Showing 1 - 10 of 43

Banker slams parties' household debt vows

Business, Somruedi Banchongduang, Published on 09/02/2026

» As political parties compete to offer quick relief for struggling households, a leading Thai banker warns the country's debt crisis cannot be resolved with tax revenues or government spending alone.

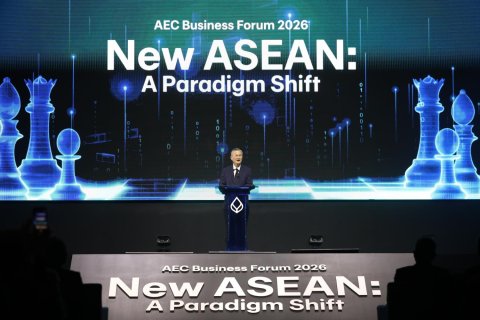

Bangkok Bank urges government emphasis on foreign direct investment

Business, Somruedi Banchongduang, Published on 15/01/2026

» Bangkok Bank (BBL) has called on the new government to emphasise investment support to accommodate an anticipated increase in foreign trade and investment flows across Southeast Asia over five years.

New central bank governor envisions expanded role

Business, Somruedi Banchongduang, Published on 24/11/2025

» The new governor of the Bank of Thailand wants to get more involved with the country's structural challenges and real sector issues, expanding the bank's role beyond its traditional focus on economic stability.

KKP targets flat growth in mortgages and bad loans

Business, Somruedi Banchongduang, Published on 16/05/2025

» Kiatnakin Phatra Bank (KKP) expects flat mortgage growth this year under its selective lending strategy, aiming to keep non-performing loans (NPLs) at their existing level.

BoT extends debt relief enrolment deadline

Business, Somruedi Banchongduang, Published on 26/04/2025

» The Bank of Thailand has extended the registration deadline for the "You Fight, We Help" debt relief programme, aimed at supporting vulnerable borrowers amid growing uncertainty and slower economic growth.

Earthquake set to worsen tourism market

Business, Somruedi Banchongduang, Published on 01/04/2025

» The Bank of Thailand believes the earthquake will further slow the already sluggish recovery of the property sector and impact foreign tourist arrivals.

KTB looks to state sector for loan gains

Business, Somruedi Banchongduang, Published on 25/01/2025

» Krungthai Bank (KTB) is targeting moderate loan growth this year, supported by the government sector and increased public investment.

Auto industry on thin ice

Business, Somruedi Banchongduang, Published on 04/01/2025

» The Bank of Thailand has expressed concerns about the uncertainty surrounding new car sales in Thailand this year and the increasing challenges facing the country's automotive industry in the medium term.

Landmark Thai loan contraction predicted

Somruedi Banchongduang, Published on 25/12/2024

» The Thai banking sector is expected to experience its first loan contraction in 15 years in 2024, driven by higher debt repayments by borrowers and tighter lending by creditors, according to Kasikorn Research Center (K-Research).

KTC preps new core system amid IT rejig

Business, Somruedi Banchongduang, Published on 10/12/2024

» Krungthai Card (KTC), a subsidiary of Krungthai Bank (KTB), is set to launch a new core system next year and restructure its IT unit to support sustainable long-term growth.