Showing 1 - 10 of 13

How to protect your finances and fight fraud

Business, Somruedi Banchongduang, Published on 15/12/2025

» If you are an avid online shopper who regularly joins flash sales and loves snapping up discounted items, you need to be extra careful before making any transfers. Even if you made it through the 12.12 sales smoothly, it is important to stay alert during the upcoming 1.1 promotions and beyond. Fraudsters posing as online merchants remain widespread.

BoT to ease baht pressure

Business, Somruedi Banchongduang, Published on 02/12/2025

» The Bank of Thailand has proposed the Finance Ministry raise the limit for foreign income repatriation to Thailand, aiming to ease pressure on the baht.

Govt mulls buying underperforming NPLs

News, Somruedi Banchongduang, Published on 24/03/2025

» The government has announced plans to purchase non-performing loans (NPLs) with outstanding balances below 100,000 baht to alleviate financial burdens on small-scale debtors.

KBank upgrades systems to fortify core infrastructure

Business, Somruedi Banchongduang, Published on 08/01/2025

» Kasikornbank (KBank) has strengthened its infrastructure by upgrading its core banking and credit scoring systems, aimed at enhancing its business capabilities and improving asset quality management amid ongoing economic uncertainties.

Escaping the debt cycle

Business, Somruedi Banchongduang, Published on 15/07/2024

» A 25-year-old woman's struggles with debt of 307,000 baht went viral on social media recently when she asked for advice on how to manage what she owed. She earns 22,000 baht per month, with 6,000 baht going towards rent and 3,000 baht monthly for motorcycle loan payments.

Bankers allay app concerns

Business, Somruedi Banchongduang, Published on 09/11/2023

» The Thai Bankers' Association (TBA) has confirmed the security and stability of banks' mobile banking applications.

Credit bureau wary of digital loans

Business, Somruedi Banchongduang, Published on 06/12/2022

» The National Credit Bureau (NCB) expects household debt in terms of loan amounts will continue to increase, despite the decline in the household debt-to-GDP ratio.

Central bank mulls joint sandbox for NDID

Business, Somruedi Banchongduang, Published on 24/05/2022

» The Bank of Thailand plans to collaborate with other regulatory agencies on setting up a co-regulatory sandbox to test digital identity verification through the National Digital ID (NDID) platform in the second half as part of efforts to further drive the digital economy.

SME debt scheme hampers loan access

Business, Somruedi Banchongduang, Published on 12/05/2020

» The troubled debt restructuring (TDR) scheme offered to small and medium-sized enterprises (SMEs) was affected by subpar economic growth, a stumbling block for many firms in accessing additional lending as well as the central bank's sponsored soft loans, says the head of the National Credit Bureau (NCB).

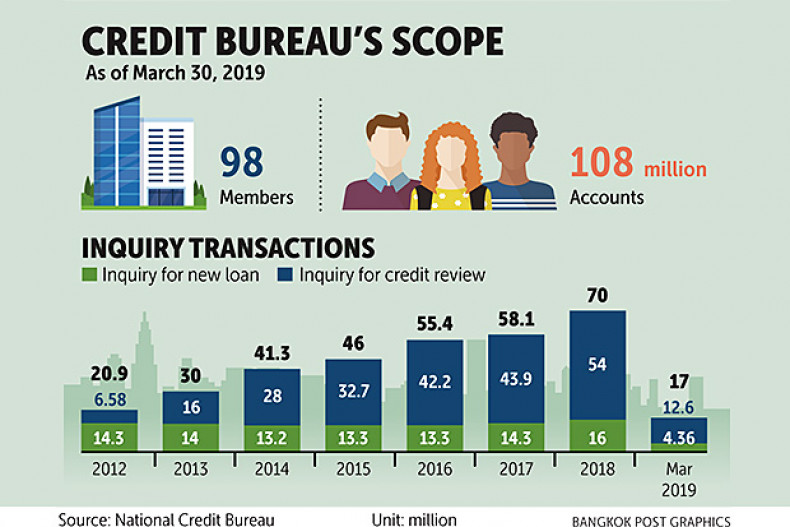

Credit inquiries climbing as household debt swells

Business, Somruedi Banchongduang, Published on 17/04/2019

» Credit inquiries at the National Credit Bureau (NCB) are expected to hit another record high this year amid mounting anxiety over swelling household debt.