Showing 1 - 10 of 71

Loan repayments set to hit record high

Business, Somruedi Banchongduang, Published on 15/01/2026

» Kasikornbank (KBank) expects loan repayments to hit a record high in 2025, with loan growth in 2026 projected to increase marginally in line with Thai economic conditions.

Bureau seeks to bring asset management companies into credit system

Business, Somruedi Banchongduang, Published on 18/11/2025

» The National Credit Bureau (NCB) is in discussions with relevant parties to bring asset management companies (AMCs) into the credit bureau system.

Bad debt scheme to be launched in New Year

Business, Somruedi Banchongduang, Published on 12/11/2025

» The government plans to roll out the new debt resolution programme "Clear Debt, Move Forward" in January next year, offering measures such as interest payment waivers and reductions of principal for qualified borrowers.

KTC opts to take cautious approach amid obstacles

Business, Somruedi Banchongduang, Published on 06/05/2025

» Krungthai Card (KTC), a leading credit card provider under Krungthai Bank (KTB), anticipates increasing challenges in its personal loan business for the remainder of the year amid economic headwinds.

Govt mulls buying underperforming NPLs

News, Somruedi Banchongduang, Published on 24/03/2025

» The government has announced plans to purchase non-performing loans (NPLs) with outstanding balances below 100,000 baht to alleviate financial burdens on small-scale debtors.

Credit card firms plead for low rate

Business, Somruedi Banchongduang, Published on 07/03/2025

» The Credit Card Club of the Thai Bankers' Association is urging the Bank of Thailand to extend the current minimum payment rate for credit cards until next year.

Regional banking boost for Krungsri

Business, Somruedi Banchongduang, Published on 04/03/2025

» Krungsri (Bank of Ayudhya) reported its regional banking business accounted for 20% of total revenue, primarily attributed to high-yield loan products.

IMF supports BoT's rate reductions

Business, Somruedi Banchongduang, Published on 22/02/2025

» The International Monetary Fund (IMF) backs the Bank of Thailand cutting interest rates to stimulate inflation and increase the capacity of borrowers to repay debt.

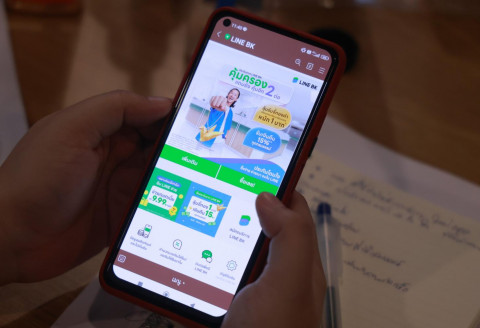

Line BK targets double-digit loan gain

Business, Somruedi Banchongduang, Published on 13/02/2025

» Line BK, a social banking platform under Kasikornbank (KBank), aims for double-digit loan growth this year, supported by enhanced technological capabilities amid sluggish economic growth.

Thai household debt falls faster than expected

Business, Somruedi Banchongduang, Published on 06/01/2025

» The Bank of Thailand expects the country's household debt-to-GDP ratio to decline faster than previously assessed, driven by debt deleveraging efforts and the recent debt relief scheme.