-Wireless corridor, Bangkok's second-largest sub-market, has seen occupancy rates decline from a peak of 95% in 2019 to 76% today, primarily due to a surge in office supply, according to property consultant Knight Frank Thailand.

Residential market seen contracting 5-10% in 2025

Business, Kanana Katharangsiporn, Published on 08/01/2025

» The residential market is projected to contract by 5-10% this year, following a slowdown last year, as younger buyers delay home purchases because of reduced confidence in the economy, according to property research firm Terra Media and Consulting.

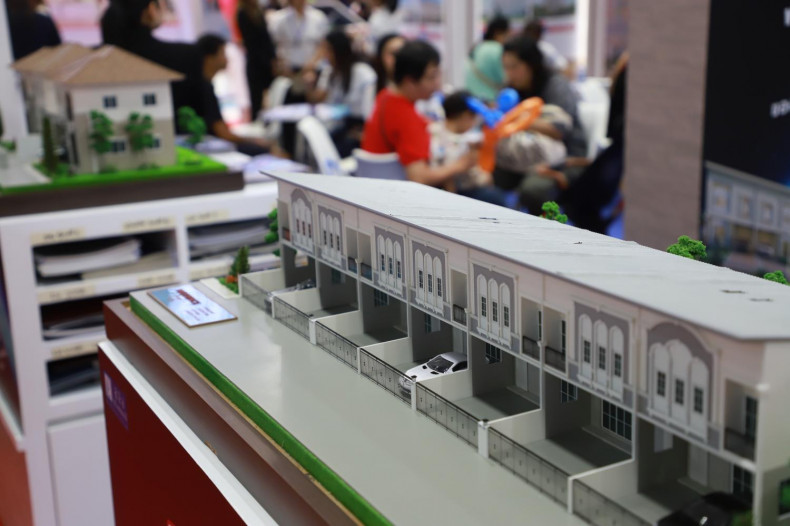

Lower-end townhouse sales stagnant

News, Kanana Katharangsiporn, Published on 10/12/2024

» Sales of townhouses in the lower-end segment in Greater Bangkok have continued to decline this year, despite a reduction in new supply, primarily attributed to the economic slowdown.

Details behind the great loan-to-value debate

Business, Kanana Katharangsiporn, Published on 07/12/2024

» Amid slowing demand and economic uncertainty, residential developers are urging regulators to ease loan-to-value (LTV) rules, believing more flexible measures could revitalise the housing market, enhance affordability and propel an economic recovery.

Sena adopts cautious investment strategy

Kanana Katharangsiporn, Published on 31/07/2024

» Developers need to be more cautious with investments in the second half, as the financial market is concerned about corporate debenture repayments, due to the economic slowdown that affected demand in the first half.

Loan rejections cause drop in housing transfers in Q1

Business, Kanana Katharangsiporn, Published on 17/05/2024

» Home loan rejections caused a dip in housing transfers nationwide in the first quarter, dropping to the lowest point in six years and marking five consecutive quarters of decline.