Showing 1 - 7 of 7

BAM eager to keep lead in distressed assets sector

Business, Somruedi Banchongduang, Published on 18/05/2024

» Bangkok Commercial Asset Management (BAM), Thailand's largest asset management company, set an ambitious goal for bad asset management over the next few years in a bid to address the burden of distressed debts within the banking industry.

Troubled debt set to exceed B1tn

Business, Somruedi Banchongduang, Published on 29/11/2023

» The National Credit Bureau (NCB) estimates by year-end, debts in the troubled debt restructuring (TDR) programme could exceed 1 trillion baht as a result of the weaker repayment ability of borrowers.

Troubled debt set to exceed B1 trillion

Somruedi Banchongduang, Published on 28/11/2023

» The National Credit Bureau (NCB) has estimated by year-end, debts in the troubled debt restructuring (TDR) programme could exceed 1 trillion baht as a result of the weaker repayment ability of borrowers.

Data, AI driving firm's new guise

Business, Somruedi Banchongduang, Published on 12/09/2023

» SET-listed Bangkok Commercial Asset Management Plc (BAM) is transforming into a data and AI-driven organisation to strengthen its business operations amid the digital era.

Credit bureau: Bad loans exceeded B1tn in Q2

Business, Somruedi Banchongduang, Published on 10/08/2023

» Non-performing loans (NPLs) measured by the National Credit Bureau reached 1 trillion baht in the second quarter this year, the highest in 12 months, says a bureau executive.

Household debt risks boiling over

Business, Somruedi Banchongduang, Published on 23/05/2020

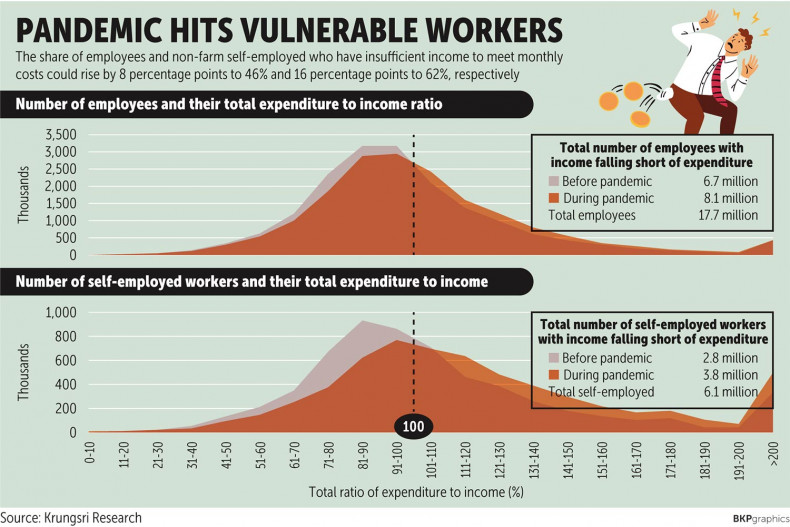

» The country's household bad debt is expected to reach 1 trillion baht this year, putting the ratio to total loans outstanding into double digits as debt-servicing ability erodes amid coronavirus-induced income shocks, says the head of the National Credit Bureau (NCB).

SME debt scheme hampers loan access

Business, Somruedi Banchongduang, Published on 12/05/2020

» The troubled debt restructuring (TDR) scheme offered to small and medium-sized enterprises (SMEs) was affected by subpar economic growth, a stumbling block for many firms in accessing additional lending as well as the central bank's sponsored soft loans, says the head of the National Credit Bureau (NCB).