Showing 1 - 10 of 70

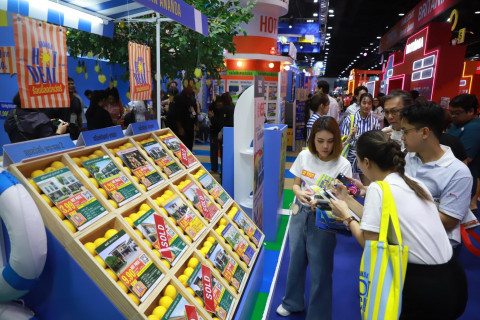

Pressured property developers look to adapt

Kanana Katharangsiporn, Published on 29/12/2025

» The residential property market closed 2025 under heavy pressure from weak purchasing power, tight mortgage lending and external shocks, prompting developers to recalibrate strategies for 2026 around affordability, risk management and liquidity preservation.

Condos priced B3-5m still in demand amid small supply

Business, Kanana Katharangsiporn, Published on 19/12/2025

» Condos priced between 3-5 million baht were the best-selling segment in Greater Bangkok the first nine months of this year as demand in the affordable market remained strong amid limited supply.

Sena focuses on rent-to-own market amid stagnant economy

Business, Kanana Katharangsiporn, Published on 05/12/2025

» SET-listed Sena Development will continue to rely on rent-to-own as a core strategy next year, with the economy expected to remain sluggish with no positive drivers on the horizon to support mortgage approvals.

Examining the crux of the credit crunch

Business, Kanana Katharangsiporn, Published on 18/10/2025

» Thailand's residential property sector is grappling with a severe credit crunch, as mortgage rejection rates have surged to an unprecedented 80% this year, up sharply from around 30% during the pandemic, according to developers.

New infrastructure expected to boost market in Northeast

Business, Kanana Katharangsiporn, Published on 19/09/2025

» New infrastructure is expected to revive the economy and strengthen home purchasing power in Nakhon Ratchasima and Udon Thani, as transfer and mortgage fee cuts and lower interest rates have had a limited effect, according to local developers.

Residential index hits record low in Q1

Business, Kanana Katharangsiporn, Published on 15/07/2025

» The Thailand Overall Residential Market Index (TORMI) fell to its lowest level since the index was introduced in 2021 in the first quarter of 2025, even dropping below the levels recorded during the Covid-19 pandemic, according to the Real Estate Information Center (REIC).

Condo market to see continued decline

Business, Kanana Katharangsiporn, Published on 17/06/2025

» Despite cuts in transfer and mortgage fees, as well as relaxed loan-to-value limits, Bangkok's condo market is expected to continue its decline from last year, driven by the ongoing economic slowdown and weak foreign demand.

Banks highlight methods to reduce mortgage rejections

Business, Kanana Katharangsiporn, Published on 17/04/2025

» Clearing debts, disclosing all sources of income, preparing documents and avoiding rushed applications can reduce the mortgage rejection rate, which rose to an average of 45% in the first quarter, according to financial institutions.

Mortgage rejection rates expected to remain high

Business, Kanana Katharangsiporn, Published on 10/04/2025

» Mortgage rejection rates are anticipated to remain elevated due to persistent global economic headwinds, though eased loan-to-value (LTV) limits and lower fees may help support a recovery in the housing market, according to banks and developers.

Home loan easing likely to disappoint

Business, Kanana Katharangsiporn, Published on 03/04/2025

» The recent easing of loan-to-value (LTV) limits may not boost residential transfers and sales as much as expected, particularly after last week's earthquake in Myanmar impacted the high-rise condo market.