Showing 1 - 10 of 11

UOB: Economic growth depends on stability

Business, Somruedi Banchongduang, Published on 11/02/2026

» Effective implementation of the new government's policies will be pivotal in building investor confidence and attracting both foreign portfolio inflows and foreign direct investment (FDI) into Thailand, according to UOB Thailand.

Joint initiative touts sustainable living

Business, Somruedi Banchongduang, Published on 22/09/2025

» Consumers have the power to drive sustainability through their spending choices, especially when it comes to home products and energy use.

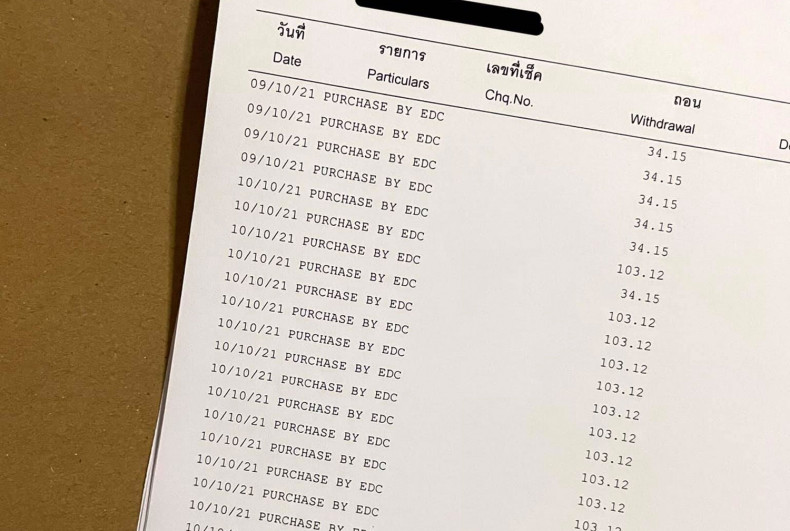

Banks to refund victims of scam

Business, Somruedi Banchongduang, Published on 20/10/2021

» Banks have confirmed they will pay back money to victims of unauthorised online withdrawals of cash debited via plastic bank cards after a spate of unauthorised online transactions.

Calls for rate cut to relieve pandemic woes

Business, Somruedi Banchongduang, Published on 03/08/2021

» Economists are urging Thailand's central bank to cut interest rates this week to support the economy amid rising downside risks.

BoT facility aims to help mutual funds

Business, Somruedi Banchongduang, Published on 25/03/2020

» The Bank of Thailand has expanded the scope of a special credit facility to provide liquidity to mutual funds by allowing banks to repurchase all money market and daily fixed-income funds, but the central bank will repurchase only underlying assets that meet its requirements.

BoT not reacting to Fed rate cut

Somruedi Banchongduang, Published on 16/03/2020

» The Bank of Thailand (BoT) has no plan to call an emergency meeting following the US Federal Reserve's weekend decision to cut its policy rate to zero.

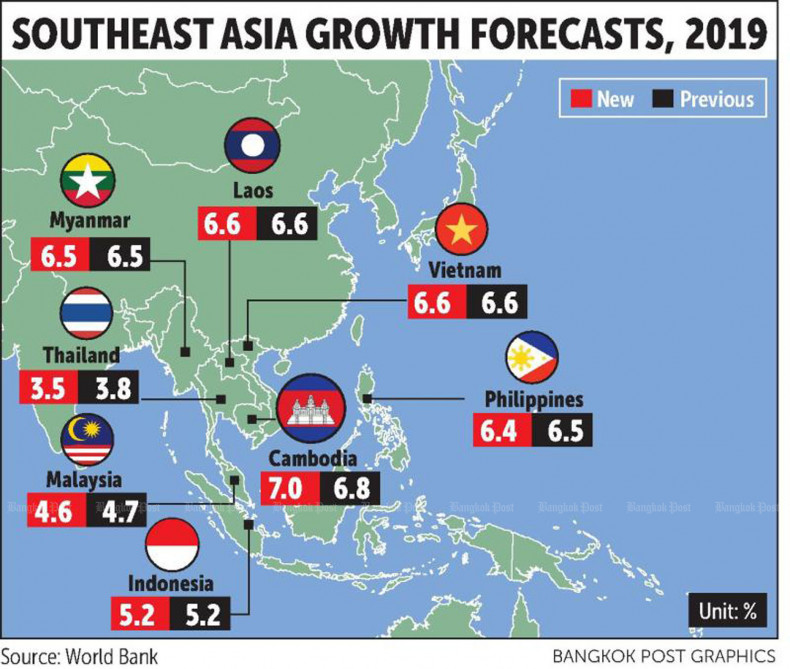

World Bank trims growth view to 3.5%

Business, Somruedi Banchongduang, Published on 07/06/2019

» The World Bank has cut its Thai economic growth forecast for 2019 to 3.5% and plans to review the economic outlook again after a new cabinet line-up is announced.

BBL reins in lending on housing glut

Business, Somruedi Banchongduang, Published on 10/09/2018

» Bangkok Bank (BBL), the country's largest lender by assets, has tightened both mortgage lending and refinancing for condominium projects to guard against risks amid an oversupply in some areas, says a high-ranking executive.

Fragile residential market presaged

Business, Somruedi Banchongduang, Published on 06/07/2018

» A higher ratio of new mortgages with loan-to-value (LTV) rates exceeding 90%, the increasing loan-to-income (LTI) proportion and deteriorating bad mortgage rates all point to the residential property market's fragility, warns the Bank of Thailand's Monetary Policy Committee and Financial Institutions Policy Committee.

BoT tells banks to rein in mortgages

Business, Somruedi Banchongduang, Published on 01/06/2018

» The Bank of Thailand has sounded an alarm to banks in light of the growing appetite for mortgages, urging them to retain their risk management practices when considering housing loans.