Showing 1 - 10 of 159

Study: Small firms must focus on profit

Business, Somruedi Banchongduang, Published on 04/02/2026

» Krungthai Compass suggests improving profit margins should be the top priority for small and medium-sized enterprises (SMEs) to address persistent liquidity shortages and high debt burdens.

Listed bank profits edge up in 2025

Business, Somruedi Banchongduang, Published on 23/01/2026

» The banking sector reported marginal net profit growth of 3.6% in 2025, with large banks posting weaker profitability while small lenders delivered strong earnings growth.

Interest rates nudge banks to record varied results

Business, Somruedi Banchongduang, Published on 22/01/2026

» Large local banks posted mixed operating results in 2025, attributed to a decrease in interest income as rates declined, as well as heightened uncertainties.

Loan repayments set to hit record high

Business, Somruedi Banchongduang, Published on 15/01/2026

» Kasikornbank (KBank) expects loan repayments to hit a record high in 2025, with loan growth in 2026 projected to increase marginally in line with Thai economic conditions.

Ttb debt aid tallies B40bn this year

Business, Somruedi Banchongduang, Published on 23/12/2025

» TMBThanachart Bank (ttb) has provided debt assistance totalling 40 billion baht this year through a range of financial relief measures.

Panel puts flood income loss at B30bn this month

Business, Somruedi Banchongduang, Published on 04/12/2025

» The private sector estimates the deadly floods in the South have caused income losses of 20-30 billion baht, weighing on GDP growth in the final quarter of this year.

YouTrip targets 10% growth a year

Business, Somruedi Banchongduang, Published on 04/12/2025

» YouTrip, Asia-Pacific's leading multi-currency travel card, expects to maintain annual growth of 10% over the next three years and is preparing to list on a US stock exchange during that period.

Credit card use to remain weak in Q4

Business, Somruedi Banchongduang, Published on 07/11/2025

» Credit card spending during the final quarter of the year is expected to remain subdued, in line with the economy, despite the government's implementation of stimulus measures.

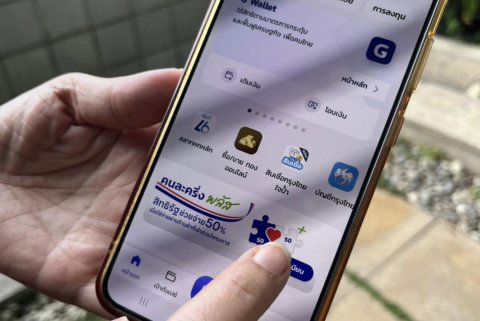

BoT predicts stimulus drives GDP growth in Q4

Business, Somruedi Banchongduang, Published on 23/10/2025

» The Bank of Thailand expects the "Khon La Khrueng Plus" co-payment scheme to help drive GDP growth in the final quarter this year.

KBank bullish on cutting employee costs

Business, Somruedi Banchongduang, Published on 15/10/2025

» Kasikornbank (KBank) has successfully implemented its early retirement (ER) programme and aims to reduce employee costs by 10-20% over five years as it increasingly adopts artificial intelligence (AI).