Showing 1 - 10 of 88

E-savings gain appeal as interest rates edge lower

Business, Somruedi Banchongduang, Published on 26/01/2026

» As interest rates continue to decline, e-savings deposit accounts are emerging as an attractive option for younger Thais looking to take their first steps towards saving.

BoT forecasts 0.2% bump from stimulus package

Business, Somruedi Banchongduang, Published on 01/10/2025

» The Bank of Thailand estimates the government's 66-billion-baht stimulus package will contribute roughly 0.2% to GDP growth.

KKP forges partnership with Goldman Sachs unit

Business, Somruedi Banchongduang, Published on 20/06/2025

» Kiatnakin Phatra Financial Group (KKP) has partnered with Goldman Sachs Asset Management (GSAM) in a move to sustain the growth of its wealth management business over the next five years.

Funding a sustainable revolution

Business, Somruedi Banchongduang, Published on 09/06/2025

» Thailand is transitioning to a sustainable economy, marked in part by the implementation of Thailand Taxonomy Phase 2 on May 27, 2025, which focuses on a sustainable finance framework.

KTC opts to take cautious approach amid obstacles

Business, Somruedi Banchongduang, Published on 06/05/2025

» Krungthai Card (KTC), a leading credit card provider under Krungthai Bank (KTB), anticipates increasing challenges in its personal loan business for the remainder of the year amid economic headwinds.

BoT extends debt relief enrolment deadline

Business, Somruedi Banchongduang, Published on 26/04/2025

» The Bank of Thailand has extended the registration deadline for the "You Fight, We Help" debt relief programme, aimed at supporting vulnerable borrowers amid growing uncertainty and slower economic growth.

Households tapping solar power

Business, Somruedi Banchongduang, Published on 03/03/2025

» Thailand is transitioning towards a green economy, and individuals can play an active role in this shift.

IMF supports BoT's rate reductions

Business, Somruedi Banchongduang, Published on 22/02/2025

» The International Monetary Fund (IMF) backs the Bank of Thailand cutting interest rates to stimulate inflation and increase the capacity of borrowers to repay debt.

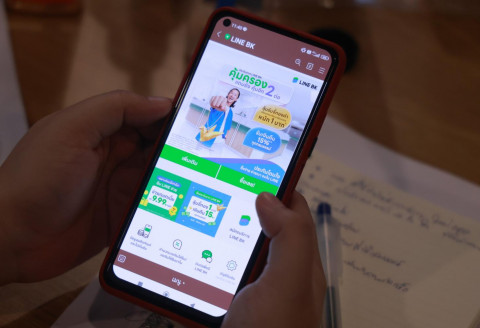

Line BK targets double-digit loan gain

Business, Somruedi Banchongduang, Published on 13/02/2025

» Line BK, a social banking platform under Kasikornbank (KBank), aims for double-digit loan growth this year, supported by enhanced technological capabilities amid sluggish economic growth.

Listed banks post 7% net profit growth last year

Business, Somruedi Banchongduang, Published on 23/01/2025

» The banking industry reported softer net profit growth of 7% in 2024, reflecting the country's economic conditions.