Showing 1 - 8 of 8

Credit card spending headed for 2020 decline

Business, Somruedi Banchongduang, Published on 13/08/2020

» Annual credit card spending is expected to contract this year because of the coronavirus crisis, particularly for outbound spending, due to the government's prohibition on cross-border travel.

NCB: Lenders' NPL ratio rises to 8.1%

Business, Somruedi Banchongduang, Published on 13/05/2020

» The National Credit Bureau's 104 members saw an upsurge in non-performing loan (NPL) ratio to 8.1% at the end of March from 6.8% a year earlier as headwinds such as the coronavirus outbreak took hold, says the NCB.

SME debt scheme hampers loan access

Business, Somruedi Banchongduang, Published on 12/05/2020

» The troubled debt restructuring (TDR) scheme offered to small and medium-sized enterprises (SMEs) was affected by subpar economic growth, a stumbling block for many firms in accessing additional lending as well as the central bank's sponsored soft loans, says the head of the National Credit Bureau (NCB).

KTC plans new applicant criteria to rein in NPLs

Business, Somruedi Banchongduang, Published on 23/11/2019

» Krungthai Card (KTC), an unsecured lending arm of Krungthai Bank (KTB), plans to tighten criteria for both new loan approvals and debt collection to prevent asset quality from deteriorating as the economy drags.

Small lenders unfazed

Business, Somruedi Banchongduang, Published on 18/05/2019

» The impact from the Bank of Thailand's amended title loan regulation is expected to be minimal on the industry's lending growth, says Ngern Tid Lor (NTL) Co Ltd, a leading player in the business.

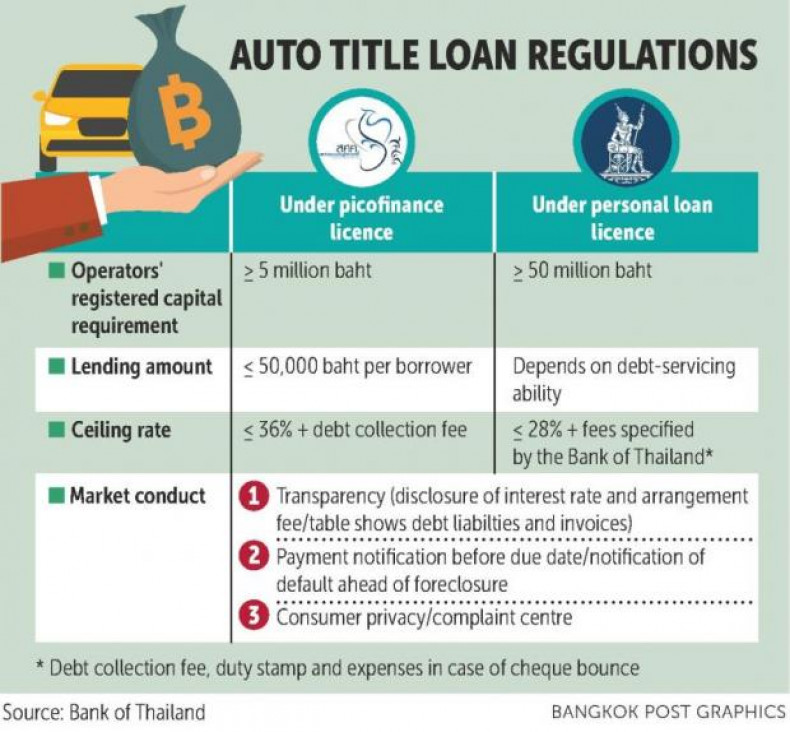

Auto title loan firms face new rules

Business, Somruedi Banchongduang, Published on 26/01/2019

» The Bank of Thailand expects the amended regulations governing auto title loans, including a cap on interest rates and practical guidelines for operators, to take effect next month.

KTC awaits bank's approval of nano- and picofinance

Business, Somruedi Banchongduang, Published on 17/12/2018

» SET-listed Krungthai Card (KTC) plans to branch into nano- and picofinance next year to create new income streams.

BoT to beef up protections for car refinancing

Business, Somruedi Banchongduang, Published on 28/09/2018

» The Bank of Thailand is set to issue regulations on auto refinancing in November aimed at standardising and creating fair practices for consumers.