Showing 1 - 10 of 17

Asset management firms to absorb bigger slice of NPLs

Business, Somruedi Banchongduang, Published on 29/10/2025

» The Bank of Thailand expects asset management companies (AMCs) to absorb 20% of non-performing loans (NPLs) to help improve bad debt management in the banking industry.

New Bank of Thailand chief pledges more help for household debtors

Somruedi Banchongduang, Published on 10/10/2025

» The new governor of the Bank of Thailand has vowed to focus more on targeted measures alongside monetary policy to deliver tangible results and provide meaningful support to the public.

KBank, BAM set up asset management company

Business, Somruedi Banchongduang, Published on 12/09/2024

» Kasikornbank (KBank) has partnered with Bangkok Commercial Asset Management (BAM) to establish a joint venture asset management company (JV-AMC) to handle non-performing loans (NPLs).

Banking on responsible lending

Business, Somruedi Banchongduang, Published on 18/11/2023

» As authorities try to ease swelling household debt, the Bank of Thailand plans to implement responsible lending guidelines to improve loan quality in the financial system, starting on Jan 1, 2024.

How interest rates affect household debt

Business, Somruedi Banchongduang, Published on 09/11/2023

» Elevated interest rates became the topic of public discussion recently after a homebuyer posted her home instalment payment of 10,900 baht on social media, of which the principal accounted for only five baht, while interest expense was 10,894.5 baht.

Credit bureau: Bad loans exceeded B1tn in Q2

Business, Somruedi Banchongduang, Published on 10/08/2023

» Non-performing loans (NPLs) measured by the National Credit Bureau reached 1 trillion baht in the second quarter this year, the highest in 12 months, says a bureau executive.

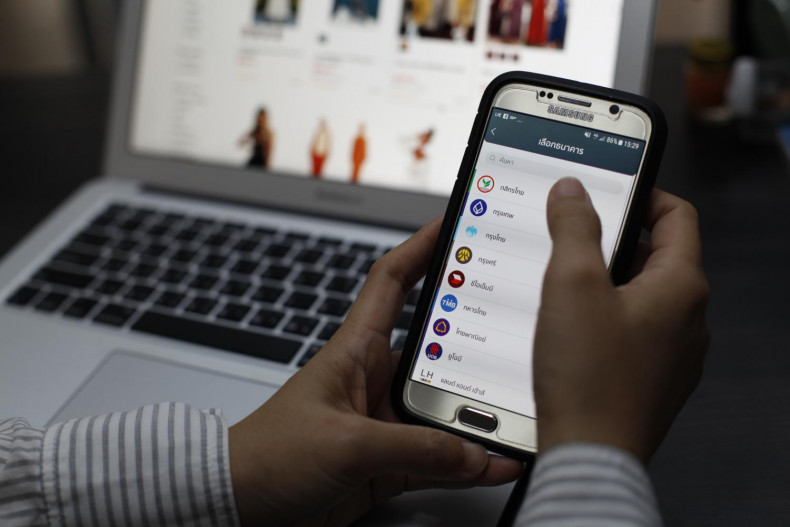

Lenders queue up for chance to offer digital loan service

Business, Somruedi Banchongduang, Published on 22/08/2022

» The provision of digital personal loans has been expanding in response to the financial behaviours of consumers in the digital era, creating opportunities for low-income earners to access financial sources.

Easy loans for all

Business, Somruedi Banchongduang, Published on 08/08/2022

» Major banks have continued to tap the underbanked, aiming to promote financial inclusion and further expand their customer base.

BoT starting digital factoring next year

Business, Somruedi Banchongduang, Published on 25/09/2020

» The Bank of Thailand plans to implement digital factoring next year to facilitate small and medium-sized enterprise (SME) access to loans.

New relief package to sustain debtors

Business, Somruedi Banchongduang, Published on 19/06/2020

» The Bank of Thailand is to unveil a relief package today to help debtors ravaged by the coronavirus pandemic, as the three-month blanket debt holiday is expiring at the end of this month.