Showing 1 - 4 of 4

BoT to mull ceiling rate reduction

Business, Somruedi Banchongduang, Published on 22/06/2021

» Ceiling interest rates of consumer loan products, which are currently over 20% per year, are expected to be reduced by at least 1-2%, following calls by the government for the Bank of Thailand (BoT) to review interest rates for credit cards and personal loans to tackle household debt.

KTC raises loan-loss buffer as 2020 looms

Business, Somruedi Banchongduang, Published on 03/12/2019

» Krungthai Card (KTC), an unsecured loan provider under Krungthai Bank, is poised to set aside higher loan-loss provisions next year as the economy will likely remain sluggish, a new financial reporting standard is implemented and business expands.

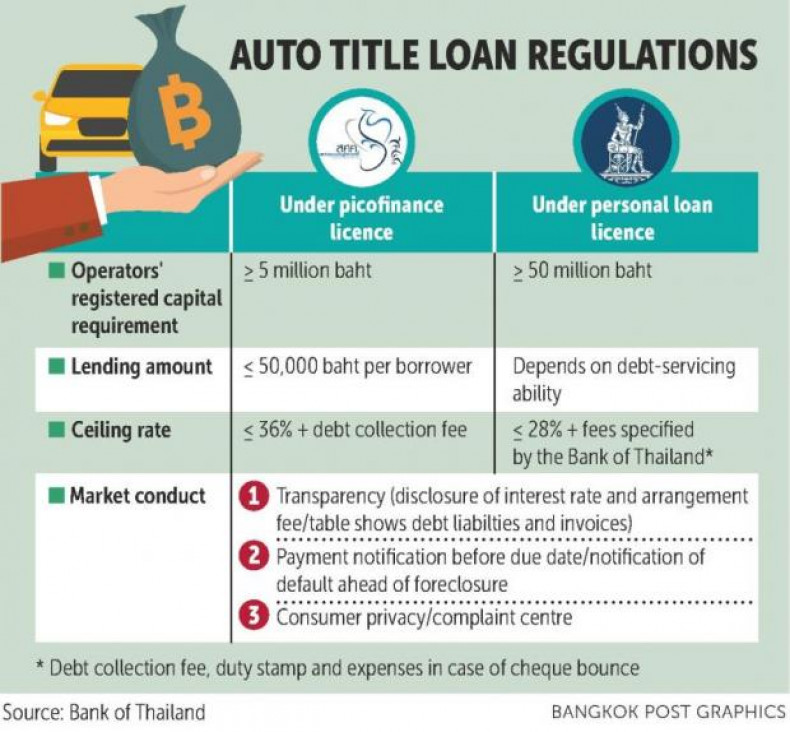

Auto title loan firms face new rules

Business, Somruedi Banchongduang, Published on 26/01/2019

» The Bank of Thailand expects the amended regulations governing auto title loans, including a cap on interest rates and practical guidelines for operators, to take effect next month.

BoT to beef up protections for car refinancing

Business, Somruedi Banchongduang, Published on 28/09/2018

» The Bank of Thailand is set to issue regulations on auto refinancing in November aimed at standardising and creating fair practices for consumers.