Showing 1 - 8 of 8

Don't sleep on tax savings

Business, Oranan Paweewun, Published on 01/06/2020

» Against the backdrop of the coronavirus crisis, income uncertainty has become heightened and some individual taxpayers may be tempted to put income tax planning on the back burner.

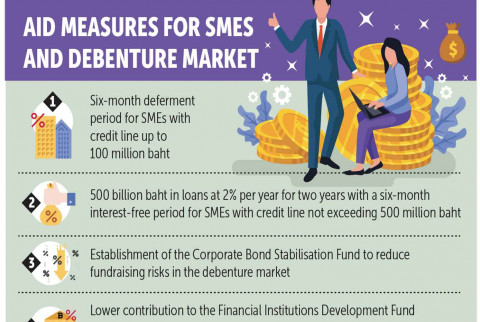

BoT schemes to cover 1.7m SMEs

Business, Oranan Paweewun, Published on 08/04/2020

» About 1.7 million small and medium-sized enterprises (SMEs) with total loans outstanding of 2.4 trillion baht are eligible to participate in the Bank of Thailand's six-month deferment period on principal and interest and a 500-billion-baht soft loan scheme, says the central bank's chief.

Breaking the bonds of debt

Business, Oranan Paweewun, Published on 16/03/2020

» Thai household borrowing rose to 13.2 trillion baht at the end of September 2019 from 12.8 trillion baht at the end of 2018, with the ratio relative to GDP climbing to 79.1% from 78.6%. These figures suggest many people are drowning in debt.

State banks enticing homebuyers

Business, Oranan Paweewun, Published on 09/12/2019

» Buying a home is the biggest purchase of most people's lives, and a mortgage the largest debt most will bear. Locking in cheap home loans can save money on interest payments over time and allow borrowers to spend less time paying off the debt.

Listed banks to see lower Q3 net profit on fee waiver

Business, Oranan Paweewun, Published on 10/10/2018

» SET-listed banks are estimated to deliver lower quarter-on-quarter net profit for the third quarter but higher year-on-year earnings, say analysts, noting the waiver of transaction fees for digital banking dealt a blow to their fee-based income and net profits.

Billionaire Bangkok Bank boss leaves solid legacy

News, Oranan Paweewun, Published on 26/06/2018

» As the former chairman of Bangkok Bank Plc, late Thai billionaire Chatri Sophonpanich was not just a prominent figure in Thailand but Asia as a whole.

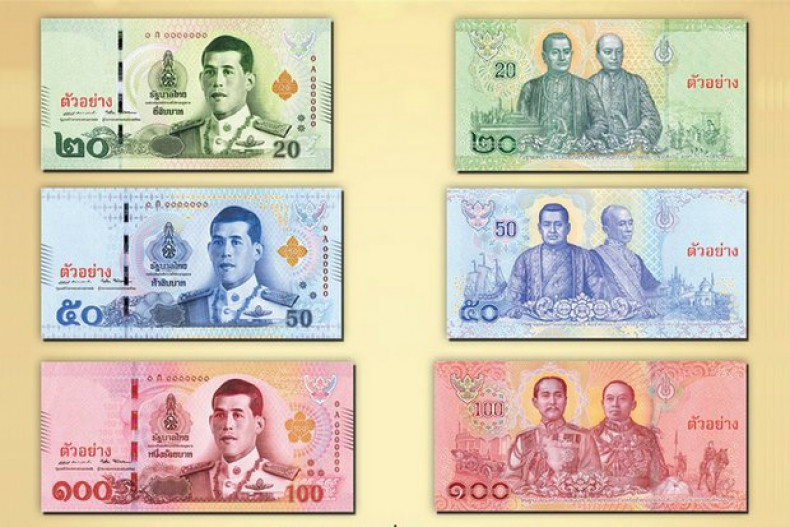

First new banknotes featuring King out on Chakri Day

Oranan Paweewun, Published on 09/03/2018

» The first series of circulating banknotes to be printed during the reign of His Majesty King Maha Vajiralongkorn Bodindradebayavarangkun will debut with three denominations on Chakri Memorial Day, April 6.

Optimism for Q4 growth results

Business, Oranan Paweewun, Published on 17/02/2018

» Economic growth in the final quarter last year likely fared better than the previous quarter's 4.3%, with full-year growth expected to at least meet the central bank's forecast of 3.9%, say economists.