Showing 1 - 9 of 9

Bank of Thailand takes closer look at large cash transactions

Business, Somruedi Banchongduang, Published on 12/02/2026

» The Bank of Thailand is tightening oversight of cash transactions by introducing stricter due diligence requirements and clearer verification of the purpose of fund usage, in an effort to curb suspicious transactions.

Innovation visionary

News, Somruedi Banchongduang, Published on 26/10/2023

» Tan Choon Hin, President and Chief Executive Officer of UOB Thailand, was honoured with the "2023 CEO of the Year Award for Innovative Financial Visionary" by the Bangkok Post for his exceptional leadership and unwavering dedication to the bank's growth and success through innovation development.

A new threat on the banking horizon

Business, Somruedi Banchongduang, Published on 14/07/2023

» The Bank of Thailand warns that online financial fraud is increasing as criminals turn to false base stations.

KBank makes most of digital channel services

Business, Somruedi Banchongduang, Published on 23/04/2020

» Kasikornbank (KBank) aims to get a 37% surge in online financial transaction volume through its mobile banking app KPlus to 11.6 billion this year after tallying 700 million in the first quarter as the lockdown increased demand in the digital channel.

Digital banking surges in sea change

Business, Somruedi Banchongduang, Published on 14/04/2020

» The pandemic has ravaged businesses and forced social distancing, spiking demand for remote and digital services as well as online banking.

Launch of e-KYC for deposits

Business, Somruedi Banchongduang, Published on 07/02/2020

» The Bank of Thailand is letting six commercial banks offer facial recognition using electronic Know Your Customer (e-KYC) technology to verify the identity of new customers under the regulatory sandbox when opening online deposit accounts, starting on Thursday.

EIC cuts GDP growth forecast to 3.1%

Somruedi Banchongduang, Published on 09/07/2019

» The Economic Intelligence Center (EIC), Siam Commercial Bank's research unit, has cut its forecast for the country's 2019 economic growth to 3.1% from the 3.3% previously seen.

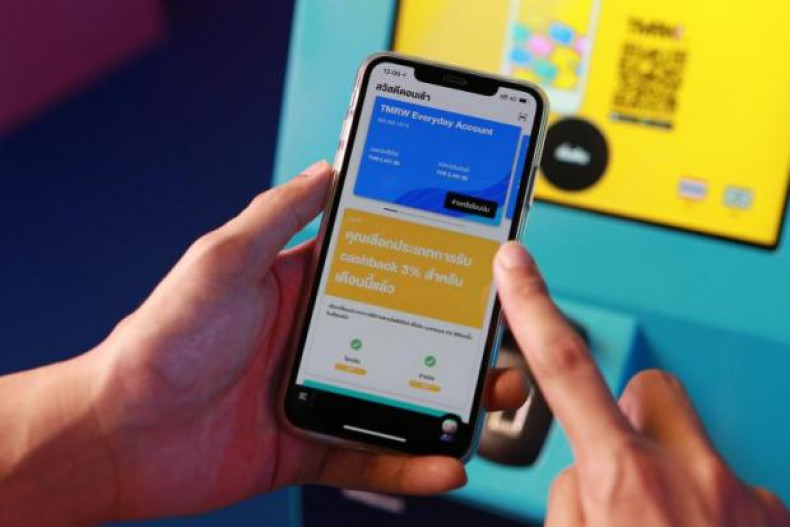

Thais tapped for UOB's mobile-only bank

Business, Somruedi Banchongduang, Published on 02/03/2019

» Singapore-based UOB Group has picked Thailand as the first country in Asean for its mobile-only bank to tap millennials.

Banks keen on e-KYC to raise account numbers

Business, Somruedi Banchongduang, Published on 14/08/2018

» Two big banks are hopeful that Electronic Know Your Customer (e-KYC) and National Digital ID will at least double the number of new deposit accounts and significantly increase their customer base.