Showing 1 - 8 of 8

Reform effort urged for incoming administration

Business, Somruedi Banchongduang, Published on 16/01/2026

» The new government is being advised to step up efforts to pursue economic reforms, with a primary focus on the tourism, agriculture and industrial sectors, or risk economic growth of only 1–2% a year, economists say.

Bangkok Bank urges government emphasis on foreign direct investment

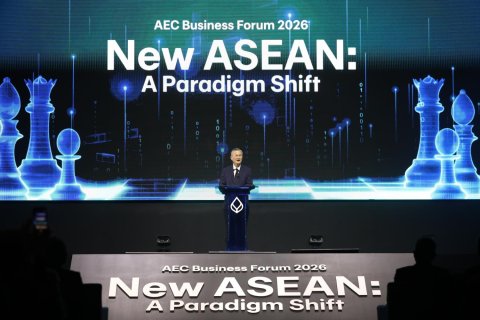

Business, Somruedi Banchongduang, Published on 15/01/2026

» Bangkok Bank (BBL) has called on the new government to emphasise investment support to accommodate an anticipated increase in foreign trade and investment flows across Southeast Asia over five years.

Joint initiative touts sustainable living

Business, Somruedi Banchongduang, Published on 22/09/2025

» Consumers have the power to drive sustainability through their spending choices, especially when it comes to home products and energy use.

Apec summit expected to generate B600bn

Business, Somruedi Banchongduang, Published on 22/12/2022

» An industry council estimates the Apec Summit 2022 held in Bangkok last month will generate 500-600 billion baht in benefits for Thailand's economy over the next 3-5 years.

BCG model expected to generate B1tn over five years

Business, Somruedi Banchongduang, Published on 13/05/2021

» The government's bio-circular-green economy (BCG) development scheme is expected to contribute 1 trillion baht to the gross domestic product (GDP) in four BCG business groups and increase the workforce by 3.5 million workers over the next five years, says Krungthai Compass, research house under Krungthai Bank (KTB).

B820bn for BCG economy projects

Business, Somruedi Banchongduang, Published on 10/02/2021

» Thailand has to invest 820 billion baht over the next five years if the country is to follow the principle of the bio-circular green (BCG) economy to rev up eco-friendly businesses and innovations, says Krungthai Compass.

Bank of Thailand issues digital loan rules

Business, Somruedi Banchongduang, Published on 18/09/2020

» The Bank of Thailand has issued digital personal loan regulations, paving a path for consumers with no financial statements to better access financial services.

BoT clarifies loans under debt restructuring scheme

Business, Somruedi Banchongduang, Published on 10/10/2019

» The Bank of Thailand insists that banks, under the new financial accounting standard, can extend fresh working capital loans to commercial loan defaulters who are in the debt restructuring process without loan-loss provision requirements for the new loans.